Archived information

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Audit of Compliance with Work Force Adjustment Related Directives and Collective Agreements - Final Report

Foreign Affairs, Trade and Development Canada

Office of the Chief Audit Executive

March 2014

Table of Contents

Executive Summary

In accordance with its approved Risk-Based Audit Plan for 2013-2014 to 2015-2016, the Office of the Chief Audit Executive at the former Canadian International Development Agency (former CIDA)Footnote 1 has completed the Audit of Compliance with Work Force Adjustment Related Directives and Collective Agreements.

The objective of this audit was to provide reasonable assurance that Work Force Adjustment (WFA) processes within the former CIDA were compliant with the applicable legislation, policies, directives, and collective agreements.

Following the announcement of Budget 2012 and the Deficit Reduction Action Plan, Canadian federal government departments and agencies were mandated to implement budgetary savings targets by fiscal year 2014-2015. The resulting savings targets were composed of a combination of reductions to operational spending, human resources, and development program funding envelopes.

Numerous stakeholders contributed directly or indirectly to former CIDA’s successful WFA exercise. As a proactive measure, former CIDA developed a WFA implementation strategy that included three oversight bodies that were accountable to ensure proper implementation of the WFA processes at the former CIDA: the Management Board, the National WFA Committee and the Street Legal Team. Risk management processes appropriately assessed the high-level risks associated with the WFA’s respective processes and informal risk management was undertaken by these oversight bodies on an ad-hoc basis through regular discussion of issues related to WFA.

Even if opportunities for improvement were identified for compensation advisors, adequate formal training was provided to HR advisors and HR liaisons responsible for implementing WFA processes across the various branches. Responsible managers facing reduction targets within their unit were also given access to information resources.

Lastly, it was found that processes performed were compliant with applicable directives and collective agreements; however, a few minor control weaknesses were identified when determining and verifying the eligibility of employees to receive a pension waiver depending on the option selected.

Audit Conclusion

Overall, the audit found that the former CIDA was compliant with WFA directives and collective agreements. Evidence shows that steps were taken to support employees and that internal processes complied with applicable authorities.

Opportunities for improvement were identified regarding the documentation of the mandate, roles and responsibilities of oversight bodies, as well as the training, tools, and peer review processes available to compensation advisors.

Statement of Conformance

In my professional judgment as the Chief Audit Executive, this audit was conducted in conformance with the Institute of Internal Auditors' International Standards for the Professional Practice of Internal Auditing and with the Internal Auditing Standards for the Government of Canada, as supported by the results of the quality assurance and improvement program. Sufficient and appropriate audit procedures were conducted, and evidence gathered, to support the accuracy of the findings and conclusion in this report, and to provide an audit level of assurance. The findings and conclusion are based on a comparison of the conditions, as they existed at the time, against pre-established audit criteria that were agreed upon with management and are only applicable to the entity examined and for the scope and time period covered by the audit.

Chief Audit Executive

1. Background

Following the announcement of Budget 2012 and the Deficit Reduction Action Plan, Canadian federal government departments and agencies were mandated to implement budgetary savings targets by fiscal year 2014-2015. The resulting savings targets were composed of a combination of reductions to operational spending, human resources, and development program funding envelopes.

To achieve these savings, the former CIDA planned reductions in its salary, non-salary, and grants and contributions budgets. For the salary budget, planned reductions meant cuts to indeterminate positions, which resulted in Work Force Adjustment situations.

In the context of Canada’s federal public service, Work Force Adjustment (WFA) is defined as “a situation that occurs when a deputy head decides that the services of one or more indeterminate employees will no longer be required beyond a specified date because of a lack of work, the discontinuance of a function, a relocation in which the employee does not wish to relocate, or an alternative delivery initiative.”Footnote 2 WFA can impact both executive and non-executive indeterminate employees in the core public administration. WFA situations are primarily governed by:

- The National Joint Council’s Work Force Adjustment Directive for non-executive employees;

- The Treasury Board’s Directive on Career Transition Agreements for executive employees;

- Applicable collective agreements governing the various represented employee groups employed by an organization facing a WFA situation.

A high-level summary of the WFA processes for non-executive indeterminate employees can be found in Appendix A. In addition to the government-wide guidance, former CIDA established department-wide policies, guidance and tools to better define the WFA process.

Non-executive employees could:

- Volunteer to leave the public service;

- Indicate their desire to participate in an alternation with another employee willing to leave the public service; or

- Participate in a Selection for Employee Retention and Lay-Off (SERLO) process to compete with equivalent resources for a limited number of positions.

Through these processes, employees either retain their position or are provided access to the options offered to opting employees, including severance pay and other forms of compensation.

Executive employees:

- Were placed into other vacant positions within the former CIDA;

- Participated in the alternation process with another executive willing to leave the public service;

- Were placed on a priority waiting list for open positions in the public service; or

- Chose to leave the public service for a negotiated compensation package.

2. Audit Objective, scope, approach and criteria

2.1 Objective

The objective of this audit was to provide reasonable assurance that Work Force Adjustment (WFA) processes within the former CIDA were compliant with applicable legislation, policies, directives, and collective agreements.

2.2 Scope

The audit focused on all Budget 2012-related WFA situations, for both executives and non-executives, within the former CIDA, between April 11, 2012 and June 25, 2013.

This audit scope was limited to the former CIDA’s processes and excluded:

- The decision process and rationale behind positions subject to lay-offs, and the impact of the lay-offs on the former CIDA; and

- The tools and assessment methods used by management for employees’ evaluations, selection for retention process, and volunteer process.

2.3 Approach and Methodology

The audit was conducted in accordance with Treasury Board policy, directives and standards on internal audit, and conforms to the International Standards for the Professional Practice of Internal Auditing of the Institute of Internal Auditors. The evidence gathered was sufficient to provide senior management with substantiation of the conclusions derived from the internal audit.

Audit criteria were developed based on identified and assessed key risks and internal controls associated with the related business processes. In order to conclude on these criteria, the audit methodology used specific audit evidence, including, but not limited to, the following:

- Review of the Treasury Board's Policy on WFA, supporting Directive and Guidelines, and related former CIDA policies, guidelines and instructions;

- Review of key controls, relevant tools and documentation related to oversight, monitoring, reporting, risk management, roles and responsibilities, training, communications, and other WFA-related processes;

- Walkthroughs and process mapping;

- Interviews with key personnel;

- Transaction testing of affected employees, volunteers, alternations, Selection for Retention or Lay-Off (SERLOs), lay-offs, and opting employees; and

- Validation of key audit findings.

The population identified for testing included all Budget 2012-related WFA actions undertaken by the former CIDA between April 11, 2012 and June 25, 2013. For cases with financial implications, testing was performed to ensure that payments made within this timeframe were accurate and compliant with the applicable authorities.

Considering its small population size, the audit tested 100% of the executive population.

2.4 Audit Criteria

The audit criteria were developed on the basis of the requirements of the National Joint Council’s Work Force Adjustment Directive, Treasury Board’s Directive on Career Transition for Executives, collective agreements, as well as relevant former CIDA policies and directives.

- Criterion 1 Oversight, monitoring, reporting and risk management mechanisms are in place to support decision-making.

- Criterion 2. Accountabilities, roles and responsibilities are clearly defined and communicated.

- Criterion 3. The organization provides employees with the necessary training, tools, resources and information to perform their duties and responsibilities.

- Criterion 4. Formal processes are established and comply with applicable Work Force Adjustment authorities.

2.5 Special Considerations

A Management Action Plan is not being requested as part of this audit because of Amalgamation, which occurred during the scope of the audit: CIDA ceased to exist on June 26, 2013 upon Royal Ascent of the Economic Action Plan 2013 Act and amalgamated with the former Department of Foreign Affairs and International Trade to become the new Department of Foreign Affairs, Trade, and Development (DFATD). Because new business processes will be established as part of the amalgamation, the findings in this report are presented as future considerations and not as recommendations requiring immediate action from management. Considerations are proposed to meet the need of any WFA situations required in the future at DFATD.

3. Main Audit Findings and Recommendations

3.1 Governance, Oversight and Risk Management

An effective governance and oversight framework is important to ensure that work force adjustment processes respect the intent of the applicable authorities and that impacted employees are cared for in a fair and equitable manner. It is also important that monitoring, reporting and risk management mechanisms are in place to support decision making regarding WFA situations, and that accountabilities, roles, and responsibilities are clearly defined and communicated.

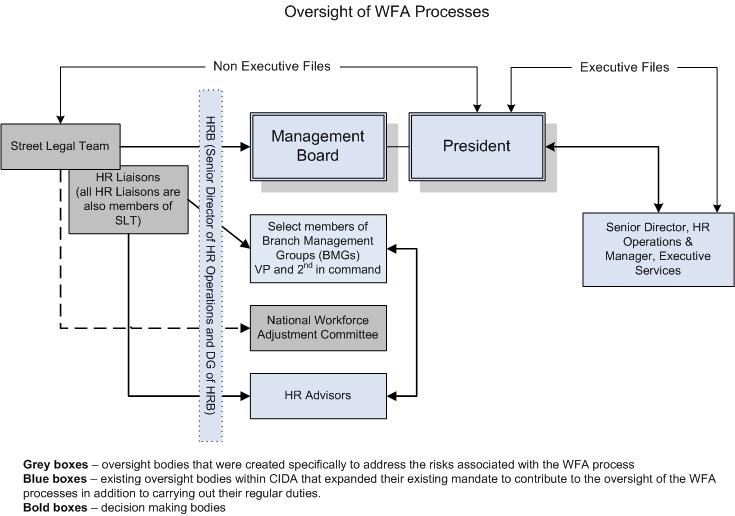

The audit team developed a diagram of the WFA oversight and governance structure, as one did not already exist.

Text Alternative - Oversight of WFA Processes

Non Executive Files

HRB (Senior Director of HR Operations and DG of HRB) (blue)

Street Legal Team (SLT) (grey) – Management Board (blue, bold) – President (blue, bold)

Street Legal Team – National Workforce Adjustment Committee (grey)

HR Liaisons (all HR Liaisons are also members of the SLT) (grey) – Select members of the Branch Management Groups (BMGs) VP and 2nd in command (blue)

HR Liaisons (all HR Liaisons are also members of the SLT) – HR Advisors (blue)

Select members of the Branch Management Groups (BMGs) VP and 2nd in command - HR Advisors

Executive Files

President – Senior Director, HR Operations and Manager, Executive Services (blue)

Legend

Grey – oversight bodies that were created specifically to address the risks associated with the WFA process

Blue – existing oversight bodies with CIDA that expanded their existing mandate to contribute to the oversight of the WFA processes in addition to carrying out their regular duties

Bold – decision making bodies

As part of former CIDA’s strategy, three oversight bodies were accountable to ensure proper implementation of the WFA processes at the former CIDA: the Management Board, the National WFA Committee and the Street Legal Team.

Management Board

The Management Board was an existing oversight and decision body at former CIDA whose mandate included the development and approval of the strategic direction at the corporate level. Membership of the Management Board was composed of senior management across all branches, including the Director General (DG) of the Human Resources Branch, and was chaired by the President. The Management Board was responsible for all decisions related to the implementation of WFA, and met on a weekly basis to discuss a variety of relevant issues, including the WFA process. During these meetings, the DG of the Human Resources Branch provided regular updates on progress made with regard to the WFA processes.

National WFA Committee

The former CIDA’s National WFA Committee was formed in April 2012 with the specific mandate of facilitating the implementation of WFA processes at the former CIDA and providing a forum for communication amongst members. Membership included senior representatives from Management Board, the Human Resources Branch and from national bargaining agents. The role and mandate of the National WFA Committee was to discuss issues and progress on the WFA processes within the former CIDA on a monthly basis, as described in the Committee’s Terms of Reference.

Street Legal Team

The Street Legal Team was established in August 2011 by the Human Resources Branch to provide operational support during the planning process for anticipate budget cuts, and subsequently played a significant working-level oversight role to facilitate the consistent application of WFA processes across all branches. The audit found that the Street Legal Team emerged as a best practice, enabling the implementation of WFA processes in compliance with applicable directives, policies, and collective agreements, as detailed in Appendix B.

However, while the Team’s specific mandate, roles, responsibilities, and duties as they relate to WFA were not formally documented, nor were meeting minutes or records of decisions, interviews supported that roles and responsibilities were well-understood by members.

Interviews with Street Legal Team members indicated that this lack of documentation could be attributed to the nature of the Street Legal Team; the Team was first established as a temporary planning body to support the Director General of the Human Resources Branch. The significant role that it ended up playing in supporting the WFA process did not materialize until senior management indicated that the Budget 2012 announcement would be accompanied by reduction targets. Aspects of the Street Legal Team, particularly the frequency of meetings and overlapping membership with other oversight bodies, helped minimize the risk that WFA processes would lack oversight at former CIDA.

While the mandate and high-level roles and responsibilities of each oversight body were in place and understood by their members, a governance framework that defined the structure, integration, and reporting relationships between the various oversight bodies was not formally documented or defined. Analysis and interviews with key personnel revealed that there were no perceived or actual gaps in the oversight of the WFA processes; however, the lack of a formally documented governance framework exposed the former CIDA to the risk that certain duties may not be performed or that actions may not be undertaken.

There were also well-established risk management processes at the former CIDA that appropriately assessed the high-level risks associated with the WFA’s respective processes. Formal risk management processes regarding WFA were defined as part of the existing risk management strategy, namely the Corporate Risk Profile (CRP), Integrated Business Plan, and branch-level Integrated Business Plans (IBP). The CRP and IBP development and update processes were postponed from March to August to enable information resulting from the 2012 Federal Budget and Deficit Reduction Action Plan to be incorporated and properly accounted for as part of the risk assessment processes. Additionally, informal risk management was undertaken by the oversight bodies on an ad-hoc basis through their regular discussion of issues related to WFA.

3.2 Training, Tools, Materials and Information

Former CIDA provided employees with the necessary training, tools, resources, and information to perform their duties and responsibilities in implementing WFA processes to support compliance with applicable policies, directives and collective agreements. A number of best practices were observed as well as evidence of both formal and informal training, tools, resources and information provided to various employee groups responsible for WFA implementation or affected by the processes themselves, as detailed in Appendix B.

Formal training was provided to HR Advisors and HR Liaisons responsible for implementing WFA processes. Managers facing reduction targets within their unit also had access to information resources, including an Agency-developed Manager’s Guide to Work Force Adjustment, and access to information sessions designed to help employee groups understand their responsibilities in implementing WFA processes. Employees were also given information such as an Employee Guide to Work Force Adjustment, a devoted information portal on the intranet that was frequently updated, information sessions, and an FAQ forum and email address to look for guidance and request additional information.

While formal training, tools, and materials were available to the majority of resource groups affected by WFA, opportunities for improvement were identified in the consistent development and dissemination of formal training, tools, resources and information for employee groups responsible for implementing WFA processes. More specifically:

- Compensation tools were not consistently used, and formal training was not developed or made available to compensation advisors due to a lack of time and resource capacity to support the preparation leading to the WFA announcement.

- Because of the same lack of time and resource capacity, precedence was given to helping affected employees through the process over formally documenting all processes. As part of the audit, process maps with supporting narratives and key controls were developed to assist the audit team’s understanding of processes as implemented. These process maps were reviewed and validated for accuracy and completeness with key resources from the Human Resources Branch and are available to support future WFA processes.

- While not a compliance issue, file testing revealed that files maintained by the Human Resources Branch, HR liaisons, and compensation advisors varied in terms of information and structure. WFA directives do not provide guidance on the documentation of WFA processes and employee files, and former CIDA did not develop specific guidelines to support the consistent documentation. In the event of a complaint following a decision resulting from a WFA process, there is a risk that an incomplete file may not support the decision originally made. Furthermore, the lack of specific guidelines to support the consistent documentation may result in inefficiencies when compensation advisors are required to refer back to the original files.

3.3 Compliance with Work Force Adjustment, related Directives, and Collective Agreements

Processes and procedures should be sufficiently defined and aligned with applicable WFA authorities to ensure that affected that employees are treated in a fair and equitable manner and to minimize the risk of errors. Former CIDA’s designed processes were compliant and aligned with the WFA related directives and collective agreements.

File testing of the various WFA processes revealed that the majority of files were executed in compliance with WFA related directives and collective agreements. However, there were some points of control weaknesses in determining and verifying the eligibility of employees to receive a pension waiver depending on the option selected. These weaknesses came about from inconsistent training and information being provided to compensation advisors on the proper interpretation of WFA directives.

4. Considerations

A number of best practices were noted during the course of the audit and can be found in Appendix B.

In preparation for possible future WFA situations, the following audit considerations should be recognized and acknowledged by DFATD when developing new HR business processes as part of the amalgamation:

- Formally define the mandate, roles, and responsibilities for each oversight body that may have a role to play in future WFA situations. The level of documentation should be reasonable and appropriate to the complexity, risk, scope, schedule, and level of effort required to implement the initiative; and

- Modify the compensation advisors’ training and peer review process to ensure the consistent interpretation, understanding, and application of controls as part of the preparation and review of compensation documentation resulting from WFA situations.

5. Conclusion

Overall, the audit found that the former CIDA was compliant with WFA directives and collective agreements. Evidence shows that steps were taken to effectively support former CIDA employees through the WFA situation and that WFA processes complied with applicable authorities.

Opportunities for improvement were identified regarding the documentation of the mandate, roles and responsibilities of oversight bodies, as well as the training, tools, and peer review processes available to compensation advisors.

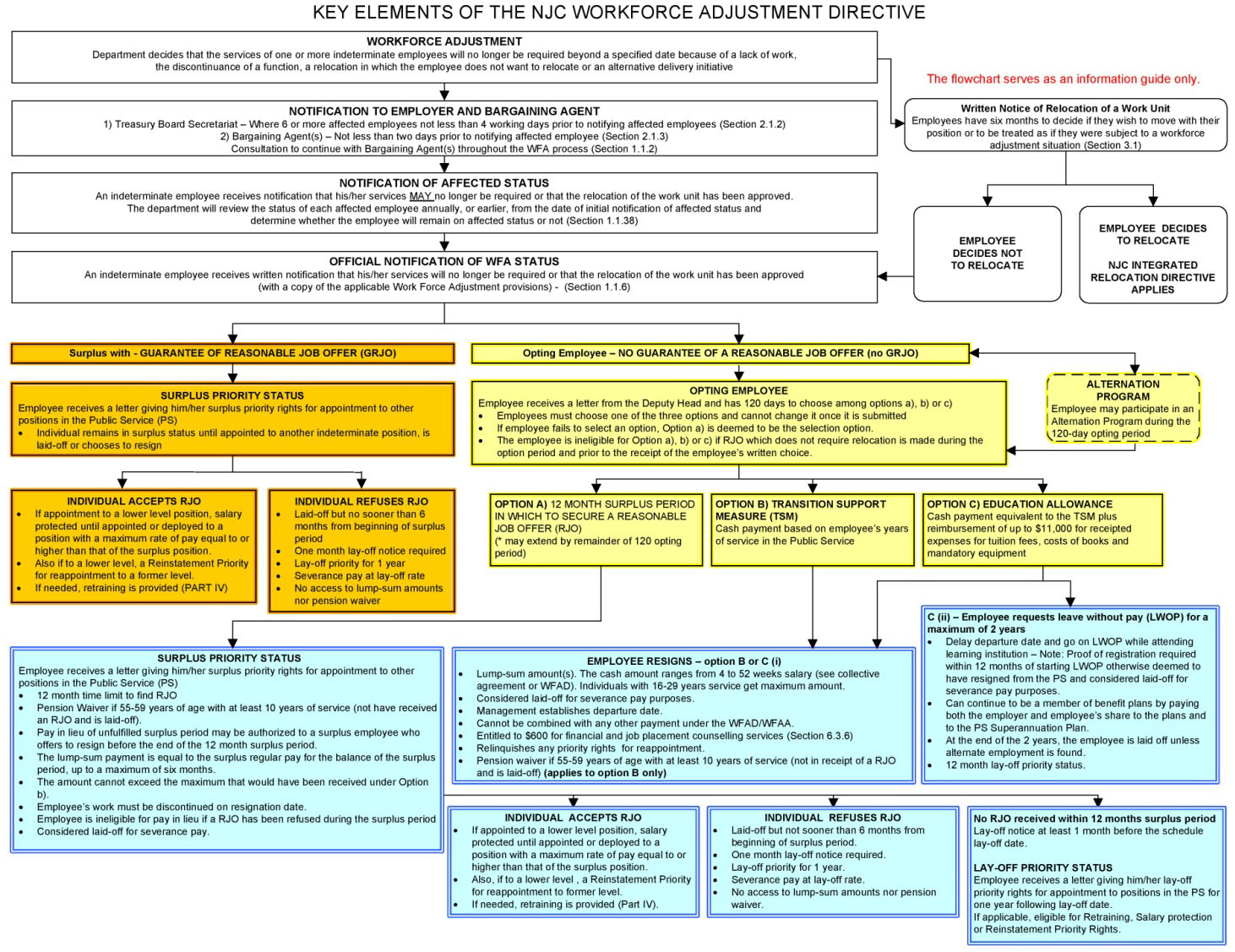

Appendix A: Flowchart of Work Force Adjustment

Alternative Text - Figure 1: National Joint Council of Canada. Work Force Adjustment Directive. Appendix D – Key Elements of the Work Force Adjustment Directive. 1 December 2010.

Workforce Adjustment

Department decides that the services of one or more indeterminate employees will no longer be required beyond a specified date because of a lack of work, the discontinuance of a function, a relocation in which the employee does not want to relocate or an alternative delivery initiative.

Written Notice of Relocation of a Work Unit

Employees have six months to decide if they wish to move with their position or to be treated as if they were subject to a work force adjustment situation (Section 3.1).

Employee Decides not to Relocate

Employee Decides to Relocate

NJC Relocation Directive Applies

Notification to Employer and Bargaining Agent(s)

- Treasury Board Secretariat - Where 6 or more affected employees not less than 4 working days prior to notifying affected employees (Section 2.1.2)

- Bargaining Agent(s) - Not less than two (2) days prior to notifying affected employee (Section 2.1.3). Consultation to continue with Bargaining Agent(s) throughout the WFA process (Section 1.1.12)

Notification of Affected Status

An indeterminate employee receives notification that his/ her services MAY no longer be required or that the relocation of the work unit has been approved. The department will review the status of each affected employee annually, or earlier, from the date of initial notification of affected status and determine whether the employee will remain on affected status or not. (Section 1.1.38).

Official Notification of WFA Status

An indeterminate employee receives written notification that his/ her services will no longer be required or that the relocation of the work unit has been approved. (with a copy of the applicable Work Force Adjustment provisions) - (Section 1.1.6).

Surplus with - Guarantee of Reasonable Job Offer (GRJO)

Surplus Priority Status

Employee receives a letter giving him/ her surplus priority rights for appointment to other positions in the Public Service (PS).

- Individual remains in surplus status until appointed to another indeterminate position, is laid- off or chooses to resign.

Individual Accepts RJO

- If appointment to a lower level position, salary protected until appointed or deployed to a position with a maximum rate of pay equal to or higher than that of the surplus position

- Also if to a lower level, a Reinstatement Priority for reappointment to a former level

- If needed, retraining is provided (Part IV)

Individual Refuses RJO

- Laid off but no sooner than 6 months from beginning of surplus period

- One month lay-off notice required

- Lay-off priority for 1 year

- Severance pay at lay-off rate

- No access to lump-sum amounts nor pension waiver

Opting Employee - No Guarantee of a Reasonable Job Offer (No GRJO)

Alternation Program

Employee may participate in an Alternation Program during the 120- day opting period.

Opting Employee

Employee receives a letter from the Deputy Head and has 120 days to choose among options (a), (b), or (c).

- Employee must choose one of the three options and cannot change it once it is submitted.

- If employee fails to select an option, Option (a) is deemed to be the selection option.

- The employee is ineligible for Option (a), (b) or (c) if a RJO which does not require relocation is made during the option period and prior to the receipt of the employee's written choice.

Option A) 12-Month Surplus Period in Which to Secure a Reasonable Job Offer (RJO)

*may extend by remainder of 120 opting period

Surplus Priority Status

Employee receives a letter giving him/ her surplus priority rights for appointment to other positions in the Public Service (PS).

- 12-month time limit to find a RJO.

- Pension Waiver if 55-59 years of age with at least 10 years of service (not have received an RJO and is laid off).

- Pay in lieu of unfulfilled surplus period may be authorized to a surplus employee who offers to resign before the end of the 12-month surplus period.

- The lump-sum payment is equal to the surplus regular pay for the balance of the surplus period, up to a maximum of 6 months.

- The amount cannot exceed the maximum that would have been received under Option (b).

- Employee's work must be discontinued on resignation date.

- Employee is ineligible for pay in lieu if a RJO has been refused during the surplus period.

- Considered laid off for severance pay.

Individual Accepts RJO

- If appointed to a lower level position, salary protected until appointed or deployed to a position with a maximum rate of pay equal to

or higher than that of the surplus position. - Also if to a lower level, a Reinstatement Priority for reappointment to former level.

- If needed, retraining is provided (Part IV)

Individual Refuses RJO

- Laid off but not sooner than 6 months from beginning of surplus period.

- One-month lay-off notice required.

- Lay-off priority for 1 year.

- Severance pay at lay-off rate.

- No access to lump-sum amounts nor pension waiver.

No RJO received within 12 months surplus period

Lay-off notice at least 1 month before the scheduled lay-off date.

Lay-Off Priority Status

Employee receives a letter giving him/her lay-off priority rights for appointment to positions in the PS for one year following lay-off date. If applicable, eligible for Retraining, Salary protection or Reinstatement Priority Rights

Option B) Transition Support Measure (TSM).

Cash payment based on employee's years of service in the Public Service.

Employee Resigns - Option B or C (i)

- Lump-sum amount(s). The cash amount ranges from 4 to 52 weeks' salary (see collective agreement or WFAD). Individuals with 16-29 years service get maximum amount.

- Considered laid off for severance pay purposes.

- Management establishes departure date.

- Cannot be combined with any other payment under the WFAD/ WFAA.

- Entitled to $600 for financial and job placement counseling services (Section 6.3.6).

- Relinquishes any priority rights for reappointment.

- Pension Waiver if 55-59 years of age with at least 10 years of service (not in receipt of a RJO and is laid-off). (applies to option B only)

Option C) Education Allowance

Cash payment equivalent to the TSM plus reimbursement of up to $11,000 for receipted expenses for tuition fees, costs of books, and mandatory equipment

C (ii) - Employee requests leave without pay (LWOP) for a maximum of 2 years

- Delay departure date and go on LWOP while attending learning institution - Note: Proof of registration required within 12 months of starting LWOP, otherwise deemed to have resigned from the PS and considered laid off for severance pay purposes.

- Can continue to be a member of benefit plans by paying both the employer and employee's share to the plans and to the PS superannuation Plan.

- At the end of the 2 years, the employee is laid off unless alternate employment is found.

- 12 month lay-off priority status.

Appendix B: Best Practices

The former CIDA adopted a concerted and strategic approach to the Deficit Reduction Action Plan and resulting WFA situation, with a focus on the guiding principles of integrity, fairness, respect, and transparency. The ultimate goal of the approach was to minimize the impact of WFA on employees. The former CIDA adopted the following strategies to support their guiding principles and to reduce the number of involuntary layoffs:

Street Legal Team

Senior management leveraged the Street Legal Team’s analysis of operational cuts to proactively manage the WFA situation in the months leading to the Budget 2012 announcement.

- Membership: The Street Legal Team membership included representatives from across the Human Resources Branch and was chaired by the Senior Director of Human Resources Operations who reported to the DG of the HR Branch. Other members that attended included the HR advisors and HR liaisons that were responsible for the implementation of WFA processes across the branches, some of whom were also attendees and contributors of the National WFA Committee. This overlapping attendance allowed for issues faced at the branch-level to be brought forward to the Street Legal Team on a timely basis.

- Effective communication and information-sharing: Effective communication was important in an environment of uncertainty. The Street Legal Team developed former CIDA specific tools and guides to facilitate the implementation of WFA in compliance with applicable directions and collective agreements. The Street Legal Team also developed strategic guidance to support Management Board in their decision-making, and once approved, resulting processes and strategies were subsequently communicated and disseminated to HR Liaisons, HR Advisors, and Branch Heads to support the consistent implementation of processes throughout the former CIDA.

- Pro-active and frequent meetings: The Street Legal Team commenced with daily meetings several months prior to the announcement of the WFA situation. This enabled the former CIDA to develop a consistent and well-prepared strategy for the roll-out of WFA processes as well as the timely escalation and resolution of WFA-related issues or risks as they arose. Issues or risks that HR Liaisons faced in supporting their branches were also discussed on a daily basis.

Procedures

- Volunteering process: A process was developed to support affected indeterminate employees who wished to volunteer to leave the public service. Employees would indicate to their manager that they wished to volunteer and initiate the process with the Human Resources Branch. Because of the number of volunteers, reduction targets were met for many employee work units: as a result, many affected letters issued to employees were rescinded, and a number of Selection for Retention or Lay-Off (SERLO) processes were cancelled.

- Informal alternation process: While the WFA and related directives provide guidance on the formal alternation process where two employees can alternate positions for mutual benefit, the Human Resources Branch created an additional process of allowing employees to identify their wish to participate in an alternation prior to the formal period during which an alternation is eligible to take place. The WFA and Public Service Commission guidance specify that employees can only participate in an alternation during the 120-day opting period; this requirement had limited the likelihood of a successful alternation. The informal alternation process and supporting database facilitated more alternations than would have otherwise occurred, by offering a flexible timeline.

Training, Tools, Materials and Information:

- The Agency sent a selected group of employees responsible for the HR operations and HR planning for WFA course-based training at the Canadian School of Public Service.

- Managers and employees affected or involved in the WFA process had access to Agency-developed guides and checklists, to help them throughout the WFA process.

- The Agency developed an information portal on “Entre Nous” that was frequently updated, and included an FAQ forum. In addition, several messages from the President and Senior Executive Vice-President were sent to all employees during the 2012 Workforce Adjustment exercise. These communications addressed all employees in a clear and transparent manner, and effectively communicated the department’s status on WFA efforts made, results achieved, and next steps.

- The Street Legal Team developed several one-pager documents as position papers that were presented to Management Board for decision. The relationship between the Street Legal Team and management, as well as the relationship between HR support services and the other groups in place to provide support to employees, were clearly established and communicated.