Canada's Statement of Case

In the London Court of International Arbitration No. 81010-B

The United States of America and Canada

Table of Contents

- Introduction

- The Context of the Present Dispute

- History of LCIA Arbitration No. 81010

- The Present Dispute

- Argument

- Conclusion

Canada's Statement of Case

1. Canada and the United States have reconvened the Tribunal that sat in LCIA Arbitration No. 81010 (“LCIA 81010”) to ask the Tribunal to choose between two competing interpretations of the Award (the “Award” or “81010 Award”) entered in that arbitration under the 2006 Softwood Lumber Agreement (“SLA” or “Agreement”). Footnote 1 Those competing interpretations are set forth in paragraphs 20-21 of the Joint Request for Arbitration.

Introduction

2.The United States refuses to accept that the Award means what it says. In the Award, the Tribunal required Canada to collect from Ontario and Québec lumber producers an export tax at fixed percentage rates for a fixed period of time. That tax was collected, at the rates ordered by the Tribunal, for the time ordered by the Tribunal. Canada, thus, has performed fully its obligations under the Award.

3. The United States now seeks to require Canada to continue collecting that tax from Ontario and Québec producers, because (a) Canada and the United States agreed after the Award to extend the date of expiration of the SLA by two years, and (b) the total amount collected does not equal the quantification of the lost U.S. producer surplus that the Tribunal used as the starting point for its determination of the appropriate tax rate.Footnote 2 This attempt to reimagine the Award should be firmly rejected. The U.S. position is unsupported by the plain meaning and text of the Award, is contrary to the principle of finality of awards, and is inconsistent with the SLA.

4.The Award imposed Compensatory Adjustments on exports of softwood lumber from Ontario and Québec to the United States. Footnote 3 The amounts of those adjustments were based on calculations performed jointly by both Parties’ experts at the direction of the Tribunal. The Tribunal’s Award clearly distinguished among (a) the quantification of benefits provided to Ontario and Québec producers, (b) the change in U.S. producer surplus found to have resulted from those benefits, and (c) the calculation of the Compensatory Adjustments needed to “neutralize the effects of the benefits provided.” Footnote 4 The Tribunal’s directions were equally clear that the Compensatory Adjustments imposed were to continue only until October 12, 2013, the date on which the SLA was then to expire.Footnote 5

5. The remedy crafted by the Tribunal was fully in keeping with the central mechanism for the regulation of the trade in lumber imposed by the SLA, which sought to bring to an end a 25-year trade war between the United States and Canada over Canadian exports of softwood lumber. The SLA resolved the dispute by imposing a system of controls – referred to in the Agreement as Export Measures – on lumber exports. These Export Measures consist of a mixture of export quotas (limits on quantity) and export charges (in effect, taxes). The logic of the SLA is that either form of control, whether a tax on Canadian exports or a limit on the quantity of such exports, will have the effect of raising lumber prices on the United States’ side of the border, and thus will protect American lumber producers.

6.The SLA also provides a remedy for any circumvention of the Export Measures. When a circumvention is found, the Export Measures can be adjusted to restrain trade to the extent needed to remedy the effects of that circumvention. That is, an action that had the effect of offsetting or reducing the Export Measures, and thus lowering prices in the United States, can be remedied either by increasing export taxes or lowering permitted export volumes, or both, in order to restore the efficacy of the Export Measures by raising prices in the United States back to the level where they would have been absent the breach of the SLA. Such an increase in the export tax was the remedy imposed by the LCIA 81010 Tribunal for the specific circumventions found in that arbitration.

7.While the 81010 Award contained the term “Change in U.S. Producer Surplus,” Footnote 6 that quantification was, and was understood to be, one element calculated by the economists’ model on the basis of economic data and assumptions projected from the summer of 2010 through October of 2013. The Award imposed no obligation to collect taxes equal to that figure or any certain dollar amount. Rather, the Award imposed additional export charges to restore the effectiveness of the Export Measures in controlling Canadian lumber exports. The current effort by the United States to reinterpret the Award to require collection of a fixed dollar amount rather than collection of “additional Export Charges” Footnote 7 at specified rates for a specified period is simply an attempt to revive an argument that the Tribunal never accepted in the course of the LCIA 81010 arbitration.

8. The Tribunal’s Award directed Canada to collect an export tax from lumber producers in Ontario and Québec at specified rates for a fixed period of time. Canada has performed fully what the Tribunal directed. The United States now seeks to obtain a remedy that the Tribunal never imposed, based on theories and logic that the Tribunal has never accepted, in order to achieve a result unsupported by the text of the Award or the SLA. The Tribunal should reject that attempt and should order, for the reasons explained in detail below, that Canada’s interpretation of the Award is the correct one.

The Context of the Present Dispute

Governing Rules

9. The rules governing this arbitration are the understanding reached between representatives of Canada and the United States in an Exchange of Diplomatic Notes between the Government of Canada and the Government of the United States of America dated September 30, 2013 (“Parties’ Understanding” or “Understanding”), Footnote 8 8 the SLA, whose remedy system constitutes a lex specialis,Footnote 9 and international law. Footnote 10

The Parties’ Understanding

10. The Understanding both establishes the procedural framework for this arbitration, and defines the substantive parameters of the Tribunal’s mandate.Footnote 11 The Parties have agreed that the only issue before the Tribunal is which of the following two positions represents the correct interpretation of the 81010 Award: Footnote 12

Canada’s position is that the Award requires Canada to collect the Compensatory Adjustments specified in the Award only until the expiration date of the SLA as it existed at the time of the Award (i.e., October 12, 2013).Footnote 13 The U.S. position is that the Award requires Canada to continue to apply the Compensatory Adjustments for as long as the SLA remains in effect until Canada has collected the amounts of change in U.S. producer surplus identified in the Award because, based on Canada’s reported collections, Canada will not collect these amounts by October 12, 2013. Footnote 14

11. The Understanding also specifies the issues not in dispute. Specifically, the Understanding provides that “neither Party will use this proceeding to litigate the issue of whether the rates of export charges, or the amounts to be collected, identified in the Award should be increased or decreased.” Footnote 15 Consistent with the limits on the issues before the Tribunal, the Parties have restricted the evidence to those facts and evidence already in the record of LCIA 81010 and have asked that the Tribunal not consider evidence outside of the LCIA

81010 record.Footnote 16

The Softwood Lumber Agreement of 2006

12.In Articles VI and VII of the SLA, Canada agreed that each province or part of a province would apply one of two different categories of Export Measures to Canadian softwood lumber exports to the United States: either an export tax, referred to as a “charge,” or an export quota coupled with a significantly lower export tax. Footnote 17Québec and Ontario chose the latter option.

13.In return for these restrictions on Canadian exports, the United States committed for the duration of the Agreement not to initiate any trade investigations or impose trade restrictions with respect to softwood lumber products from Canada.Footnote 18

14.To prevent circumvention of the commitments in the SLA, the Parties agreed in Article XVII(1) not to take actions that would offset or reduce Canada’s commitment to impose Export Measures or undermine the U.S. commitment not to impose trade actions, including “any action having the effect of reducing or offsetting the Export Measures.” Footnote 19

15.The SLA contains specific provisions concerning the remedies available in case of a breach of the SLA. Pursuant to Article XIV(22), if a tribunal finds a breach it must set a time period to cure the breach and “determine appropriate adjustments to the Export Measures to compensate for the breach” if the party fails to cure.Footnote 20 The adjustments may be in the form of an increase in the Export Charge or a reduction in export volumes, or both.Footnote 21 If the breach in question is a circumvention in violation of Article XVII, the remedy must compensate for the reduction or offset of the Export Measures in restraining trade to the U.S. market.

History of LCIA Arbitration No. 81010

16.LCIA 81010 was initiated by the United States in 2008 to challenge certain programs adopted by the Provinces of Ontario and Québec as breaches of Article XVII of the SLA. Although LCIA 81010 was the second dispute arising out the 2006 SLA, it was the first in which the United States alleged that Canada had circumvented the Agreement in breach of Article XVII.Footnote 22 That is, it was the first arbitration in which the United States had alleged that Canada had taken an action having the effect of reducing or offsetting the

Export Measures.

17.The United States initially proposed to the LCIA 81010 Tribunal two remedy alternatives in the event that the Tribunal found liability with respect to any of the challenged programs. The United States proposed either: (1) to increase the export charges in an amount equal dollar for dollar to the grants or other benefits that were determined to have been provided (the “Beck Remedy”); or (2) to impose additional export charges to eliminate the effect of the provincial programs on the Export Measures (and consequently on U.S. lumber prices) as calculated through an economic model designed by its economics expert, Professor Topel (the “Topel Remedy”). Footnote 23

18.Canada, in its Statement of Defence, argued that the provincial programs did not circumvent the SLA, either because the programs did not provide the grants or other benefits alleged by the United States, or because the programs fell within the safe harbours of Article XVII (Article XVII(2)(a) through (c)).Footnote 24 With regard to remedy, Canada agreed with the principle underlying the Topel Remedy if circumvention were found: that the SLA provides for the imposition of Compensatory Adjustments calculated to neutralize the

economic effects on the Export Measures caused by any provincial program found to breach the SLA. Footnote 25

19. The United States changed tack in its Reply Memorial. It explained that, while it had presented the Topel remedy as a “separate remedy proposal” in its Statement of Case, the Tribunal should now regard Professor Topel’s work as a “component of a comprehensive remedy that compensates for both harm to United States producers and benefits to Canadian producers.” Footnote 26

The United States went on to note that its “proposed adjustments to Ontario and Quebec Exports” (which it had calculated to be at least C$217 million and which it asked the Tribunal to order remain in place until the entire amount was collected) “satisfy these criteria.” Footnote 27 In subsequent submissions, and during the Hearing, the United States continued to request that the remedy imposed by the Tribunal consist of requiring a dollar amount to be collected through an export tax until the full amount was collected.Footnote 28

20. The Tribunal decided that the wording of Article XVII, coupled with the wording of Article XIV, led to the conclusion that any reduction or offset of the Export Measures must be:(a) determined by looking at the effect of the benefits provided under the programs on lumber prices in the U.S. market (i.e., lost producer surplus);Footnote 29and (b) addressed, if an adverse effect were found, through an additional export tax that would reverse the estimated price effects on the U.S. lumber market and thus address the harm caused to U.S. producers.Footnote 30 The remedy would accomplish this by causing prices in the U.S. market to rise. This is reflected in Professor Kaufmann-Kohler’s statement during the Hearing: “{I}f the tribunal finds that there is a violation of the SLA, then it must set a compensatory adjustment. For that, we understand conceptually in broad terms that we must first determine the amount of the benefit, then determine the effect of the benefit on the measure and then determine the necessary adjustment or tax to compensate for this effect.” Footnote 31

Procedural Order No. 6

21.Following the Hearing in LCIA 81010, the Tribunal issued Procedural Order No. 6 (“P.O. 6”).Footnote 32 In that Order, the Tribunal directed Canada’s economics expert, Professor Kalt, and the U.S. economics expert, Professor Topel, to submit a joint report addressing specific questions posed by the Tribunal.Footnote 33 In particular, P.O. 6 instructed the economists to calculate the “reduction or offset of the Export Measures (as defined by the SLA) caused by such {program} benefits and calculate the compensatory adjustments to be collected in order to neutralize such reductions or offsets.”Footnote 34

22.Upon receipt of P.O. 6, the experts notified the Tribunal that “counsel for the United States and Canada agree that we should take the expiration date for the Softwood Lumber Agreement to be October 12, 2013” and that the experts would “use that date for the relevant calculations” unless the Tribunal advised otherwise.Footnote 35The Tribunal confirmed that the experts were to “proceed using October 12, 2013, as the expiration date of the SLA.” Footnote 36 In that same letter, the Tribunal further directed that the experts should perform two separate calculations, each of which was to provide Compensatory Adjustments “to be applied from January 1, 2011 to October 12, 2013.” Footnote 37

The Joint Expert Report

23. Following the Tribunal’s directions, the experts submitted a joint report setting forth their approach to determining remedy as well as areas of agreement and disagreement with respect to methodology and inputs.Footnote 38 Despite a number of disagreements, the authors of the Joint Expert Report agreed on the general contours of their mandate. They “agree{d} on the basic structure of the economic model” as well as that the economic model “generates the compensatory tax rates to offset the effects of the subject programs.”Footnote 39 The experts created and submitted to the Tribunal an economic model that allowed them to:

- Estimate the effects of the programs on US lumber prices;

- Estimate lost US producer surplus; {and}

- Estimate export tax rates that offset the effects of the programs during the period the duty is imposed, as well as lost US producer surplus before and after the charge is imposed. Footnote 40

24. To estimate the effects of the programs on U.S. lumber prices and consequent harm to U.S. producers in the form of lost producer surplus, the experts relied on numerous inputs and assumptions about how the lumber market would behave from June 2010, the date of the report, until October 2013, when the SLA was due to expire. These included assumptions about: (a) annual softwood lumber production in each of the provinces, in the rest of Canada, and in the United States; (b) annual softwood lumber prices; (c) annual investment levels in softwood milling, logging, and forestry; (d) the value of softwood lumber exports subject to the Export Measures; (e) required rates of return to investors of capital in lumber production; (f) depreciation rates of capital used in softwood lumber production; and (g) the responsiveness of softwood lumber purchasers to changes in lumber prices.Footnote 41 These assumptions of how the relevant market would behave through October 12, 2013 amounted to predictions for years into the future.

25.The experts’ model calculated past and future harm to U.S. producers.Footnote 42 In each scenario their economic model produced a single export tax rate, designed to neutralize both past effects and projected future effects of each program through October 12, 2013.Footnote 43 The experts also calculated for the Tribunal the amounts of anticipated duty that they estimated would be collected as a result of such charges.

26.Professor Kalt explained in the Joint Expert Report the basic mechanism by which an export tax offsets harm to U.S. producers:

The resulting export duty taxes and, thus, discourages, exports.

Resulting reductions in export supply put upward pressure on U.S. lumber prices, generating US producer surplus gainsFootnote 44

The experts accordingly proposed remedial Compensatory Adjustments in the form of fixed percentage export charges that would be imposed through October 12, 2013 and that would have the effect of reducing each province’s exports, thereby increasing the price of U.S.- produced lumber to levels sufficient to compensate U.S. producers for both past and projected future effects of the programs found to circumvent the SLA

27.In its Award dated January 20, 2011, the 81010 Tribunal found certain of the provincial programs to be in breach of the SLA and further found that, in the absence of a cure, Compensatory Adjustments would be required.Footnote 45 The Tribunal concluded that the Compensatory Adjustments set by the Tribunal “must be such that they neutralize the effects which the breaching programs had on the level playing field created by the Export Measures.” Footnote 46The Tribunal adopted the approach to remedy proposed by Professors Kalt and Topel in their Joint Expert Report and used the economic model submitted by the joint experts as the basis for setting the Compensatory Adjustments. Footnote 47

28. The Award did not adopt the positions urged by the United States with respect to several important issues. In particular, the Tribunal did not grant the United States’ request for Compensatory Adjustments in the form of an export tax that would collect a dollar amount certain. Rather, the Tribunal decided that the Compensatory Adjustments should be those calculated using the Interactive Spreadsheet in Attachment A to the Joint Expert Report.Footnote 48 This decision resulted in fixed percentage tax rates to be collected on exports from each province until October 12, 2013. Those rates were set out in the table headed “Attachment A” incorporated into paragraph 410 of the Award and reproduced below.

| Program($ Millions) | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | Total | Post SLA |

|---|---|---|---|---|---|---|---|---|---|---|

| Ontario FSPF | ||||||||||

| Benefit Amount($CDN) | $0.00 | $3.86 | $0.00 | $0.25 | $1.46 | $1.83 | $1.83 | $1.43 | $10.65 | - |

| Tax Rate | - | - | - | - | - | 0.14% | 0.14% | 0.14% | - | - |

| Anticipated Duty Amount to Be Collected ($US) | - | - | - | - | - | $0.80 | $0.80 | $0.63 | $2.23 | - |

| Ontario LGP | ||||||||||

| Benefit Amount($CDN) | $0.00 | $1.34 | $0.00 | $0.00 | $7.32 | $6.79 | $6.16 | $4.30 | $25.92 | - |

| Tax Rate | - | - | - | - | - | 0.14% | 0.00% | 0.00% | - | - |

| Anticipated Duty Amount to Be Collected ($US) | - | - | - | - | - | $0.00 | $0.00 | $0.03 | $0.00 | - |

| ONTARIO PROGRAMS | ||||||||||

| Change in U.S. Producer Surplus ($US) | $0.00 | $0.33 | $0.56 | -$0.29 | $0.22 | $1.32 | -$1.19 | -$2.48 | -$1.54 | $0.00 |

| Tax Rate | - | - | - | - | - | 0.10% | 0.10% | 0.10% | - | - |

| Anticipated Duty Amount to Be Collected ($US) | - | - | - | - | - | $0.56 | $0.56 | $0.44 | $1.56 | - |

| Québec Capital Tax Credit | ||||||||||

| Benefit Amount($CDN) | $0.03 | $2.12 | - | - | - | - | - | - | $2.14 | - |

| Tax Rate | - | - | - | - | - | 0.05% | 0.05% | 0.05% | - | - |

| Anticipated Duty Amount to Be Collected ($US) | - | - | - | - | - | $0.42 | $0.42 | $0.33 | $1.17 | - |

| Québec Roads Tax Credit | ||||||||||

| Benefit Amount($CDN) | $4.52 | $32.80 | $34.53 | $35.06 | $35.18 | $29.70 | $21.30 | $11.25 | $204.35 | - |

| Tax Rate | - | - | - | - | - | 2.35% | 2.35% | 2.35% | - | - |

| Anticipated Duty Amount to Be Collected ($US) | - | - | - | - | - | $18.76 | $18.76 | $14.59 | $52.10 | - |

| Québec PSIF | ||||||||||

| Benefit Amount($CDN) | $0.31 | $1.83 | $3.84 | $2.52 | $1.67 | $1.55 | $1.41 | $0.98 | $14.12 | - |

| Tax Rate | - | - | - | - | - | 0.10% | 0.10% | 0.10% | - | - |

| Anticipated Duty Amount to Be Collected ($US) | - | - | - | - | - | $0.56 | $0.56 | $0.44 | $1.56 | - |

| QUÉBEC PROGRAMS | ||||||||||

| Change in U.S. Producer Surplus ($US) | -$1.10 | -$6.48 | -$6.15 | -$5.00 | -$9.94 | -$12.19 | -$10.34 | -$6.10 | -$57.31 | $0.00 |

| Tax Rate | - | - | - | - | - | 2.60% | 2.50% | 2.60% | - | - |

| Anticipated Duty Amount to Be Collected ($US) | - | - | - | - | - | $20.82 | $20.82 | $16.20 | $57.84 | - |

29. The table headed Attachment A did not provide for any tax to be applied as a Compensatory Adjustment after 2013.Footnote 49

The Present Dispute

30. Pursuant to the terms of the Award,Footnote 50 Canada began applying the Compensatory Adjustments on March 1, 2011, and has continued to apply the Compensatory Adjustments at the rates specified by the Tribunal. Footnote 51 The United States has not disputed that Canada has complied with the Tribunal’s Award.

31.On January 20, 2011, when the Award in 81010 was issued, the date of termination of the SLA was October 12, 2013. A year after the Award was issued, on January 23, 2012, Canada and the United States agreed to extend the SLA through October 12, 2015, as permitted under Article XVIII of the SLA.Footnote 52 The Parties did not condition this extension upon any new terms or make reference in the extension agreement to collection of export charges required by awards already issued.Footnote 53

32. Nevertheless, the United States now insists that Canada is obligated to continue to apply the additional export charges specified in the Award beyond the termination date in place as of the time of the Award, in order to pursue collection of a certain dollar amount.Footnote 54 The Parties, in consequence, have asked this Tribunal to resolve their dispute by deciding which of their respective interpretations of the Award is correct.Footnote 55To maintain the status quo during the pendency of this proceeding, Canada has continued, without prejudice, to collect the export charges from Ontario and Québec producers since October 12, 2013.

Argument

I. The Tribunal Awarded Compensatory Adjustments in the Form of a Fixed Percentage Tax Rate

33.The Award required Canada to collect a fixed percentage tax rate until October 12, 2013. The Tribunal specifically directed that the Compensatory Adjustments ordered by the Award “shall take the form of additional Export Charges.” Footnote 56 The Tribunal set forth the tax rates to be collected in Attachment A at paragraph 410 of the Award. The Tribunal’s Award of Compensatory Adjustments in the form of a fixed percentage tax rate for a fixed time, rather than an award in the form of an amount certain, is the logical remedy for circumvention given the logic and structure of the SLA. The United States’ arguments to the contrary fail for two distinct and independent reasons.

A. Collection of a Fixed Percentage Tax Rate, Not an Amount Certain, Is Consistent with the Logic and Structure of the SLA

34. The SLA imposes a system of export controls (taxes and/or quotas) to regulate trade in lumber from Canada to the United States, not to collect a certain amount of taxes annually. Article VII(2) of the SLA (reproduced below), which deals with basic export controls, illustrates that the effects of such controls have no relationship to the amount of tax collected. Article VII(2) imposes export taxes, but contains no provision to adjust taxes up or down to ensure that any particular amount is collected.Footnote 57Article VII(2) provides:

2. Subject to paragraphs 3 through 9, the Export Measures that Canada applies under Option A and Option B shall be based on the following table:

| Prevailing Monthly Price | Option A - Export Charge (Expressed as % of Export Price) | Option B - Export Charge (Expressed as % of Export Price) with Volume Restraint |

|---|---|---|

| Over $US 355 | No Export Charge | No Export Charge and no volume restraint |

| $US 336-355 | 5% | 2.5% Export Charge + maximum volume that can be exported to the United States cannot exceed the Region's share of 34% of Expected U.S. Consumption for the month |

| $US 316-355 | 10% | 3% Export Charge + maximum volume that can be exported to the United States cannot exceed the Region's share of 32% of Expected U.S. Consumption for the month |

| $US 315 or Under | 15% | 5% Export Charge + maximum volume that can exported to the United States cannot exceed the Region's share of 30% of Expected U.S. Consumption for the month |

35. True to its logic, the SLA imposes higher Export Measures on Canadian exports when U.S. markets are weak and lumber prices are low, and lower rates when U.S. markets are strong and lumber prices are high. Footnote 58 Indeed, no restraints on Canada’s exports are imposed by the SLA once U.S. prices Footnote 59 reach the agreed-upon “ceiling” of U.S. $355 per thousand board feet of lumber. Footnote 60 That the SLA’s purpose is not to collect certain tax amounts is also clear from the logic underlying the SLA’s treatment of a relatively low export tax, when combined with a volume constraint, as the equivalent of a much higher tax-only Export Measure.Footnote 61

36. The Tribunal gave careful consideration to the structure of the SLA and the internal logic of its provisions when it determined that the purpose of the Compensatory Adjustments was “to neutralize the reduction or offsets to the Export Measures caused by

the programs and measures in breach of the SLA.”Footnote 62 That determination was fully consistent with the instructions the Tribunal had previously given the economists to “calculate the reduction or offset of the Export Measures (as defined by the SLA) caused by such benefits, including the past effects of such benefits, and calculate the compensatory adjustments to be collected in order to neutralize such reductions or offsets.” Footnote 63

37.While the two economists differed about some of the details of the economic model they used, their fundamental methodology and approach were the same. Footnote 64 The Compensatory Adjustments proposed by both economists to address the decline in producer surplus took the form of increases in the tax rate on exports of lumber from Ontario and Québec.Footnote 65 These increases were designed to reduce lumber exports from Ontario and Québec with the objective of restoring U.S. producer surplus to the levels that would have prevailed absent the provincial programs. Reducing exports increases U.S. lumber prices, thereby neutralizing the effect of the provincial programs. The tax rates were calibrated by using the economic model developed jointly by Professors Topel and Kalt specifically for this purpose.

38. In the Joint Expert Report at paragraph 183, Professor Kalt included an illustration of how the experts’ joint modeling operated to calculate Compensatory Adjustments:

To illustrate, take SLA’s Export Measures to be a duty of 10% during the term of the SLA. This duty has the effect of raising lumber prices in the US by some amount (less than 10%, because a duty on an exporting region’s exports is not fully passed through in the form of higher prices). Our calculations of remedial export duties during the term of the SLA measure the effective offset or reduction to the SLA’s Export Measures during the term of the SLA. Thus, for example, if (for the sake of illustration) our calculation of during-SLA remedial duties results in a 2% remedial duty, this arises because our modeling calculates that the effect of the subject programs was to offset or reduce a 10% SLA export duty and render it effectively only an 8% duty. In short, our calculations during the period of the SLA convert the programs’ supply and demand impacts into measures of how much the programs effectively offset or reduce the SLA’s Export Measures.Footnote 66

39.The Tribunal found that the benefits granted under several provincial programs reduced or offset the Export Measures.Footnote 67 A Compensatory Adjustment in the

form of a tax rate calculated by Professors Topel and Kalt eliminated that reduction or offset and restored the effects of the Export Measures.Footnote 68 In this case, the reduction or offset of the Export Measures caused by the provincial programs required a Compensatory Adjustment

to the Export Measures of 2.6 percent for Québec and 0.1 percent for Ontario.Footnote 69

B. The U.S. Position Erroneously Equates Amounts Collected in Taxes from Canadian Producers with the Effects of Those Taxes on U.S. Producers

40.Although it is undisputed that Canada has applied the fixed percentage export rates ordered by the Tribunal since March 2011, the United States argues that Canada has under-collected the remedy provided in the Award.Footnote 70 At its core, the U.S. position is based on the misconception that the collection of export taxes results in a dollar-for-dollar gain in U.S. producer surplus and, consequently, that lower-than-expected tax revenue collections must mean that the intended increase in U.S. producer surplus has not been achieved. An argument that equates tax collections with U.S. producer surplus changes cannot be sustained.

41.The two amounts, collections from export taxes and the change in producer surplus resulting from those taxes, are calculated in different ways and can differ significantly, depending on the economic characteristics of the market. Professors Kalt and Topel both calculated lost producer surplus as the change (reduction) in U.S. lumber prices resulting from the benefits provided by the provincial programs, multiplied by the total quantity of U.S. lumber production. Footnote 71 The total anticipated amount of tax collection, by contrast, is simply the remedial export tax multiplied by the total quantity of Ontario and Québec exports.

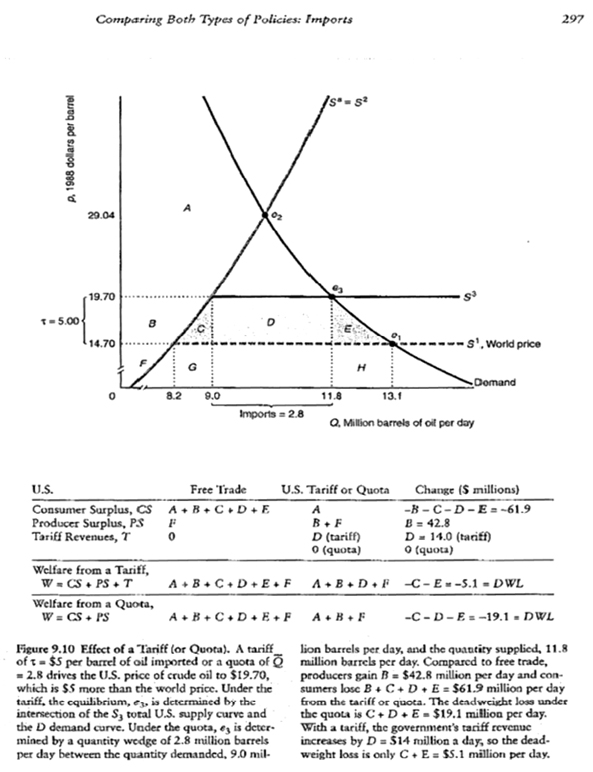

42.The figure below, taken from a microeconomics textbook and used by Professor Topel in his second report,Footnote 72 graphically demonstrates the non-equivalency of these amounts in certain market conditions:

In the example reproduced above involving the economic effect of a trade tax on crude oil, an export tax on oil exports to the United States of $5 per barrel with the market characteristics depicted in the supply and demand graph, would result in a producer surplus gain of $42.8 million per day, but tariff revenue of only $14 million per day. Notably, the amount of tax collected by the tariff (area “D” in the figure) has no overlap with and is of a different size than the change in producer surplus resulting from that tax (area “B” in the figure). As this textbook example illustrates, the U.S. position that export tax collections can be equated with gains in U.S. producer surplus is simply wrong.

43. An export tax, such as the Export Measures, affects producer surplus through its effect on market supply and demand – and, hence, on prices received by producers. This effect implies no equivalency between the amount collected in export taxes and the amount of surplus realized by U.S. producers. To take an extreme illustration, if export taxes were set sufficiently high, exports would cease altogether.Footnote 73Cutting off exports would raise U.S. prices and increase U.S. producer surplus, but zero exports would result in zero export tax collections. In fact, producer surplus gain from the tariff would be at its maximum for the domestic producers, but tariff revenue would be zero. U.S. producers would face no competition or pricing pressure from imports, but there would be no exports from Canada to tax.

44. This distinction between tax collections and effect on U.S. producers applies to both pre- and post-Award changes in U.S. producer surplus. In both cases, the harm to U.S. producers is measured in terms of the extent to which the market position of U.S. producers was adversely affected by the effects of the programs on exports from Québec and Ontario.Footnote 74 Consequently, the Compensatory Adjustments neutralized those effects by restraining exports from Québec and Ontario to improve the market position of U.S. producers to an extent sufficient to offset both the pre- and projected post-Award effects of the programs. The rate was calculated to increase producer surplus both to compensate for the past harm and to correct for producer surplus going forward and includes an increment to be applied until October 12, 2013 that compensates for the past effects.Footnote 75 The effect that collection of any given amount of taxes will have on exports and on U.S. producer surplus thus depends on a complex set of assumptions regarding past and future market supply and demand characteristics and calculations regarding, among other things, levels of demand and market shares.

45.Collection of a smaller-than-anticipated amount of export taxes simply indicates that the actual volume or price (or some combination of both) of exports fell short of the projections about the future made by the economists in their Joint Expert Report.One reason for this shortfall might be that the benefits provided by the Ontario and Québec programs actually had less of an effect on the Export Measures than anticipated. Another might be that the Award’s Compensatory Adjustments were more potent and curtailed exports to a greater extent than anticipated. Yet another might be that overall market conditions and U.S. and Canadian producers’ responses to these conditions, perhaps in combination with the effects of the Compensatory Adjustments, depressed exports.

46.That Canada did not collect the anticipated amount of export tax revenues, therefore, does not mean the U.S. producers were not compensated in full for their “lost producer surplus” by the Compensatory Adjustments ordered by the 81010 Award.

II. The Compensatory Adjustments Were to be Collected Only Until October 12, 2013

A. The Tribunal Set the Compensatory Adjustments Based on a Termination Date of October 12, 2013

47.The Tribunal’s Award makes clear that collections of the export tax specified in paragraph 410 of the Award were to continue only until October of 2013. Attachment A to the Joint Expert Report, used as the basis for the table in paragraph 410 of the Award, contains columns calculating tax rates only through 2013.

48.The tax rate specified in paragraph 410 of the Award was based on the common understanding of the Parties, the economists, and the Tribunal that the SLA was to end as of October 12, 2013. Upon receipt of P.O. 6, the experts notified the Tribunal that: counsel for the United States and Canada agree that we should take the expiration date for the Softwood Lumber Agreement to be October 12, 2013. Accordingly, we intend to use that date for the relevant calculations – unless, of course, you advise otherwise.Footnote 76

The Tribunal confirmed that the experts were to “proceed using October 12, 2013, as the expiration date of the SLA.” Footnote 77

49.The Tribunal’s directions that Professors Kalt and Topel were to perform two separate calculations were equally clear about the termination date to be used in each:

Scenario I: compensatory adjustments (to be applied from January 1, 2011 to October 12, 2013) covering only program- induced lumber price effects that offset or reduce the Export Measures during the validity of the SLA.

Scenario II: compensatory adjustments (to be applied from January 1, 2011 to October 12, 2013) that also take into account the effects of benefits (distributed during the period of validity of the SLA) after the expiration of the SLA. Footnote 78

Notably, in both scenarios, the Tribunal required that the Compensatory Adjustments be applied only until October 12, 2013.

50.In developing the Compensatory Adjustments to be collected in order to neutralize the reductions or offsets to the Export Measures, Professors Topel and Kalt followed the direction of the Tribunal to use October 12, 2013 as the expiration date of the SLA.Footnote 79 Professor Topel explained, “I understand that compensating measures under the SLA can be imposed only during the term of the SLA. The SLA expires at the end of 2013, and the taxes must do the same.”Footnote 80

51.The Parties, the experts, and the Tribunal all agreed that October 12, 2013 was the appropriate end date for the experts to use in their joint calculations and for the application of the Compensatory Adjustments. It is self-evident that changing the termination date to 2015 would result in collections that would bear no relationship to the experts’ calculation of the effects of the programs on U.S. producers.

52.The United States’ request simply to extend the current percentage export tax rate for two years to 2015 would be contrary to the terms of the Award and would result in an inappropriate collection. It should not be entertained by the Tribunal.

B. Extending Application of the Award Beyond October 12, 2013 Would Be Inconsistent with the Principles of Finality and Predictability and Would Undermine the SLA

53.The Award ordered Canada to apply a fixed percentage tax rate until October 12, 2013. That decision was final and binding. By inviting the Tribunal to extend collection of the Compensatory Adjustments beyond 2013, the United States improperly seeks to expand the 81010 Award beyond its original terms.

54.It is important to consider the 81010 Award in the context of the SLA, a uniquely tailored agreement that provides for binding arbitration between States. After decades of trade disputes over softwood lumber that resulted in a multitude of appeals to NAFTA and WTO tribunals, the Court of International Trade and the Court of Appeals for the Federal Circuit, the finality and predictability inherent in arbitration was a negotiated element of the SLA.

55.The SLA specifies in detail how trade disputes arising under the SLA are to be handled. Article XIV of the SLA details the Parties’ agreed-upon dispute resolution provisions and demonstrates an emphasis on expediency, predictability, and finality.Footnote 81 Notably, the Parties eschewed appeal-prone litigation and committed to arbitrate their disputes.Footnote 82The Parties specifically agreed that awards issued under the SLA “shall be final and binding and shall not be subject to any appeal or other review.”Footnote 83The Parties’ preference for finality is further demonstrated by the adoption of the LCIA Arbitration Rules, which also severely curtail the right of appeal.Footnote 84

56.It would be counter to the spirit of finality and party autonomy (given the carefully-crafted SLA provisions limiting post-Award recourse to tribunals) for the Tribunal to accept the U.S. invitation to revisit its decision. Instead, the Tribunal should be faithful to the Parties’ ex ante shared expectations. The Tribunal determined the appropriate fixed percentage adjustments to the Export Measures to compensate for the breaches, and Canada applied those adjustments for the specific period of time specified in the Award – until October 12, 2013.The United States’ request to extend the current percentage export tax rates forward two years beyond the period for which they were calculated would untether the Compensatory Adjustments from their rationale and would materially alter the terms of the Award.

57.Tribunals are frequently in a position of having to award remedies based on predictions regarding future market conditions. For example, a tribunal is often required to calculate the discounted present value of a future lost income stream based on assumptions and predictions developed for the purpose. But no rules of arbitration permit a tribunal to revisit its award. The principles underlying international arbitration dictate that decisions are final, even when they are based on forward-looking projections that turn out otherwise than expected.

58. The Tribunal has been asked to choose between two alternatives.The first is to find that Canada fully complied with its obligations under the Award by imposing the Compensatory Adjustments set out in the Award through October 12, 2013, the period specified in the Award.The second is to require Canada to continue for two more years to impose Compensatory Adjustments that would no longer be tethered to any economic theory or calculation, simply because the amounts of revenue collected have not coincided with the economists’ predictions about future behavior and outcomes in the market. Sound policy as articulated in the SLA, respect for the actual wording and mandate of the Award, and consistency with the economic analysis underlying the Joint Expert Report all point firmly to the first alternative.

Conclusion

59. For all of the foregoing reasons, Canada respectfully requests that the Tribunal confirm that Canada's obligation to collect the Compensatory Adjustments set out in the 81010 Award terminated on October 12, 2013, the original termination date for the SLA. Canada further requests that the Tribunal direct that the Compensatory Adjustments collected from exporters between October 12, 2013 and the date of the Award should be

reimbursed.

Respectfully submitted,

John M. Townsend (Signature)

John M. Townsend

Joanne E. Osendarp

Eric S. Parnes

John M. Ryan

Elizabeth C. Solander

HUGHES HUBBARD & REED LLP

1775 I Street, N.W. Washington, D.C. United States

Tel: +1.202. 721.4600

Fax: +1.202.721.4646

townsend@hugheshubbard.com

osendarp@hugheshubbard.com

parnes@hugheshubbard.com

ryanj@hugheshubbard.com

solander@hugheshubbard.com

Attorneys for Canada

Arun Alexander Michael Owen Isabelle Ranger Trade Law Bureau

Government of Canada

Lester B. Pearson Building

125 Sussex Drive

Ottawa, Ontario K1A OG2

Canada

Tel: +1 (613) 943-2803

arun.alexander@international.gc.ca

michael.owen@international.gc.ca

isabelle.ranger@international.gc.ca

December 17, 2013

Footnotes

- Footnote 1

Award in United States of America v. Canada, LCIA Arbitration No. 81010 (Jan. 20, 2011) (Exhibit A to Joint Request for Arbitration); Softwood Lumber Agreement between the Government of Canada and the Government of the United States of America (Sept. 12, 2006, entered into force Oct. 12, 2006) (81010 R-1) (Exhibit B to Joint Request for Arbitration).

- Footnote 2

2 Lost producer surplus is a term used by economists to measure the economic impact on producers (in this case, US lumber producers) of actions that affect the prices for the commodity produced. A definition can be found in Professor Topel’s First Report. Expert Report of Robert H. Topel in United States of America v. Canada, LCIA Arbitration No. 81010, ¶ 57 & n.25 (Nov. 21, 2008) (hereinafter “Topel Report I”)

(81010 C-2).- Footnote 3

Capitalized terms not defined in this submission have the meanings assigned to them in the SLA.

- Footnote 4

81010 Award ¶ 407 (emphasis added); id. ¶ 410.

- Footnote 5

Letter from Tribunal to Experts at A.1 & B.5 (Apr. 15, 2010).

- Footnote 6

81010 Award ¶ 410, table headed Attachment A.

- Footnote 7

Id. ¶ 411.

- Footnote 8

Exchange of Diplomatic Notes between the Government of Canada and the Government of the United

States of America (Sept. 30, 2013) (Exhibit C to Joint Request for Arbitration).- Footnote 9

81010 Award ¶ 326.

- Footnote 10

81010 Award ¶¶ 327-328.

- Footnote 11

The limitations set forth in the Parties’ Understanding are appropriate under the LCIA rules, which encourage parties to “agree on the conduct of their arbitral proceedings” and also allow for parties to limit a tribunal’s discretion by written agreement. LCIA Rules Art. 14.

- Footnote 12

Parties’ Understanding ¶ 4; Joint Request for Arbitration ¶ 22.

- Footnote 13

Parties’ Understanding ¶ 4(a); Joint Request for Arbitration ¶ 20.

- Footnote 14

Parties’ Understanding ¶ 4(b); Joint Request for Arbitration ¶ 21.

- Footnote 15

Parties’ Understanding ¶ 7 (emphasis added).

- Footnote 16

Id. A flash drive containing the record in LCIA 81010 was sent to the members of the Tribunal on

December 13, 2013.- Footnote 17

SLA 2006 Art. VII (81010 R-1).

- Footnote 18

Id. Art. V.

- Footnote 19

Id. Art. XVII(1).

- Footnote 20

Id. Art. XIV(22).

- Footnote 21

Id. Art. XIV(23)(a).

- Footnote 22

The earlier arbitral proceeding under the SLA, LCIA No. 7941, did not involve Art. XVII, but instead involved a miscalculation of quota amounts resulting in shipments exceeding the quota limits. See United States v. Canada, LCIA Arbitration No. 7941, Award on Remedies (Feb. 23, 2009) (81010 CA-12).

- Footnote 23

United States Second Corrected Statement of Case in United States of America v. Canada, LCIA Arbitration

No. 81010, ¶¶ 140-142, 144, 159, 164 (Dec. 23, 2008).- Footnote 24

Canada’s Corrected Statement of Defence in United States of America v. Canada, LCIA Arbitration No. 81010,

¶¶ 4-15 (Feb. 27, 2009).- Footnote 25

Canada’s Rejoinder in Rebuttal to Claimant’s Reply to Respondent’s Statement of Defence in United States of

America v. Canada, LCIA Arbitration No. 81010, ¶¶ 444-447, 643 (May 8, 2009).- Footnote 26

Corrected United States Reply Memorial in United States of America v. Canada, LCIA Arbitration No. 81010,

¶ 284, n.84 (Apr. 3, 2009) (emphasis added).- Footnote 27

Id. ¶¶ 279, 281, 284 & n.84, 299(a). Professor Topel never presented a total dollar amount prior to the

Joint Expert Report; he presented only tax rates in each of his reports.- Footnote 28

See, e.g., United States Post-Hearing Brief in United States of America v. Canada, LCIA Arbitration No. 81010,

¶ 153 (Oct. 8, 2009); United States Post-Hearing Reply Brief in United States of America v. Canada, LCIA

Arbitration No. 81010, ¶ 147 (Nov. 13, 2009); United States Comments on the Experts’ Joint Report in

United States of America v. Canada, LCIA Arbitration No. 81010, ¶ 86 (July 15, 2010).- Footnote 29

81010 Award ¶¶ 348-349.

- Footnote 30

Id. ¶¶ 352, 408(viii).

- Footnote 31

Arbitration Hearing Before the LCIA Tribunal in United States of America and Canada, LCIA Arbitration

81010 (July 2009), Tr. vol. 4-A, 960:19-961:1.- Footnote 32

Procedural Order No. 6 in United States of America v. Canada, LCIA Arbitration No. 81010 (Jan. 21, 2010).

- Footnote 33

Id.

- Footnote 34

P.O. 6 § 1.3 (emphasis added).

- Footnote 35

Letter from Professor Joseph P. Kalt to the Tribunal ¶ 1 (Apr. 2, 2010) (emphasis added); see also Letter from Professor Robert H. Topel to the Tribunal at 1 (Apr. 2, 2010) (agreeing with the expiration date presented by Professor Kalt in his letter of the same date).

- Footnote 36

Letter from Tribunal to Experts at A.1 (Apr. 15, 2010) (under the heading “Requests on which both experts are in agreement,” the Tribunal set forth its confirmation “that the experts shall proceed using October 12, 2013, as the expiration date of the SLA.”).

- Footnote 37

Id. at B.5. The Tribunal requested one calculation with and one calculation without post-SLA effects.

- Footnote 38

Revised & Final Report to the Tribunal pursuant to Procedural Order No. 6, by Professor Joseph P. Kalt & Professor Robert H. Topel in United States of America v. Canada, LCIA Arbitration No. 81010 (June 22, 2010) (hereinafter “Joint Expert Report”).

- Footnote 39

Id. ¶ 144 (emphasis added).

- Footnote 40

Id. (emphasis added).

- Footnote 41

Id. ¶¶ 145-146.

- Footnote 42

Id. ¶ 14.

- Footnote 43

Id. ¶ 183 & n.135.

- Footnote 44

Id. ¶ 200.

- Footnote 45

81010 Award ¶ 415.

- Footnote 46

Id. ¶ 352.

- Footnote 47

See, e.g., id. ¶¶ 337, 349, 409-410.

- Footnote 48

Id. ¶¶ 410-411. Attachment A as it appeared in the Joint Expert Report was an interactive spreadsheet for the Tribunal to use in making its decisions. Attachment A as it appears in the Award and in this submission reflects the Tribunal’s decisions.

- Footnote 49

Id. ¶ 410.

- Footnote 50

Id. ¶ 415.

- Footnote 51

Joint Request for Arbitration ¶ 17.

- Footnote 52

Agreement Between the Government of the United States of America and the Government of Canada Extending the Softwood Lumber Agreement, as Amended (Jan. 23, 2012) (“Agreement to Extend the SLA”) (Exhibit E to the Joint Request for Arbitration).

- Footnote 53

Id.

- Footnote 54

Parties’ Understanding ¶ 4(b); Joint Request for Arbitration ¶ 21.

- Footnote 55

Parties’ Understanding ¶ 4; Joint Request for Arbitration ¶ 22.

- Footnote 56

81010 Award ¶ 411; see also id. ¶ 408(viii) (recognizing that the “Compensatory Adjustments must be set in an amount equal to that of adjusted production taxes in accordance with Prof. Kalt’s methodology,” that is, a fixed percentage export tax rate.).

- Footnote 57

81010 Award ¶ 411; see also id. ¶ 408(viii) (recognizing that the “Compensatory Adjustments must be set in an amount equal to that of adjusted production taxes in accordance with Prof. Kalt’s methodology,” that is, a fixed percentage export tax rate.).

- Footnote 58

Id. For example, with regard to Option A regions, compare the 5 percent export tax for when the price is

$US 336-355 with the 10 percent export tax applied when the price is $US 316-335 with the 15 percent export tax levied when the price is $US 315 or under.- Footnote 59

The export taxes and quotas set out in Article VII(2) are dependent on the Prevailing Monthly Price of Lumber. The Agreement explains that “the Prevailing Monthly Price means the most recent four-week average of the weekly framing lumber composite (“FLC”) prices available 21 days before the beginning of the month to which the Prevailing Monthly Price shall be applied.” Id. Annex 7A.

- Footnote 60

Id. Art. VII(2).

- Footnote 61

Id. The SLA also provides for other Export Measures, including a surge mechanism and a third country adjustment provision (in Article VIII and Article IX, respectively). The surge mechanism provides for application of an additional Export Charge if the volume of exports for the Option A regions exceeds the Region’s Trigger volume. The third country adjustment provision allows Canada to refund export charges in certain circumstances, such as a decrease in Canadian market share of U.S. Consumption, increase in U.S. domestic producers’ market share of U.S. Consumption, and increase in third party market share of U.S. Consumption by at least 20 percent.

- Footnote 62

81010 Award ¶¶ 344-348.

- Footnote 63

P.O. 6 § 1.3 (emphasis added).

- Footnote 64

First, both Professors Kalt and Topel estimated the benefits associated with the provincial programs at issue. They then examined the effect of the benefit amounts on the levels of investment in, and expansion of production of, softwood lumber in Ontario and Québec. The economists next estimated the amount by which lumber exports to the United States from Ontario and Québec expanded as a consequence of increased production of lumber in these provinces. The increases in lumber exports to the United States were assessed for their effects on U.S. producers’ lumber prices. The model used in the Joint Expert Report (which built on the Kalt and Topel expert reports submitted earlier) then determined the Compensatory Adjustments that would neutralize the decline in U.S. producer surplus caused by the programs adopted by Québec and Ontario. See Rebuttal Expert Witness Statement of Joseph P. Kalt (May 8, 2009), ¶ 106 (hereinafter “Kalt Report II”) (81010 R-101).

- Footnote 65

oint Expert Report ¶ 144 (the experts “agree{d} on the basic structure of the economic model” and that the model “generates the compensatory tax rates to offset the effects of the subject programs”). Professors Topel and Kalt both agreed in their several independent economic reports submitted prior to the Joint Expert Report that the appropriate compensatory adjustment was a tax rate and not collection of a specified total amount of tax. Topel Report I, Exhibit 7 (81010 C-2); Expert Response Report of Robert H. Topel (Mar. 23, 2009), Exhibit 7 (hereinafter “Topel Report II”) (81010 C-44); Expert Rejoinder Report of Robert H. Topel (June 19, 2009), Exhibit 7 (81010 C-62); Expert Witness Statement of Joseph P. Kalt (Feb. 20, 2009), ¶¶ 159-161 (hereinafter “Kalt Report I”) (81010 R-2); Kalt Report II, App. Figures D-1 to D-5B (81010 R-101); and Second Rebuttal Expert Witness Statement of Joseph P. Kalt (July 7, 2009), ¶ 80 and App. Figures D-1 to D-5D (81010 R-148).

- Footnote 66

Joint Expert Report ¶ 183.

- Footnote 67

81010 Award ¶ 415.

- Footnote 68

Joint Expert Report ¶ 144.

- Footnote 69

81010 Award ¶ 410.

- Footnote 70

Parties’ Understanding ¶ 4(b); Joint Request for Arbitration ¶¶ 21, 24.

- Footnote 71

See Topel Report I ¶ 57 (“I first calculate lost producer surplus in the United States, which I approximate as the amount by which prices were lower times total production in the United States.”); id. at Exhibit 4 (“Lost Producer Surplus is Calculated as Annual US Production Volume*SWL Price*Subsidy Price Distortion”) (81010 C-2).

- Footnote 72

72 See Topel Report II, App. C (p. 109 of pdf document), excerpt from Jeffrey M. Perloff, Microeconomics,

297 (4th ed.) (81010 C-44).- Footnote 73

In the above textbook illustration, that would amount to an additional tariff of $9.34 per barrel, which would result in prices of $29.04, but no tax revenue collections, because imports would be zero at point O2 on the graph.

- Footnote 74

See Kalt Report II ¶ 129 (81010 R-101).

- Footnote 75

Joint Expert Report ¶ 183 & n.135. Because there is no direct equivalency between an amount collected as a result of the export tax and the change in producer surplus, the remedy adopted by the Tribunal compensates for both pre- and post-award producer surplus without requiring collection of an amount

certain for either element (retrospective or prospective).- Footnote 76

Letter from Professor Joseph P. Kalt to the Tribunal ¶ 1(Apr. 2, 2010) (emphasis added); see also Letter from Professor Robert H. Topel to the Tribunal at 1 (Apr. 2, 2010).

- Footnote 77

Letter from Tribunal to Experts at A.1 (Apr. 15, 2010) (under the heading “Requests on which both experts are in agreement.”).

- Footnote 78

Id. at B.5 (Apr. 15, 2010) (emphasis added).

- Footnote 79

Joint Expert Report ¶ 12.

- Footnote 80

Id. ¶ 167.

- Footnote 81

See, e.g., SLA 2006 Art. XIV(3), (19), (20) (81010 R-1).

- Footnote 82

Id. Art. XIV(2), (6).

- Footnote 83

Id. Art. XIV(20) (emphasis added).

- Footnote 84

LCIA Rules Art. 26.9 (“All awards shall be final and binding on the parties. By agreeing to arbitration under these Rules, the parties undertake to carry out any award immediately and without any delay (subject only to Article 27); and the parties also waive irrevocably their right to any form of appeal, review or recourse to any state court or other judicial authority, insofar as such waiver may be validly made.”).

- Date Modified: