Archived information

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Annual report to parliament on the administration of the Export and Import Controls Permits Act - 2017

PDF Version (628 KB)

Introduction

The attached Annual Report to Parliament on the administration of the Export and Import Permits Act (EIPA) for the year 2017 is submitted pursuant to Section 27 of the Act, Chapter E-19 of the 1985 Revised Statutes of Canada, as amended, which provides:

“As soon as practicable after December 31 of each year the Minister shall prepare and lay before Parliament a report of the operations under this Act for that year.”

Purpose of the Export and Import Permits Act

The authority to control the import and export of goods and technologies is derived from the EIPA. It finds its origin in the War Measures Act and was first introduced as an Act of Parliament in 1947 and subsequently amended on a number of occasions.

The EIPA provides that the Governor in Council may establish lists known as the Import Control List (ICL), the Export Control List (ECL), the Area Control List (ACL), and the Automatic Firearms Country Control List (AFCCL). For each one of these lists, the EIPA sets out criteria that govern the inclusion of goods, technologies or countries on the respective lists and provides that the Governor in Council may revoke, amend, vary or re-establish any of the lists. Control over the flow of goods and technology contained on these lists or to the specified destinations is affected through the issuance of import or export permits.

The EIPA delegates to the Minister of Foreign Affairs the authority to grant or deny applications for these permits and thus confers broad powers to control the flow of the goods and technology contained in these lists.

While the overall authority for the EIPA is that of the Minister of Foreign Affairs, to ensure the efficient functioning of the administration of the EIPA, the Minister of Foreign Affairs and the Minister of International Trade traditionally divide responsibility for the EIPA. This is in accordance with the Department of Foreign Affairs, Trade and Development Act, whereby the Minister of International Trade may assist with Minister of Foreign Affairs in carrying out responsibilities that are related to international trade.

Through an exchange of letters, the Minister of Foreign Affairs has asked the Minister of International Trade to take responsibility for import and export controls implemented for economic and trade-related reasons. These include import controls on agricultural products (including supply-managed products like poultry, eggs and dairy), along with sugar containing products, textiles and clothing, and steel for monitoring purposes; and export controls on peanut butter, sugar, sugar-containing products, sugar confectionery and chocolate preparations, processed foods, dog and cat food, textiles and clothing, and vehicles.

The Minister of Foreign Affairs retains decision-making authority for controls over military, dual-use and strategic goods and technology, while first seeking the views and recommendations of the Minister of International Trade for certain sensitive applications.

The operations carried out under the EIPA include:

- Trade Controls implemented for economic reasons, which are an important element of Canada’s free trade agenda: ensuring that Canadians and Canadian businesses are able to benefit from an open global trading regime, while also supporting vulnerable Canadian industries and important Canadian policies, such as supply management.

- Export Controls over dual-use, military and strategic goods and technology, which are designed to ensure that our exports are consistent with Canadian foreign and defence policies. A key priority of Canada’s foreign policy is the maintenance of peace and security.

Report

Key developments in 2017

Legislative amendments to the Export and Import Permits Act

Comprehensive Economic and Trade Agreement (CETA)

In 2017, the EIPA was amended by Bill C-30 (An Act to implement the Comprehensive Economic and Trade Agreement between Canada and the European Union and its Member States and to provide for certain other measures) which received Royal Assent on May 16, 2017. This Act amended the EIPA to enable the implementation of the Canada-European Union Comprehensive Economic and Trade Agreement.

Bill C-47: An Act to amend the Export and Import Permits Act and the Criminal Code (amendments permitting the accession to the Arms Trade Treaty and other amendments)

On April 13, 2017, the Honorable Chrystia Freeland, Minister of Foreign Affairs, introduced legislation to allow Canada to accede to the Arms Trade Treaty (ATT). The ATT ensures that countries effectively regulate the international trade of arms so they are not used to support terrorism, international organized crime, gender-based violence, human rights abuses, or violations of international humanitarian law. Canada’s existing system of export controls meets or exceeds the majority of ATT provisions, but to both enhance transparency and fully comply with the Treaty; legislative amendments have been proposed to the Export and Import Permits Act (EIPA) and one section of the Criminal Code of Canada. To implement necessary changes and further strengthen Canada’s export controls, Budget 2017 announced an investment of $13 million for Global Affairs Canada. As of December 31, 2017 the Bill was at the Committee stage of Second Reading in the House of Commons.

Import controls policy

Comprehensive Economic and Trade Agreement (CETA)

Cheese

Under the Canada-European Union Comprehensive Economic and Trade Agreement (CETA), Canada established two new tariff rate quotas (TRQs) for cheese originating in the European Union: one for 16,000,000 kg of cheeses of all types; and one for 1,700,000 kg of cheeses of all types to be used in food processing (industrial cheese). The two quotas will be phased in over five years, reaching the maximum negotiated market access quantity in January 2022. Both TRQs came into force on October 2nd, 2017.

For 2017 only, the origin quota and cheese TRQ year extended from September 21, 2017 to December 31, 2017 inclusive, and the access level for the origin quotas was pro-rated to that period.

Beef and Veal and Milk Protein Substances

A key objective of CETA was the elimination of trade barriers between Canada and the EU on most originating goods, including the removal of tariffs on a wide variety of products, including some of which were subject to import controls under the EIPA. With the provisional application of CETA on September 21st, 2017, Canada removed the import controls associated with imports of certain beef and veal products (ICL numbers 112 to 114) and certain milk protein substances (ICL number 125.2) ) originating from an EU country or other CETA beneficiaries.

Textiles and Apparel

Imports from the EU and its Member States to Canada of textiles and apparel that are eligible under CETA origin quotas are subject to import controls under the EIPA and require import permits to obtain the preferential tariff rate under CETA. For more information on the CETA import origin quotas and their administration:

Amendments to the Import Control List (ICL)

On September 21, 2017 the ICL was amended for the purposes of adding textile and apparel goods to the ICL to facilitate administration of import origin quotas under CETA; and to remove controls for beef and veal products and milk protein substances originating in an EU country or other CETA beneficiary. A complete list of goods on the import control list can be found online at:

Changes to the ICL relating to the Customs Tariff: As result of amendments to the Schedule to the Customs Tariff (Customs Tariff) further to Canada’s status a contracting party to the International Convention on the Harmonized Commodity Description and Coding System, the ICL was amended to ensure concordance between those tariff lines identified within the Customs Tariff and the ICL. These amendments implemented minor changes to a small number of item codes and descriptions (less than ten ICL items). The amendment involved no changes in tariff or import policies.

Amendments to General Import Permits (GIP)

As result of amendments to the ICL to reflect changes to ICL item numbers and the provisional application of CETA, consequential amendments were required to three General Import Permits (GIPs), including: General Import Permit No. 1 – Dairy Products for Personal Use; General Import Permit No 2 – Chickens and Chicken Products for Personal Use; and General Import Permit No. 100 – Eligible Agricultural Goods.

- Order Amending General Import Permit No. 1 – Dairy Products for Personal Use

- Order Amending General Import Permit No 2 – Chickens and Chicken Products for Personal Use

- Order Amending General Import Permit No. 100 – Eligible Agricultural Goods

Steel

A Notice to Importers was issued on November 11, 2017 to inform Importers that the steel import monitoring program has been extended until November 1, 2020.

Export controls policy

Comprehensive Economic and Trade Agreement (CETA)

Under CETA, Canada and the EU agreed to establish a number of origin quotas to allow specific quantities of some products to receive preferential tariff treatment if the products meet certain conditions.

Exports from Canada of high sugar containing products, sugar confectionery and chocolate preparations, processed foods, dog and cat food, vehicles products and certain apparel that are eligible under the CETA origin quota are subject to export controls under the EIPA. Accordingly, an export permit is required for shipments of these products from Canada to the EU in order to obtain the preferential tariff rate under CETA. In addition, allocation policies were established for two products (high sugar and vehicles). The origin quota year extends from January 1 to December 31.

Amendments to the Export Control List: As a result of the provisional application of CETA, on September 21, 2017, the ECL was amended to add controls over sugar confectionery and chocolate preparations (ECL item 5206), processed foods (ECL item 5207), dog and cat food (ECL item 5208), high-sugar containing products (ECL item 5205), vehicles (ECL item 5210), and specific apparel goods (ECL item 5209) for export marketing purposes. These controls only apply to exports of these items to an EU country or other CETA beneficiary.

Exports from Canada to the EU of fish and seafood products, all textiles and most apparel that are eligible under CETA origin quotas are not subject to export controls.

For more information on the export origin quotas and their administration:

- High Sugar containing products, see Notice to Exporters No.207

- Sugar Confectionery and Chocolate Preparations, see Notice to Exporters No.208

- Processed Food, see Notice to Exporters No.208

- Dog and Cat Food, see Notice to Exporters No.208

- Fish and Seafood, see Notice to Exporters No.209

- Apparel, see Notice to Exporters No.210

- Vehicles, see Notice to Exporters No.211

In conjunction with the implementation of origin quotas relating to the provisional application of CETA, Global Affairs Canada established, via the Governor in Council process, new Export Allocation Regulations and Export Permit Regulations (Non-Strategic Products).

- Order Establishing Export Allocation Regulations

- Order Establishing Export Permit Regulations (Non-Strategic Products)

Concurrent with the establishment of new Export Permit Regulations (Non-Strategic Products), related amendments were made to the existing Export Permit Regulations which apply to military, dual-use and strategic goods and technologies on the Export Control List.

Updates to the Automatic Firearms Country Control List (AFCCL)

Ukraine: On November 23, 2017, Ukraine was formally added to the AFCCL, allowing exporters to apply for permits for the export of prohibited firearms, weapons, and devices from Canada to government and approved end-users in that country. Export permit applications for AFCCL items to Ukraine will still be reviewed on a case-by-case basis.

Updates to the Area Control List (ACL)

Belarus: On June 20, 2017 the Government of Canada finalized the regulatory process to amend the Area Control List (ACL) to remove Belarus from the list of countries to which the Governor in Council deems it necessary to control the export or transfer of any goods and technologies. Exporters of uncontrolled goods and technology (i.e. items that are not listed on Canada's Export Control List) no longer require an export permit to lawfully export those items to Belarus. For those goods and technologies that are listed on the ECL, applications for export permits will be reviewed on a case-by-case basis.

- For more information, see Notice to Exporters No.212

Updates to the Export Control List (ECL) for Military, Dual Use and Strategic Goods and Technologies

On August 11, 2017, the annual regulatory process to update and amend the ECL came into effect. This amendment serves to add, clarify and remove controls over specific items as agreed upon up to December 2015 in the various multilateral export control regimes in which Canada participates.

- The new version of the “A Guide to Canada’s Export Controls List” (Guide) 2015

Import controls

In 2017, Global Affairs Canada:

- issued 44,527 permits (including CETA permits);

- rejected 4,287 applications for permits; and

- cancelled 2,544 permits (cancellations were generated by the need to amend permit details, such as quantity, import date or supplier information).

Figure 1: Total number of Import Permits Issued for Controlled Goods in 2017 (including CETA permits)

Text version

| Controlled goods | Number of Import Permits Issued |

|---|---|

| Beef and Veal | 3,113 |

| Cheese | 7,290 |

| Dairy | 4,957 |

| Broiler Hatching Eggs and Chicks | 2,565 |

| Eggs and Egg Products | 2,458 |

| Margarine | 918 |

| Chicken and Chicken Products | 6,445 |

| Turkey and Turkey Products | 734 |

| Sugar Containing Products | 0 |

| Wheat and Barley | 840 |

| Textiles and Clothing | 14,987 |

| Weapons, Munitions and Chemicals | 220 |

| Total Import Permits | 44,527 |

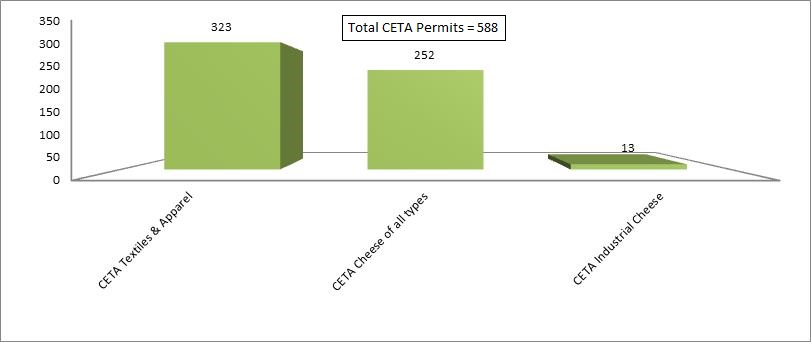

Figure 1a: Number of Import Permits Issued for CETA in 2017

Text version

| CETA Controlled Goods | Number of Import Permits Issued |

|---|---|

| CETA Textiles & Apparel | 323 |

| CETA Cheese of all types | 252 |

| CETA Industrial Cheese | 13 |

| Total CETA Permits | 588 |

Import Controls: Textiles and Clothing

Textile and clothing imports are controlled as a result of various free trade agreements, including the North American Free Trade Agreement (NAFTA), and the free trade agreements with Chile, Costa Rica and Honduras. The agreements provide for preferential access for non-originating products through the use of Tariff Preference Levels (TPLs).

All TPLs for imports are made available on a first-come, first-served basis. Once the specified annual quantity under a free trade agreement has been fully utilized, non-originating apparel, textiles and made-up goods will be subject to the Most Favored Nation tariff rate for the remainder of that TPL year. Canadian importers require a shipment-specific import permit for all TPL imports into Canada under the negotiated quantity. TPL-eligible shipments entering Canada under a shipment-specific import permit can normally do so at the rate equivalent to the originating rate.

There were no changes to the administration of existing agreements in 2017. TPL imports and utilization for 2017 are noted in Table 1A.

| United States | Mexico | Chile | Costa Rica | Honduras | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Square metre equivalents (sme) or Kilograms (Kg) | Access Level | Utilization | Access Level | Utilization | Access Level | Utilization | Access level | Utilization | Access Level | Utilization |

| Wool Apparel (sme) | 919,740 | 257,623 | 250,000 | 82623 | 112,616 | 0 | N/A | N/A | N/A | N/A |

| Cotton or Man-made Fibre Apparel (sme) | 9,000,000 | 9,000,000 | 6,000,000 | 1,628,970 | 2,252,324 | 0 | N/A | N/A | N/A | N/A |

| Cotton or Man-made Fibre Fabrics and Made-up Goods (sme) | 2,000,000 | 0 | 7,000,000 | 0 | 1,000,000 | 0 | 1,000,000 | 0 | N/A | N/A |

| Cotton or Man-made Fibre Spun Yarns (sme) | 1,000,000 | 429,993 | 1,000,000 | 0 | 500,000 | 0 | 150,000 | 0 | N/A | N/A |

| Wool Fabrics and Made-up Goods (kg) | N/A | N/A | N/A | N/A | 250,000 | 0 | 250,000 | 0 | N/A | N/A |

| Fabric and Made-up Goods (kg) | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 1,000,000 | 0 |

| Apparel (sme) | N/A | N/A | N/A | N/A | N/A | N/A | 1,379,570 | 0 | 4,000,000 | 1,388,812 |

CETA Textiles and Apparel

Imports from the EU and its Member States to Canada of textiles and apparel that are eligible under CETA origin quotas are subject to import controls under the EIPA. Accordingly, import permits are required for imports of these products in order to obtain the preferential tariff rate under CETA.

The origin quotas specify the quantity of a product(s) that can qualify as originating and receive preferential CETA tariff treatment. In order to receive this treatment the product must meet the product description and undergo sufficient production to satisfy the applicable product-specific rule of origin associated with that origin quota.

CETA contains growth factors for the textiles and apparel origin quotas that provide for an increase in the volume of the origin quotas if certain conditions are met. Growth factor provisions are outlined in the Agreement.

| Description | HS Classification U = Units KG = Kilograms M2 = Square Metres | Access Level | Utilization |

|---|---|---|---|

| CETA Origin Textiles & Apparel | 5702.42 (M2) Carpets and other Floor coverings, man-made, woven | 52,258 | 3,827 |

| Apparel 61.06 (U) Blouses, shirts and shirt blouses, knitted or crocheted (excluding T-shirts and vests.) | 35,211 | 49 | |

| Apparel 61.09 (U) T-Shirts, singlets and other vests knitted or crocheted | 201,764 | 281 | |

| Apparel 61.10 (U) Jerseys, pullovers, cardigans, waistcoats and similar articles knitted or crocheted (excluding wadded waistcoats) | 150,066 | 4,164 | |

| Apparel 6105.10 (U) Men’s or boys shirts of cotton knitted or crocheted (excluding nightshirts, t-shirts, singlets and other vests) | 12,855 | 200 | |

| Apparel 62.04 (U) Women’s or girls suits, ensembles, jackets, blazers, dresses etc (excluding knitted or crocheted and swimwear) | 150,066 | 5.041 | |

| Apparel 6202.11 (U) Women’s or girls overcoats, raincoats, car coats, capes, cloaks and similar articles of wool or fine animal hair, not knitted or crocheted. | 4,192 | 282 | |

| Apparel 6202.93(U) Women’s or girls anoraks, windcheaters, wind jackets and similar articles, of manmade fibres (not knitted or crocheted) | 4,471 | 82 | |

| Apparel 6203.11 (U) Men’s or boys suits of wool or fine animal hair. | 10,899 | 2,738 | |

| Apparel 6203.12 to 6203.49 (U) Men’s or boys suits (excluding wool or fine animal hair), ensembles, jackets, blazers, trousers, bib and brace overalls, breeches and shorts (excluding knitted or crocheted and swimwear) | 78,526 | 4,304 | |

| Apparel 6205.20 (U) Men’s or boys shirts of cotton, not knitted or crocheted | 50,860 | 8,675 | |

| Apparel 61.14 (KG) Other garments not elsewhere specified or included, knitted or crocheted | 16,208 | 858 | |

| Apparel 62.11 (KG) Tracksuits, ski suits, swimwear and other garments, not elsewhere specified or included (excluding knitted or crocheted) | 23,753 | 4,898 | |

| Apparel 6302.21 (KG) Bed linen, printed, of cotton, not knitted or crocheted | 49,184 | 2 | |

| Apparel 6302.31 (KG) Bed linen (other than printed) of cotton, not knitted or crocheted | 60,362 | 4 | |

| Apparel 62.12 (DZN) Brassieres, girdles, corsets, braces, suspenders, garters and similar articles and parts thereof, of all types of Materials, whether or not elasticated including knitted or crocheted (excluding belts and corselets made entirely of rubber) | 7,266 | 242 | |

| *Note: For 2017 only, the origin quota year extended from September 21, 2017 to December 31, 2017 inclusive, and the access level for the origin quotas is pro-rated to that period. | |||

Import Controls: Agriculture and Dairy Products

Canada is a signatory to the World Trade Organization (WTO) Agreement on Agriculture concluded in December 1993. This Agreement obliged Canada to convert its existing quantitative agricultural import controls to a system of tariff rate quotas (TRQs), which came into effect in 1995.

Under TRQs, imports are subject to low within-access commitment rates of duty up to a predetermined limit (i.e., until the import access quantity has been reached), while imports over this limit are subject to higher over-access commitment rates of duty. For most products, the privilege of importing at the within-access commitment rates of duty is allocated to firms through the issuance of import allocations (or "quota-shares"). Those with quota-shares normally receive, upon application, specific import permits giving access to the within-access commitment rates of duty as long as they meet the terms and conditions of permit issuance. These conditions are normally described in Allocation Method Orders and in Notices to Importers. Imports in excess of access levels are permitted under General Import Permit No. 100 - Eligible Agricultural Goods, which allows unrestricted imports at the higher rate of duty. Canada continues to respect its access level commitments under the NAFTA, and where both WTO and NAFTA commitments exist, Canada applies the higher of the two levels for the product in question.

Under the EIPA, the Minister may, at his discretion, authorize imports of products subject to TRQs apart from the import access quantity, particularly if the Minister determines that the importation of these products is required to meet Canadian market needs. Supplemental import permits are normally issued for the following specific purposes:

- to address domestic market shortages;

- to assist Canadian manufacturers to compete with similar imported products that can enter Canada duty free or at a low rate of duty as a result of the NAFTA (the Import-to-Compete Program);

- to assist Canadian manufacturers to compete in foreign markets (the Import for Re-Export Program (IREP);

- to facilitate test marketing in the Canadian market of new products that are, for example, unique or are produced with unique processes and require a substantial capital investment for their production; or

- to address extraordinary or unusual circumstances.

Policies governing supplemental import permits for each commodity can be found at Export and Import Controls, with any updates published under a Notice to Importers.

All TRQs are based on Customs Tariff item numbers. When the TRQs came into effect in 1995, the ICLwas amended to replace named products (e.g. turkey and turkey products) with tariff item numbers. For ease of understanding, the older product descriptions continue to be used in this report.

Poultry Products

Effective January 1, 1995, Canada's chicken, turkey, broiler hatching eggs and chicks, shell egg and egg product quantitative restrictions were converted to TRQs and were maintained on the ICL in order to support supply management of poultry under the Farm Products Marketing Act and to support action taken under the WTO Agreement Implementation Act.

Chicken was placed on the ICLon October 22, 1979. Pursuant to the NAFTA, the import access level is set annually at 7.5 per cent of domestic production for that year or the WTO level of 39,900,000 kilograms, expressed in eviscerated equivalent (EE) weight, whichever is higher.

Turkey and turkey products were placed on the ICL on May 8, 1974. Pursuant to the NAFTA, the access level is 3.5% of the current year’s domestic production quota or the WTO level of 5,588,000 kilograms (EE), whichever is higher.

Broiler hatching eggs and chicks for chicken production were placed on the ICL on May 8, 1989. Pursuant to the NAFTA, the combined import access level for broiler hatching eggs and chicks is 21.1 per cent of the estimated domestic production of broiler hatching eggs for the calendar year to which the TRQ applies. The combined annual import access level is divided into separate levels of 17.4 per cent for broiler hatching eggs and 3.7 per cent for egg-equivalent chicks.

Eggs and egg products were placed on the ICL on May 9, 1974. Pursuant to the NAFTA, the import access level for eggs and egg products is set at a total of 2.988 per cent of the previous year’s domestic production and in accordance with the following breakdown: 1.647 per cent for shell eggs; 0,714 per cent for liquid, frozen or further-processed egg products; and 0.627 per cent for egg powder.

In 1996, an allocation for eggs for breaking purposes was introduced. This resulted from a WTO commitment to increase the import access quantity to a level greater than the NAFTA access level at the time. The WTO level (21,370,000 dozen eggs in 2017) continues to be higher than Canada's NAFTA access level. The eggs for breaking purposes allocation are equal to the difference between the WTO and NAFTA commitment levels.

There were no changes made regarding the administration of these controls for 2017. Details are summarized in Table 2.

| Tariff Rate Quotas | Supplemental Imports | ||||||

|---|---|---|---|---|---|---|---|

| Description | Unit of Measure | Access Level | Within-Access Imports | IREP | Import to Compete | Market Shortage | Other |

| Chicken and Chicken Products | EE Kilograms | 86,110,275 | 84,968,707 | 18,554,838 | 6,252,464 | 5,508,899 | 0 |

| Turkey and Turkey Products | EE Kilograms | 5,588,000 | 5,438,388 | 0 | 9,146 | 0 | 0 |

| Broiler Hatching Eggs and Chicks | Egg Equivalent | 161,530,159 | 160,074,568, | 893,484 | 0 | 7,313,820 | 5,281,848 |

| Eggs and Egg Products | Egg Equivalent | 21,370,000 | 20,702,223 | 0 | 0 | 0 | 0 |

| Shell Eggs | Dozens | 11,242,412 | 11,241,224 | 11,727,836 | |||

| Shell Eggs for Breaking | Dozens | 973,931 | 973,930 | 1,535,040 | 0 | 8,650,591 | 0 |

| Egg Powder | Kilograms | 646,265 | 556,749 | 0 | 0 | 0 | 0 |

| Liquid, frozen or further processed egg products | Kilograms | 2,802,412 | 2,759,994 | 893,484 | 0 | 1,229,218 | 0 |

| Import permits are required for importing inedible egg products into Canada, for monitoring purposes only. Permits were issued for 2,288,005 kilograms of this type of product in 2017. | |||||||

Dairy Products

Quantitative restrictions in 12 categories of dairy products were converted to TRQs in support of supply management under the Canadian Dairy Commission Act and action taken under the WTO Agreement Implementation Act. These products are:

- i) butter, dairy spreads, and oils and fats derived from milk (implemented on August 1, 1995);

- ii) cheese of all types other than imitation cheese (implemented on January 1, 1995);

- iii) buttermilk powder (implemented on January 1, 1995);

- iv) fluid milk (implemented on January 1, 1995)Footnote 1;

- v) dry whey (implemented on August 1, 1995);

- vi) concentrated/condensed milk/cream (implemented on January 1, 1995);

- vii) cream (implemented on August 1, 1995);

- viii) products consisting of natural milk constituents (implemented on January 1, 1995);

- ix) food preparations under tariff item 1901.90.33 (implemented on January 1, 1995);

- x) ice cream and ice cream novelties and yoghurt (implemented on January 1, 1995);

- xi) dairy products, and other food preparations containing dairy, not subject to TRQs, including skimmed and whole milk powder, cream powder, other milk powder, other cream powder, buttermilk (other than powdered buttermilk), curdled milk and cream, kephir and other fermented or acidified milk and cream, animal feed, non-alcoholic beverages containing milk, and chocolate ice cream mix and ice milk mix (implemented on January 1, 1995); and

- xii) milk protein substances with a milk protein content of 85 per cent or more by weight, calculated on the dry matter, that do not originate in the United States, Mexico, Chile, Costa Rica or Israel (implemented on September 8, 2008).

There were no changes made regarding the administration of these controls for 2017. TRQ import levels for 2017 are noted in Table 3. However, additional dairy commitments were implemented under CETA (see following section).

| Tariff Rate Quotas | Supplemental Imports | ||||||

|---|---|---|---|---|---|---|---|

| Kilograms (Kg) except where otherwise indicated with Tonnes (t) | Description/tariff item number | Access Level | Within-Access Imports | IREP | Import to Compete | Market Shortage | Other |

| Butter, dairy spreads, and oils and fats derived from milk (Aug. 1 - Jul. 31) | (TRQ allocated to Canadian Dairy Commission with 2,000,000 reserved for NZ) | 3,274,000 | 3,274,000 | 10,185,675 | 0 | 0 | 11,226,063 |

| Cheese of all types other than imitation cheese | (66% allocated to European Union) | 20,411,866 | 20,285,111 | 3,317,789 | 0 | 0 | 1,551,232 |

| Powdered buttermilk | (reserved for imports from NZ) | 908,000 | 220,000 | 95,333 | 0 | 0 | 0 |

| Buttermilk (other than powdered buttermilk), curdled milk and cream, kephir and other fermented or acidified milk and cream | 0403.90.91.10 0403.90.91.90 | 0 | 0 | 0 | 0 | 0 | 57,107 |

| Fluid milk | 64,500 (t) | 0 | 14,174,457 | 0 | 0 | 589 | |

| Dry whey (Aug. 1 - Jul. 31) | 3,198,000 | 199,894 | 1,186,860 | 0 | 0 | 2,581 | |

| Concentrated/condensed milk/cream | (reserved for imports from Australia) | 11,700 | 0 | 1,229,799 | 0 | 0 | 0 |

| Cream (Aug. 1 - Jul. 31) | (sterilized, minimum 23% butterfat and sold in cans with volume less than 200 millilitres | 394,000 | 383,341 | 905,814 | 0 | 7,200,512 | 0 |

| Products consisting of natural milk constituents | 4,345,000 | 2,687,809 | 382,527 | 0 | 0 | 560 | |

| Food preparations | 1901.90.33 | 70,000 | 70,000 | 0 | 0 | 0 | 0 |

| 1901.20.11 | 0 | 0 | 0 | 0 | 0 | 0 | |

| 1901.90.21 | 0 | 0 | 0 | 0 | 0 | 0 | |

| 1901.90.31 | 0 | 0 | 0 | 0 | 0 | 0 | |

| 1901.90.51 | 0 | 0 | 0 | 0 | 0 | 0 | |

| 1901.90.53 | 0 | 0 | 116,678 | 0 | 0 | 0 | |

| 2106.90.31 | 0 | 0 | 0 | 0 | 0 | 0 | |

| 2106.90.93 | 0 | 0 | 437,236 | 0 | 0 | 236,625 | |

| Ice cream and ice cream novelties and yoghurt | Ice Cream | 484,000 | 400,972 | 0 | 0 | 0 | 3,016 |

| Yoghurt | 332,000 | 167,086 | 163,767 | 0 | 0 | 283,790 | |

| Dairy products, other than food preparations, not subject to tariff rate quotas, including, skimmed and whole milk powder, cream powder, other milk powder, other cream powder, animal feed, non-alcoholic beverages containing milk, and chocolate ice cream mix and ice milk mix | Skimmed Milk Powder | 0 | 0 | 2,982,196 | 0 | 0 | 182,699 |

| Whole Milk Powder | 0 | 892,147 | 0 | 0 | 433,727 | ||

| Other Chocolate Ice Cream Mix and Ice Milk Mix | 0 | 0 | 0 | 0 | 0 | 0 | |

| Non-alcoholic Beverages containing Milk | 0 | 0 | 0 | 0 | 0 | 0 | |

| Complete Feeds and Feed Supplements containing 50% or more Milk Solids | 0 | 0 | 0 | 0 | 0 | 0 | |

| Cream Powder | 0 | 0 | 254,628 | 0 | 0 | 0 | |

| Milk protein substances with a milk protein content of 85% or more by weight, calculated on the dry matter, that do not originate in the United States, Mexico, Chile, Costa Rica, or Israel (Apr. 1 - Mar. 31) | 10,000,000 | 2,568,211 | 0 | 0 | 0 | 0 | |

CETA Cheese of all Types and Industrial Cheese Products:

As a result of the provisional application of CETA, Canada established two new TRQs for cheese originating from an EU country or other CETA beneficiary.

For 2017, access volumes were prorated to reflect the date of provisional application of the agreement (September 21, 2017) and the end of the TRQ year (December 31, 2017).

| Description | Unit of Measure | Access Level | Within-Access Imports |

|---|---|---|---|

| CETA Cheese of all Types | Kilograms | 745,299 | 719,832 |

| CETA Industrial Cheese | Kilograms | 79,085 | 47,497 |

Other Agricultural Products

Other agriculture products subject to import controls are: margarine; wheat, barley and their products; and beef and veal.

The TRQ for margarine was introduced on January 1, 1995.

The restrictions imposed on imports of wheat, barley and their products under the Canadian Wheat Board Act were converted to TRQs on August 1, 1995. These TRQs are administered by Global Affairs Canada and Canada Border Services Agency on a first-come, first-served basis using an August-July year. Importers may cite General Import Permit No. 20 - Wheat and Wheat Products, Barley and Barley Products to import goods at the lower rate of duty. Once the access levels are filled, importers must cite General Import Permit No. 100 - Eligible Agricultural Goods on customs entry documents to import goods at the higher rate of duty. Administrative measures are established to ensure full usage of quota, which sometimes results in imports at the within-access rate over the TRQ limit.

The restrictions on imports of non-NAFTA beef and veal established under the Meat Import Act were converted to a TRQ on January 1, 1995. The TRQ applies to all imports of fresh, chilled and frozen beef and veal that do not originate in Chile, a NAFTA country or an EU country or other CETA beneficiary.

| Tariff Rate Quotas | Supplemental Imports | ||||||

|---|---|---|---|---|---|---|---|

| Kilograms (Kg) except where otherwise indicated with Tonnes (t) | Description/tariff item number | Access Level | Within-Access Imports | IREP | Import to Compete | Market Shortage | Other |

| Margarine | 7,558,000 | 2,968,046 | 0 | 0 | 0 | 0 | |

| Wheat, Barley and their Products | Wheat | 226,883 (t) | 104,987 (t) | ||||

| Wheat Products | 123,557 (t) | 195,325 (t) | 0 | 0 | 8,679 | ||

| Barley | 399,000 (t) | 63,199 (t) | |||||

| Barley products | 19,131 (t) | 41,831 (t) | 0 | 16,418 | |||

| Beef and Veal (non-NAFTA except Chile) | Imports from Australia | 35,000 (t) | 47,482(t) | N/A | N/A | 0 | 5,244 |

| Imports from New Zealand | 29,600 (t) | ||||||

| Imports from all countries certified by the CFIA | 11, 809 (t) | ||||||

Import Controls: Steel Monitoring

Carbon steel products (semi-finished steel, plate, sheet and strip steel, wire rods, wire and wire products, railway-type products, bars, structural shapes and units, and pipes and tubes) were initially placed on theICL, effective September 1, 1986, following a report by the Canadian Import Tribunal recommending the collection of information on goods of this type entering Canada. Speciality steel products (stainless flat-rolled products, stainless steel bars, wire and wire products, alloy tool steel, mould steel and high speed steel) were added to the ICL, effective June 1, 1987, pursuant to an amendment to the EIPA providing for import monitoring of steel products under certain conditions.

A General Import Permit (GIP) has been established for each of these items: GIP 80 (Carbon Steel) and GIP 81 (Specialty Steel).

The purpose of placing carbon and speciality steel on the ICL is to provide more timely and precise steel import data than that available via the normal export reports produced by Statistics Canada. There are no quantitative restrictions, and the requirement for shipment-specific import permits was removed in 2012.

In accordance with Section 5.1(3) of the EIPA, the Minister of Foreign Affairs tables an annual report to Parliament with a statistical summary of any information collected during that year related to imports of steel. The report is required to be tabled within the first 15 sitting days of Parliament following the end of the calendar year. The 2017 report was tabled in Parliament on February 16, 2018.

Import Controls: Weapons, Munitions and Chemicals

Pursuant to items 70 to 73 and 91 of the ICL, a permit is required to import into Canada all small- and large-calibre weapons, ammunition, bombs, pyrotechnics, tanks and self-propelled guns. As well, all components and parts specifically designed for these items also require import permits. Firearms classified as non-restricted or restricted in legal classification and destined to sporting or recreational use, and their parts, are exempted from an import permit. Manufacturers and businesses licensed by the Provincial Chief Firearms Officers may import prohibited weapons, prohibited firearms and prohibited devices under strictly controlled conditions. Pursuant to item 74 of the ICL, an import permit is required to import certain toxic chemicals, precursors and mixtures.

In 2013-14, broad-based Import Permit Letters were introduced for low-risk, high-volume commercial importers of firearms and related goods, leading to a significant reduction of the number of import permits for weapons, munitions and chemicals issued annually.

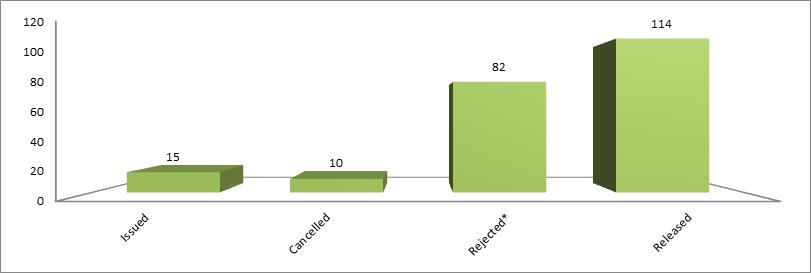

Figure 2: Number of Import Permits Issued for Weapons, Munitions and Chemicals in 2017

*import permits issues for weapons, munitions and chemicals are usually rejected due to a lack of appropriate information.

Text version

| Import Permits | Number |

|---|---|

| Issued | 15 |

| Cancelled | 10 |

| Rejected* | 82 |

| Released | 114 |

Import Controls: International Import Certificates and Delivery Verification Certificates

The issuance of international import certificates and delivery verification certificates is provided for under section 9 of the EIPA and under the Import Certificate Regulations (C.R.C., c. 603). International import certificates enable an importer to describe goods in detail and to certify that he/she will not assist in their disposal or diversion during transit. Such assurances may be required by the country of export before permitting the shipment of certain goods, most notably munitions and strategic goods. An international import certificate is not an import permit and does not entitle the holder to import the goods described on the certificate into Canada. Delivery verification certificates may be issued following arrival of the goods in Canada to enable an exporter of goods to Canada to comply with requirements of the exporting country.

Since 2011, International Import Certificate (IIC) letters have been issued to trusted high-volume importers, which have resulted in a significant reduction in the number of individual certificates issued.

In 2017, Global Affairs Canada issued 1,671 international import certificates and 321 delivery verification certificates.

Import Controls: General Import Permits

The Act provides for the issuance of general permits authorizing the import of certain designated goods to all destinations or to specified destinations. General Import Permits (GIPs) are intended to facilitate imports by enabling importers to import selected goods without applying for individual permits.

The following GIPs were in effect during 2017.

- GIP 1 - Dairy Products for Personal Use

- GIP 2 – Chicken and Chicken Products for Personal Use

- GIP 3 – Wheat and Wheat Products and Barley and Barley Products for Personal Use

- GIP 6 – Roses for Personal Use

- GIP 7 – Turkey and Turkey Products for Personal Use

- GIP 13 – Beef and Veal for Personal Use

- GIP 14 – Margarine for Personal Use

- GIP 20 – Wheat and Wheat Products and Barley and Barley Products

- GIP 60 – Import of Arms Permit

- GIP 80 – Carbon Steel

- GIP 81 – Specialty Steel

- GIP 100 – Eligible Agricultural Goods

- GIP 108 – CWC Toxic Chemicals and Precursors

Export controls

Canada’s system of export controls are authorized by the Export and Import Permits Act (EIPA). Section 3 of the EIPA provides that the Governor in Council may establish a list of goods and technology, to be called the Export Control List, including therein any article the export of which the Governor in Council deems it necessary to control for purposes specified in the EIPA. The ECL was amended twice in 2017. A complete list of controls may be found online.

The ECL comprises seven groups, as follows:

Group 1: Dual Use List

Group 2: Munitions List

Group 3: Nuclear Non-proliferation List

Group 4: Nuclear-Related Dual Use List

Group 5: Miscellaneous Goods and Technology

Group 6: Missile Technology Control Regime List

Group 7: Chemical and Biological Weapons Non-Proliferation List

Groups 1 and 2 encompass Canada's multilateral strategic commitments under the Wassenaar Arrangement and control, respectively, dual-use and military goods and technology. The Wassenaar Arrangement was established in order to contribute to regional and international security and stability, by promoting transparency and greater responsibility in transfers of conventional arms and dual-use goods and technologies, thus preventing destabilising accumulations. The aim is also to prevent the acquisition of these items by terrorists.

- The 2017 Report on Military Exports contains extensive detail and break down of information on Group 2 exports.

Groups 3, 4, 6 and 7 represent Canada’s multilateral commitments under the various non-proliferation regimes (the Nuclear Suppliers Group, the Australia Group, and the Missile Technology Control Regime) designed to control the proliferation of weapons of mass destruction (chemical, biological and nuclear weapons) as well as their delivery systems.

Group 5 comprises various strategic and non-strategic goods and technologies that are controlled for other purposes, as provided in the EIPA. This category includes, inter alia, forest products (logs, softwood lumber), agricultural products (peanut butter, sugar and sugar-containing products) and CETA origin quotas.

Group 5 also includes controls on the export of United States origin goods and technology not otherwise controlled on the ECL and controls over the export of other goods and technology not controlled elsewhere. Group 5 also contains a catch-all provision to control the export of goods or technology that may be destined for use in an activity or facility involved in weapons of mass destruction.

In addition, in accordance with the authority in the EIPA to implement an intergovernmental agreement, textile and clothing exports to countries with relevant free trade agreements (United States, Mexico, Chile, Costa Rica and Honduras) are regulated under the EIPA. Section 9.1 of the EIPA also authorizes the Minister of Foreign Affairs to issue export certificates of eligibility.

In 2017, for non-strategic exports (softwood lumber, logs, clothing and textiles, agricultural products and CETA products); Global Affairs Canada:

- issued 254,678 permits

- rejected 4,884 applications; and

- cancelled 14,576 permits (note that the term “denied” is not used for non-strategic exports.)

Figure 3A: Number of Export Permits Issued for Controlled Goods in 2017 - Non-Strategic

Text version

| Controlled Goods | Number of Export Permits Issued |

|---|---|

| Sugar | 4,069 |

| Peanut Butter | 2,968 |

| Clothing/Textile | 24,093 |

| Softwood Lumber | 215,593 |

| Logs | 7,834 |

| CETA - Textiles & Apparel | 62 |

| CETA - Dog & Cat Food | 32 |

| CETA - Vehicles | 27 |

In 2017, for military, dual-use and strategic goods exports, Global Affairs Canada:

- issued 6,634 permits;

- returned without action 342 applications;

- withdrawn 594 applications; and

- denied 4 applications.

Figure 3B: Number of Export Permits Issued for Controlled Goods in 2017 - Strategic

*Further details on Group 2 exports can be found in the 2017 Military Exports Report

*The category of “others” captures exports of permitted goods (e.g. humanitarian) to ACL countries not captured elsewhere on the ECL.

Text version

| Controlled Goods | Number of Export Permits Issued |

|---|---|

| Group 1 - Dual Use | 1,854 |

| Group 2 - Munitions* | 3,401 |

| Group 3 - Non-Proliferation | 164 |

| Group 4 - Nuclear | 173 |

| Group 5 - Goods & Tech | 228 |

| Group 6 - Missile | 88 |

| Group 7 - Chemical | 48 |

| Others* | 678 |

Export controls: Military, Strategic and Dual-use Items

The EIPA requires those who wish to export from Canada any items included on the Export Control List (ECL) to obtain, prior to shipment, an export permit issued by Global Affairs Canada.

An export permit describes, among other things, the quantity, description and nature of the items to be exported, as well as the final destination country and final consignee. Unless otherwise stated, an export permit may authorize multiple shipments, up to the expiry of the permit and as long as the cumulative total of the quantity or value of items exported does not exceed the quantity or value stated on the permit. An export permit constitutes a legally-binding authorization to export controlled goods or technology as described.

The principal objective of export controls is to ensure that exports of certain goods and technology are consistent with Canada’s foreign and defence policies. Among other policy goals, export controls seek to ensure that exports from Canada:

- do not cause harm to Canada and its allies;

- do not undermine national or international security;

- do not contribute to national or regional conflicts or instability;

- do not contribute to the development of nuclear, biological or chemical weapons of mass destruction, or of their delivery systems;

- are not used to commit human rights violations; and

- are consistent with existing economic sanctions’ provisions.

With respect to military goods and technology, Canadian export control policy has, for many years, been restrictive. Under export control policy guidelines approved in 1986 by Cabinet, Canada closely controls the export of military goods and technology to:

- countries which pose a threat to Canada and its allies;

- countries involved in or under imminent threat of hostilities;

- countries under United Nations Security Council sanctions; or

- countries whose governments have a persistent record of serious violations of the human rights of their citizens, unless it can be demonstrated that there is no reasonable risk that the goods might be used against the civilian population.

All applications to export goods or technology are carefully reviewed against the criteria listed above, and if any risks are identified, sent for wide-ranging consultations among geographic, human rights, international security and defence-industry experts at Global Affairs Canada (including at Canada’s overseas diplomatic missions), the Department of National Defence and, as necessary, other government departments and agencies. Through such consultations, export permit applications are assessed for their consistency with Canada’s foreign and defence policies. Regional peace and stability, including civil conflict and human rights, as well as the possibility of unauthorized transfer or diversion of the exported goods and technology, are actively considered.

| Submitted | Returned without action | Withdrawn | Cancelled | Issued | Denied | |

|---|---|---|---|---|---|---|

| Group 1 | 1,854 | 51 | 63 | 11 | 1,727 | 2 |

| Group 2* | 3,401 | 94 | 62 | 108 | 3,136 | 1 |

| Group 3 | 164 | 3 | 3 | 0 | 158 | 0 |

| Group 4 | 173 | 10 | 2 | 3 | 158 | 0 |

| Group 5 | 228 | 13 | 47 | 0 | 168 | 0 |

| Group 6 | 88 | 1 | 3 | 2 | 81 | 1 |

| Group 7 | 48 | 8 | 1 | 0 | 39 | 0 |

| Others | 678 | 162 | 413 | 0 | 102 | 0 |

| Totals | 6,633 | 342 | 594 | 124 | 5,569 | 4 |

| * Further detailed information on Group 2 exports is available in the 2017 Military Exports Report | ||||||

Definitions:

- Returned without action

- A permit application is returned without action by Global Affairs Canada if it is administratively incomplete, or if there is inconsistent information. A company that wishes to pursue the export would then be required to submit a new permit application.

- Withdrawn

- Permit applications may be withdrawn either at the request of the exporter (e.g., if the permit is no longer required because the commercial deal falls through or if the company becomes aware of commercial, political or other types of risk that may affect their application, and decides not to pursue the commercial opportunity), or by Global Affairs Canada (e.g., if the goods or technology proposed for export are not controlled, or if a General Export Permit applies).

- Cancelled

- An export permit that has been issued may be cancelled for administrative reasons (e.g., at the request of applicant as the permit is no longer required, or due to an error on the permit requiring replacement by a new permit), or by direction of the Minister of Foreign Affairs. An export permit that has been cancelled is no longer valid for the export of goods or technology.

- Issued

- means a permit approved and issued.

- Denied

- A permit that was denied by the Minister of Foreign Affairs, either directly or further to policy direction received by officials. An export permit application may be denied by the Minister of Foreign Affairs. This is unusual, occurring in fewer than 1% of cases annually, and is generally for reasons of Canada’s foreign and defense policy, as provided in the criteria for controlling the export of military, dual use and strategic goods outlined above.

| Destination | % of Permits Issued | |

|---|---|---|

| 1 | United Kingdom | 10.90% |

| 2 | Germany | 6.90% |

| 3 | France | 6.10% |

| 4 | Israel | 5.20% |

| 5 | South Africa | 4.40% |

| 6 | China | 4.20% |

| 7 | Australia | 3.40% |

| 8 | Japan | 3.30% |

| 9 | Korea (South), Republic of | 3% |

| 10 | United States* | 2.60% |

| 11 | Switzerland | 2.50% |

| 12 | Turkey | 2% |

| *Export permits are only required for a small number of items controlled for strategic purposes on the ECL when exported to the United States. This chart reflects the top 12 destinations by number of permits issued this year for all military, dual-use and strategic items on the ECL. The 2017 Military Exports Report has a similar table but is a listing of Canada’s top destinations for military items (group 2 only) by value outside of the United States for permits utilized in 2017. | ||

Export controls: Area Control List

On June 20, 2017 the Government of Canada finalized the regulatory process to amend the ACL of the EIPA. This amendment formally removed Belarus from the ACL, a list of countries to which the Governor in Council deems it necessary to control the export or transfer of any goods and technology.

Exports of uncontrolled goods and technology (i.e. items that are not listed on Canada’s Export Control List – (ECL) no longer require an export permit issued under the authority of the EIPA in order to lawfully export those items to Belarus.

For those items that are listed on Canada’s ECL, export permits are required in accordance with the regular export controls process.

This decision supersedes Notice to Exports No. 197 “Exports of items listed on the ECL to Belarus”.

Section 4 of the Act provides for the control of "any goods or technology to any country included in an ACL. Currently there is one country on the ACL:Democratic People’s Republic of Korea (North Korea). In 2017, 105 permits were issued for Belarus and 3 for North Korea, falling within the Government of Canada’s general humanitarian policy, which was established to allow the approval of export permits to countries on the ACL, if the export in question has a humanitarian basis.

Export controls: Automatic Firearms Country Control List (AFCCL)

The Act provides for the establishment of an AFCCL. Export permit applications for automatic firearms and certain other prohibited firearms, weapons and devices are only considered to countries on the AFCCL. Ukraine was added on November 23, 2017.

The countries listed on the AFCCL in 2017 were: Albania, Australia, Belgium, Botswana, Bulgaria, Chile, Colombia, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Israel, Italy, Kuwait, Latvia, Lithuania, Luxembourg, Netherlands, New Zealand, Norway, Peru, Poland, Portugal, Romania, Saudi Arabia, Slovakia, Slovenia, Spain, Sweden, The Republic of Korea (South Korea), Turkey, United Kingdom, Ukraine and United States.

Export controls: Softwood Lumber

With the expiry of the 2006 Canada-United States of America Softwood Lumber Agreement, on October 12, 2015, Global Affairs Canada continued to require export permits for shipments to the United States with the implementation of a monitoring program effective October 13, 2015.

For 2017, exports of softwood lumber, based on definitions specific to the Agreement, totalled 14 billion board feet, as indicated in Table 8.

| Month | Foot Board Measure (FBM) | Number of Issued Permits |

|---|---|---|

| January | 1,267,698,635 | 20,439 |

| February | 1,118,260,154 | 16,609 |

| March | 1,336,441,250 | 20,344 |

| April | 1,257,404,279 | 19,208 |

| May | 1,139,950,763 | 16,569 |

| June | 1,111,159,722 | 16,715 |

| July | 1,069,156,022 | 15,673 |

| August | 1,120,800,498 | 16,803 |

| September | 1,238,031,499 | 18,652 |

| October | 1,286,031,026 | 19,705 |

| November | 1,246,126,739 | 18,912 |

| December | 1,015,776,554 | 15,964 |

| Total | 14,206,837,141 | 215,593 |

Notes:

| ||

Export controls: Logs

A federal export permit issued by Global Affairs Canada is required for the export of all logs from any type of land in Canada (e.g., provincial Crown land, federal Crown land, private lands, parks and reserves). Additional information on the export process for logs can be found at http://www.international.gc.ca/controls-controles/logs-bois/index.aspx?lang=eng

In 2017, Global Affairs Canada issued 7,834 permits for 8 million cubic metres (m3) of logs. The value indicated for those logs for the same period was approximately $1.15 billion. Details are provided in Table 9.

| Month | Volume (m3) | Number of Issued Permits |

|---|---|---|

| January | 594,636 | 672 |

| February | 852,581 | 734 |

| March | 1,308,310 | 616 |

| April | 548,098 | 662 |

| May | 675,069 | 823 |

| June | 624,053 | 660 |

| July | 701,353 | 814 |

| August | 601,988 | 704 |

| September | 507,014 | 455 |

| October | 503,892 | 513 |

| November | 604,664 | 597 |

| December | 484,635 | 583 |

| Total | 8,006,292 | 7,834 |

Notes:

| ||

Export controls: Agri-food Products to the United States

As part of its implementation of WTO commitments, the United States established TRQs for imports of peanut butter, certain sugar-containing products and refined sugar. Within these TRQs, Canada receives a country-specific quota allocation. The United States Government administers these TRQs on a first-come, first-served basis. In order to help ensure the orderly export of these programs against Canada’s country-specific quotas, Canada placed these products on the ECL. Accordingly, in order to comply with the EIPA and to benefit from the in-quota United States’ tariff rate, Canadian exports of peanut butter, certain sugar-containing products and refined sugar to the United States require an export permit issued by Global Affairs Canada. There are no quantitative restrictions for Canadian exports of these products to destinations outside of the United States.

Peanut butter was placed on the ECL on January 1, 1995.

Sugar-containing products were placed on the ECL on February 1, 1995. The global TRQ of the United States’ sugar-containing products is 64,709,000 kilograms and applies to imports of certain sugar-containing products falling under Chapters 17, 18, 19 and 21 of its Harmonized Tariff Schedule. The quota year for sugar containing products is from October 1 to September 30. In September 1997, Canada and the United States exchanged letters of understanding, under which Canada obtained a country-specific reserve within the United States’ sugar-containing products TRQ of 59,250,000 kilograms. The understanding also provides that only goods that are "product of Canada" may benefit from Canada's country-specific reserve.

Refined sugar was placed on the ECL on October 1, 1995. The quota year for refined sugar is from October 1 to September 30. In September 1997, Canada and the United States exchanged letters of understanding, under which Canada obtained a 10,300,000 kilogram (or 10.3 tonnes) country-specific quota. The understanding also provides that only goods that are "product of Canada" may benefit from Canada's country-specific reserve. Exports of agri-food products in 2017 are summarized in Table 10.

| Kilograms (Kg) | Quota | Utilization | Permits Issued |

|---|---|---|---|

| Peanut Butter | 14,500,000 | 13,231,922 | 2,754 |

| Sugar-containing Products | 59,250,000 | 47,172,892 | 3,960 |

| Refined Sugar *raw equivalent | 10,300,000 | 10,255,000 | 557 |

Export controls: Textiles and Clothing – Tariff Preference Levels

Textile and clothing exports are controlled as a result of various free trade agreements, including NAFTA, and the agreements with Chile, Costa Rica and Honduras. The agreements provide for preferential access for non-originating products through the use of Tariff Preference Levels (TPLs).

As of July 5, 2010, all TPLs for export to the United States, except for yarn, are allocated on a historical-use basis to the extent of utilization by exporters and on a first-come, first-served basis for those amounts not allocated directly to exporters. The TPL for yarn for exports to the United States and all TPL exports to Mexico, Chile, Costa Rica and Honduras are made available to exporters on a first-come, first-served basis.

As provided for in the NAFTA, the annual growth rates for the TPL volumes for Canadian goods entering the United States were eliminated at the end of 1999. No growth rates were provided for trade with Mexico.

TPL exports to the United States and Mexico must be accompanied by a certificate of eligibility. Other TPL exports do not require a certificate of eligibility. There were no changes to the administration of the existing agreements.

In 2017, Global Affairs Canada issued 23,627 certificates; 1,641 applications were rejected and 1,564 were cancelled. The vast majority of permit cancellations are generated by the need to amend permit details, such as quantity or export date. A small number of permits are cancelled to address non-compliance with legislative, regulatory or policy requirements or criteria. TPL export levels and utilization for textiles and clothing during 2017 are summarized in Table 11.

| United States | Mexico | Chile | Costa Rica | Honduras | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Square metre equivalents (unless otherwise indicated) | Access Level | Utilization | Access Level | Utilization | Access Level | Utilization | Access Level | Utilization | Access Level | Utilization |

| Wool Apparel | 5,325,413 | 2,600,875 | 250,000 | 54 | 112,616 | N/A | N/A | N/A | N/A | N/A |

| Cotton or Man-made Fibre Apparel | 88,326,463 | 15,588,902 | 6,000,000 | 389,960 | 2,252,324 | N/A | N/A | N/A | N/A | N/A |

| Cotton or Man-made Fibre Fabrics and Made-up Goods | 71,765,252 | 67,256,620 | 7,000,000 | 0 | 1,000,000 | N/A | 1,000,000 | N/A | N/A | N/A |

| Cotton or Man-made Fibre Spun Yarns | 11,813,664 | 3,676,315 | 1,000,000 | 1,312 | 500,000 | N/A | 150,000 | N/A | N/A | N/A |

| Wool Fabrics and Made-up Goods (kg) | N/A | N/A | N/A | N/A | 250,000 | N/A | 250,000 | N/A | N/A | N/A |

| Apparel | N/A | N/A | N/A | N/A | N/A | N/A | 1,379,570 | N/A | 4,000,000 | N/A |

| Fabric and Made-Up Goods | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 1,000,000 | N/A |

Export controls: CETA Origin Quota

Certain exports from Canada that are eligible under the CETA origin quota are subject to export controls under the EIPA. Accordingly, an export permit is required for shipments of these products from Canada to the EU in order to obtain the preferential tariff rate under CETA. These include high-sugar containing products, sugar confectionery and chocolate preparations, processed foods, dog and cat food, vehicles, and certain apparel products.

Exports of fish and seafood products, textiles and most apparel products from Canada to EU are not subject to export controls under the EIPA. Accordingly, export permits are not required for shipments of these products to the EU in order to obtain the preferential tariff under CETA.

Origin quota access is made available on a first-come, first-served basis, with the exception of the origin quotas for high sugar and vehicles for which allocation policies have been established.

CETA contains growth factors for origin quotas, with the exception of vehicles that provide for an increase in the volume of the origin quotas if certain conditions are met. Growth factor provisions are outlined in CETA.

In 2017, Global Affairs Canada issued 358 permits for CETA origin quota goods. The 2017 origin quota levels and utilization are summarized in Table 12. Note that origin quota levels were pro-rated for the period of September 21, 2017 to December 31, 2017.

| (t) for tonnes (u) for units or (kg) for kilograms | Access Level | Utilization |

|---|---|---|

| High Sugar containing products | 8,384(t) | 0 |

| Sugar Confectionery and Chocolate Preparations | 2,795(t) | 0 |

| Process Food | 9,781(t) | 0 |

| Dog and Cat Food | 16,767,000(kg) | 761,398 (kg) |

| Apparel | 26,827 (u) | 26,827 (u) |

| Vehicles | 27,945(u) | 2,327 (u) |

Export controls: General Export Permits

The Act provides for the issuance of general permits authorizing the export of certain designated goods or technology to all destinations or to specified destinations. General Export Permits (GEPs) are intended to facilitate exports by enabling exporters to export selected goods without applying for individual permits.

The following GEPs were in effect during 2017.

- GEP EX. 1: Goods with a value of less than $100, household articles, personal effects, business equipment required for temporary use outside Canada and personal automobiles

- GEP EX. 3: Consumable Stores Supplied to Vessels and Aircraft

- GEP EX. 5: Forest Products

- GEP EX. 10: Export of Sugar Permit

- GEP EX. 12: United States-Origin Goods

- GEP EX. 18: Personal Computers

- GEP EX. 31: Peanut Butter

- GEP EX. 37: Chemicals and Precursors to the United States

- GEP EX. 38: Chemical Weapons Convention Toxic Chemical and Precursor Mixtures

- GEP EX. 41: Dual-Use Goods and Technology to Certain Destinations

- GEP EX. 43: Nuclear Goods and Technology to Certain Destinations

- GEP EX. 44: Nuclear-Related Dual-Use Goods and Technologies to Certain Destinations

- GEP EX. 45: Cryptography for the Development or Production of a Product

- GEP EX. 46: Cryptography for Use by Certain Consignees.

Offences under the Export and Import Permits Act

Penalties are listed in subsection 19(1) of the EIPA as follows:

Every person who contravenes any provision of this EIPA or the regulations is guilty of:

- (a) an offence punishable on summary conviction and liable to a fine not exceeding $25,000 or to imprisonment for a term not exceeding 12 months, or to both; or

- (b) an indictable offence and liable to a fine in an amount that is in the discretion of the court or to imprisonment for a term not exceeding ten years, or to both.

A prosecution under section 19(1)(a) may be instituted at any time within but not later than three years after the time when the subject-matter of the complaint arose.

Section 25 of the EIPA delegates responsibility for the enforcement of the EIPA to all officers as defined in the Customs Act (subsection 2(1)). Global Affairs Canada entrusts the enforcement of the EIPA to the Canada Border Services Agency (CBSA), and to the Royal Canadian Mounted Police (RCMP).

Export control enforcement continued to be a key element in Canada's export control system in 2017.

Global Affairs Canada works closely with enforcement agencies, in particular the CBSA and the RCMP, which are responsible for enforcing the provisions of the EIPA. On receipt of information relating to an unauthorized export or import of controlled items, Global Affairs Canada may, depending on the circumstances of the case, refer the matter to the RCMP or CBSA for investigation and decision as to whether to proceed with administrative measures and/or penalties or criminal charges. Global Affairs Canada also routinely provides, assistance, expert advice, and investigative support to CBSA, RCMP and other investigative agencies. In 2017, Global Affairs Canada responded to 9 formal requests for investigation support.

Alleged violations may come to the attention of Global Affairs Canada directly (e.g., a Canadian exporter or importer may bring a suspected violation to the attention of Global Affairs Canada) or indirectly, as the result of an investigation and/or audit. Potential violations may also be identified in the course of CBSA operations at border control locations and major ports of entry and exit. CBSA may detain a shipment, referring to the appropriate department, including Global Affairs Canada, to verify that legislative and regulatory requirements controlling exports (e.g. export controls under the EIPA; sanctions; licenses from the Canadian Nuclear Safety Commission for nuclear-related items) have been met. In 2017, the CBSA referred 280 export detentions to Global Affairs Canada.

Global Affairs Canada recognizes that, on occasion, responsible exporters and importers inadvertently fail to comply with the EIPA. Exporters and importers finding themselves in such a situation are encouraged to disclose any incidents of non-compliance to Global Affairs Canada as soon as possible. If after considering the information provided GAC is satisfied that the exporter has fully cooperated, no further action maybe warranted. Depending on the gravity or overall circumstances of a case, Global Affairs Canada may nonetheless refer disclosures to CBSA or RCMP for further review. In 2017, Global Affairs Canada received 33 voluntary disclosures from Canadian exporters regarding the export of strategic and/or military goods and technology.

The Minister of Foreign Affairs has the authority to designate inspectors, who for any purpose related to the administration or enforcement of the EIPA may inspect, audit or examine the records of any person who has applied for an authorization under the EIPA. Such activities are conducted to ensure compliance with the EIPA and its associated regulations and established policies, including eligibility criteria associated with various TRQs.

Global Affairs Canada has verification teams deployed to four major metropolitan areas to support the administration of import and export permits related to trade commodities: Ottawa, Montreal, Toronto and Vancouver. Between 100 and 140 verification exercises are conducted annually.

Performance standards

Global Affairs Canada is committed to providing clients with prompt and reliable service based on Canadian export and import controls law, regulation and policy.

Our aims are: to foster an orderly processing of controlled imports into and exports from Canada; implement our commitments under international agreements; and ensure that the administration of trade controls under the authority of the EIPA is carried out smoothly and without undue hindrance to Canadian exporters, importers and consumers.

To fulfill this policy, and under the authority of the EIPA, Global Affairs Canada is responsible for issuing permits for importing controlled goods into Canada that are included in the ICL, and for exporting goods included in the ECL or for exporting goods to destinations included in the ACL.

In order to fulfill our responsibilities under the EIPA, Global Affairs Canada has established service standards.

- The target for processing import and export permit applications for non-strategic goods within the Export Import Controls System (EICS) is within four business hours of receipt.

- The target for processing of log permit applications for log exports is within three working days.

- The target for processing permit applications to export controlled strategic goods or technology within the Export Controls On-line System (EXCOL) is within 10 working days; and should consultations be required, the period is within 40 days.

In 2017, a total of 335,167 permit applications were processed within EICS and EXCOL, and approximately 96.9 per cent of those permit applications were processed within the allotted service periods. (Further detail on the specific service standards for military, dual-use and strategic permits may be found in the Report on Military Exports).

Glossary

- ACL

- Area Control List

- AFCCL

- Automatic Firearms Country Control List

- CDC

- Canadian Dairy Commission

- CETA

- Comprehensive Economic and Trade Agreemen

- CHFTA

- Canada-Honduras Free Trade Agreement

- ECL

- Export Control List

- EE

- Eviscerated Equivalent

- EICS

- Export and Import Controls System

- EIPA

- Export and Import Permits Act

- EXCOL

- Export Controls System On-line

- FBM

- Foot Board Measure

- GEP

- General Export Permit

- ICL

- Import Control List

- IREP

- Import for Re-export Program

- MFN

- Most Favoured Nation

- NAFTA

- North America Free Trade Agreement

- NZ

- New Zealand

- SME

- Square Metre Equivalents

- TRQs

- Tariff Rate Quotas

- WTO

- World Trade Organization

Footnotes

- Footnote 1

The fluid milk access level represents estimated annual cross-border purchases by Canadian consumers. The goods are imported under General Import Permit No. 1 - Dairy Products for Personal Use. On January 26, 2000 General Import Permit No. 1 was amended. The $20 limit in value for each importation of fluid milk for personal use was removed.

- Date Modified: