Report: Public Consultations on priorities for trade negotiations with the United Kingdom

On December 9, 2020, Canada and the United Kingdom signed the Canada-U.K. Trade Continuity Agreement (Canada-U.K. TCA). The Canada-U.K. TCA, which entered into force on April 1, 2021, provides stability and predictability for businesses and workers in both countries following the U.K.'s withdrawal from the European Union (EU), and associated departure from the Canada-EU Comprehensive Economic and Trade Agreement (CETA). Under the terms of the Canada-U.K. TCA, Canada and the U.K. have committed to enter into subsequent negotiations within one year of the TCA's entry into force to work towards concluding a new comprehensive trade agreement within three years that is tailored to the bilateral relationship.

On a separate track, on February 1, 2021, the U.K. submitted a notification of intent to begin the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) accession process. Since the CPTPP is an in-force agreement, any economy that seeks to join the agreement will need to demonstrate that it can comply with the existing high standards and comprehensive rules.

Furthermore, the economy must also meet the level of ambition required by the existing members in the areas of goods, services, investment, government procurement, state-owned enterprises and temporary entry. CPTPP parties have not yet taken a decision on whether to initiate an accession process with the U.K.

Summary of consultations

From March 12 to April 27 2021, Global Affairs Canada conducted public consultations on priorities for both sets of possible negotiations – negotiations for a bilateral free trade agreement with the U.K. and the U.K.'s accession to the CPTPP. Public consultations included a Canada Gazette notice inviting written submissions, as well as targeted engagement with a wide variety of domestic stakeholders through virtual meetings and roundtable discussions. Virtual engagement sessions included roundtable discussions with stakeholders in the agriculture, natural resources and clean technology sectors, as well as meetings with provinces and territories, Indigenous groups and gender and trade advisors through Global Affairs Canada's ongoing consultative mechanisms.

In total, Global Affairs Canada received 118 written submissions from Canadians across the country during the formal consultations period, including:

- 57 businesses and industry associations

- 7 provinces and territories

- 1 Indigenous organization

- 6 academics

- 3 labour organizations

- 2 civil society organizations

- 42 individuals

In addition, we received a petition representing the views of 1,266 people, along with 22 individual submissions, on a single non-trade related issue.

Additional submissions were received after the formal closure of the consultations period. Although these are not counted in the total number of submissions received, these views have been shared with Canadian trade negotiators and will contribute to informing possible future negotiations with the U.K.

Figure 1. Written submissions received during public consultations, according to stakeholder type

Alternative text

Submissions by stakeholder type

Academia (6)

Business (57)

Civil Society (2)

Indigenous organization (1)

Individuals (42)

Labour organizations (3)

Provinces and Territories (7)

What we heard from stakeholders

Overall, stakeholders across a broad range of sectors indicated support for bilateral free trade agreement negotiations with the U.K., as well as for the U.K. joining the CPTPP. They overwhelmingly cited an interest in building on historical ties, shared values and strong trade and investment linkages to increase economic opportunity for Canadians.

Figure 2. Level of stakeholder supported indicated in written submissions received during public consultations

Alternative text

Level of stakeholder support

Positive (68%)

Neutral (17%)

Conditional (10%)

Negative (3%)

Cautious (2%)

For the most part, stakeholders did not indicate a strong preference for pursuing either a bilateral free trade agreement or supporting the U.K.'s accession to the CPTPP at the exclusion of the other. Rather, stakeholders generally view both initiatives as important opportunities to ensure a strong, more competitive bilateral economic relationship with the U.K. and to contribute to sustainable and inclusive growth, supply chain resiliency and a strong economic recovery post-COVID-19.

Priorities at the top of mind for Canadians are preserving continuity and predictability in trade with the U.K., as well as consistency with the level of access provided by CETA, to ensure it remains easy to do business with both the U.K. and the EU going forward. That said, a number of stakeholders would like the government to pursue bilateral Canada - UK free trade negotiations to address ongoing non-tariff barriers that they believe have not been addressed satisfactorily via the Canada-U.K. Trade Continuity AgreementFootnote 1, such as rebalancing outcomes related to the temporary entry for business persons, and including modern, inclusive provisions on:

- small and medium-sized enterprises (SMEs)

- trade and gender

- Indigenous peoples

Overall, Canadians also shared positive views towards possible U.K. accession to the CPTPP, citing the potential to strengthen an important historical relationship, and deepen trade and investment ties. Stakeholders commented that Canada would have the opportunity to work with the U.K. within the CPTPP to advance shared objectives, and to strengthen rules-based trade at a time of increased protectionism. One stakeholder indicated that participation by the U.K. could create an incentive for others to join the CPTPP, generating additional opportunities for trade diversification and export-led growth. Overall, stakeholders suggested that Canada would benefit from the U.K.'s adherence to the CPTPP's comprehensive and high-standard rules and ambitious market access commitments.

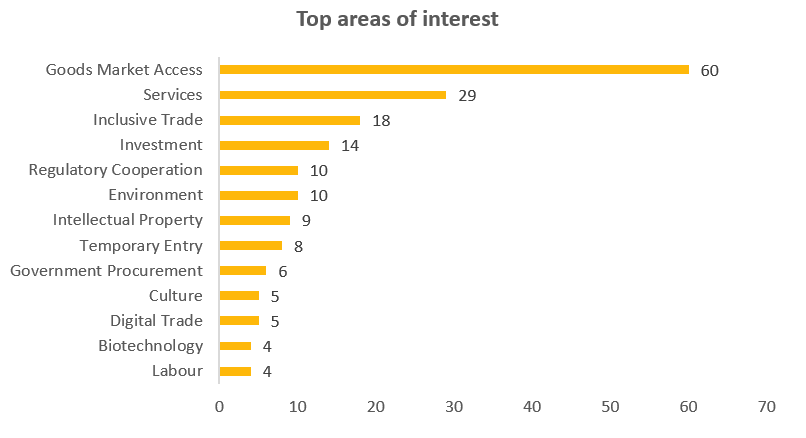

Figure 3. Top areas of interest identified in written submissions received during public consultations

Alternative text

Top areas of interest

Goods market access (60)

Services (29)

Inclusive trade (18)

Investment (14)

Regulatory cooperation (10)

Environment (10)

Intellectual property (9)

Temporary entry (8)

Government procurement (6)

Culture (5)

Digital trade (5)

Biotechnology (4)

Labour (4)

Views of Canadian businesses

We heard from Canadian businesses from across a broad range of sectors, including:

- agriculture and agri-food

- professional services (e.g. architecture, engineering)

- financial services

- clean technology

- life sciences, forestry

- fish and seafood

- aerospace

- automotive

- tourism

- transportation logistics

- mining and natural resources

In general, businesses indicated support for free trade negotiations with the U.K. – whether bilaterally or through CPTPP accession – in order to preserve or expand market access, to put in place trade rules and procedures that make it easier to trade, and to ensure that businesses have access to the talent, capital and markets they need to thrive. We also heard that such agreements should support innovation and address emerging trade issues, such as facilitating digital trade. The issue of reliable access to supply chains is top of mind for many businesses as they look at diversifying their supply chains to new markets in Asia or to markets closer to home.

Agriculture and agri-food

The government received a total of 26 submissions from business councils and associations in the agriculture sector, and 2 submissions from individual companies. Export-oriented agriculture sectors (e.g. beef, pork, oilseeds, grains, pulses, horticulture, spirits and processed foods) expressed the strongest support for a possible bilateral free trade agreement and CPTPP accession, noting the importance of the U.K. as one of the sector's largest and longest-standing trading partners in Europe and as a high-value market for Canadian agriculture and agri-food products.

A number of agri-food stakeholders emphasized the importance of preserving the access and benefits in place in CETA and the Canada-U.K. TCA – whether in a bilaterally or through CPTPP accession. Others view free trade negotiations as an important opportunity to secure rules that facilitate trade, and to address tariff and non-tariff barriers that continue to hinder Canadian exports. Certain agri-food stakeholders stressed the importance attached to concluding a new agreement with the U.K. on terms that provide reciprocal access for key products into both markets. Addressing non-tariff barriers to trade to avoid market access challenges is a top priority for the majority of agriculture stakeholders, who identified a number of ongoing barriers (especially concerning sanitary and phytosanitary (SPS) measures) that they indicate have not been addressed satisfactorily in CETA and have been carried over to trade with the U.K. under the Canada-U.K. TCA. Consequently, they recommend that future agreements between Canada and the U.K. – whether through a bilateral agreement or CPTPP - address ongoing non-tariff barriers, including those currently and previously experienced in the EU. Further, they recommend rules that require regulatory measures for food safety and animal and plant health be science-based, transparent, harmonized with international standards, and not applied in a manner that creates unnecessary barriers to trade.

Numerous submissions noted that approval processes and regulatory regimes often differ across jurisdictions, which can cause unnecessary trade disruptions and slow agri-food innovation (e.g. crop protection products and products of biotechnology). Stakeholders across a range of agricultural sectors called for Canada to work with the U.K. to prevent the carryover of non-tariff barriers under the EU regulatory regime. Stakeholders also called for any new agreement to support and reinforce regulatory frameworks that are based on science and internationally accepted risk assessment principles. On biotechnology, stakeholders recommended that commitments on predictable, timely, transparent and science-based approval processes form a baseline for discussions.

While stakeholders from supply managed sectors (i.e. dairy, poultry, eggs) indicated that they are not opposed to negotiations towards a new free trade agreement with the U.K., or its accession to the CPTPP, they insisted that Canada refrain from making any further market access concessions for supply managed products and ensure that any access be limited to already-negotiated volumes provided for in existing agreements. Certain groups also noted concerns related to higher fill rates if the U.K. were to have access to Canada's CPTPP tariff rate quotas.

Canada's refined sugar industry is supportive of addressing tariff and non-tariff barriers to the U.K. for refined sugar, high-sugar content sugar-containing products, and other processed foods containing sugar. Stakeholders in sugar beet production expressed concern that a free trade agreement with the U.K., or U.K. accession to the CPTPP, could result in increased competition and substantial harm to the Canadian sugar beet industry.

Fish and seafood

Fish and seafood stakeholders underlined the importance of the U.K. as an export market for a wide range of Canadian fish and seafood products, and noted that there is strong potential for future growth. In order to maintain market access opportunities, stakeholders recommended that Canada seek tariff reductions on par with those in the CETA/Canada-U.K.TCA. One stakeholder noted an opportunity to seek updated rules of origin in a bilateral agreement with the U.K. to reflect current Canadian sourcing and production patterns.

Forest products

Stakeholders in the forest product sector noted a long trading history with the U.K. and expressed a desire to expand opportunities for Canadian exports, both through preserving market access and by ensuring SPS requirements are based on science and do not act as a barrier to trade. Several forest sector stakeholders called on Canada to engage with the U.K. to ensure open and predictable access to the U.K. market that is at least as favourable as treatment provided under CETA, and ideally better than current CETA arrangements as it relates to conformity assessment procedures. In particular, structural lumber stakeholders requested that Canada ensure recognition of a lumber certification system that avoids duplication or overlapping requirements.

Mining

Mining stakeholders emphasized the importance of the U.K., the headquarters of many of the world's largest mining firms, as a key trading partner and source of investment as it looks to enhance and secure its supply chains. A national industry association proposed that the government explore a formal mechanism to support strategic discussions around critical minerals, trade and investment, including secure supply chains, in the context of both bilateral free trade negotiations and under the CPTPP.

Clean energy

Stakeholders requested that Canada seek the U.K.'s recognition of Canadian sustainability standards, including codes and certifications, to ensure that Canadian clean energy exports do not face market access challenges when entering the U.K. Two industry associations also noted that Canada should refrain from creating potential market access challenges for the importation of U.K. clean technologies and innovation, as Canadian industries may gain from having access to such products.

Aerospace

We heard from the aerospace sector about the challenges with accessing the U.K. and broader European government procurement markets, with opportunities for some products being effectively blocked for Canada's manufacturers. Bilateral free trade negotiations would be an opportunity to seek equal access to the U.K. for non-European aerospace manufacturers and establish fair, open and transparent trade.

Automotive manufacturing

Some Canadian vehicle manufacturers are supportive of the government pursuing a comprehensive agreement with the U.K. that increases trade opportunities for Canada's domestic industry. This would include carrying over the CETA auto-related provisions that recognize the highly integrated North American industry by allowing for cumulation of North American content in Canadian assembled vehicles.

Life sciences

We heard from the brand name and generic pharmaceutical industry that they would like to see CETA's intellectual property and regulatory commitments upheld in a new bilateral free trade agreement. Areas of priority for the generic pharmaceutical industry are regulatory cooperation and convergence, and ensuring that intellectual property rights measures for pharmaceuticals do not impose new obligations on Canada nor erode current flexibilities. On the CPTPP, stakeholders acknowledged that the intellectual property rules have already been established, and they did not foresee any issues with the U.K. acceding to the CPTPP. A medical device company indicated support for both a bilateral agreement and the U.K. joining the CPTPP, noting the importance of the U.K. market in terms of access to:

- innovation capital (especially for women-owned enterprises)

- new markets

- skilled talent

- collaborations and partnerships

Services

Professional services providers indicated that they view the U.K. services sector as presenting a substantial opportunity for growth. They highlighted the importance of market access and mobility of skilled talent, including in such professions as architecture and engineering. Stakeholders stressed the importance of measures to ease the ability of companies to move skilled talent into the U.K. to fully leverage the benefits of global trade in services and to ensure that they can service their foreign investment operations. At the same time, some stakeholders emphasized the importance of maintaining the high ethics, qualifications and practice standards that define professions in Canada. One submission indicated support for the U.K. to adhere to CPTPP-type provisions that ensure the secure and uninterrupted flow of data across borders, and that prioritize streamlined regulatory procedures and increased predictability and transparency of regulatory processes.

In the financial services sector, we heard support for provisions that promote regulatory alignment and cooperation, facilitate the free flow of cross-border data, and simplify procedures for the movement of professionals and intra-corporate transferees. We also heard support for an investor-state dispute settlement mechanism to protect companies against discriminatory measures.

Views on labour rights

Organizations that submitted input on labour issues emphasized that the U.K. must be subject to fully enforceable provisions for labour rights, with the possibility to impose trade sanctions in cases of non-compliance. We also heard that, in pursuing a bilateral agreement, Canada should seek to build upon new provisions found in the Canada-U.S.-Mexico Agreement (CUSMA)'s labour chapter (which are not contained in the CPTPP). These include commitments for each country to implement policies to protect workers from sexual harassment, as well as wage and employment discrimination on the basis of sex, the prohibition of the importation of goods produced by forced labour, or the protection of migrant workers under domestic labour laws. Labour organizations also indicated that any agreement should not undermine Canada's ability to implement regulations intended to protect workers, citizens and the environment.

Views on the environment

A range of stakeholders cited environment and climate change considerations, including non-governmental organizations, academics, labour organizations, individuals, and some provinces and territories. Should the U.K. accede to the CPTPP, it will be subject to robust and enforceable provisions on environment. Likewise, in the event of a bilateral trade agreement with the U.K., a number of stakeholders stressed that such an agreement should incorporate enforceable environment commitments, including binding commitments to combat climate change and implement international climate obligations. Some stakeholders noted that a trade agreement between Canada and the U.K. provides an opportunity to influence the emerging international trade and environment agenda, pointing to examples such as carbon border adjustments, public procurement tools, and regulatory cooperation. A number of stakeholders encouraged the government to pursue trade rules that support and facilitate the trade in renewable and clean energy technologies and environmental services. We also heard that Canada should ensure that no rules in a trade agreement could be used against ambitious climate and environmental policies, including through investor rights provisions.

Horizontal considerations

We heard from a number of stakeholders that Canada has an opportunity to work with the U.K. to advance our shared interest in pursuing an inclusive approach to trade to advance opportunities for:

- SMEs

- women

- Indigenous people

- racialized communities

A number of stakeholders support provisions that ensure that the particular needs and obstacles faced by women, Indigenous entrepreneurs and SMEs who do business internationally are addressed. Suggested provisions include:

- strong cooperative mechanisms to support the exchange of knowledge and best practices

- new tools to better understand the agreement

- rules that decrease administrative burden

We also heard from academics and individual Canadians who were supportive of protecting Canadian cultural industries and cultural sovereignty.

Indigenous peoples

In the event of a bilateral agreement with the U.K., we heard support for a general exception for the rights of Indigenous peoples, as well as carve-outs and special provisions in several chapters of any agreement. One Indigenous group proposed that a bilateral free trade agreement with the U.K. include a stand-alone chapter that would support Indigenous peoples' participation in international trade, and that it expressly provide preferential trading status for Indigenous peoples.

Provinces and territories

Seven provinces and territories prepared written submissions. Submissions highlighted the importance of the U.K. as a trade and investment partner, and welcomed opportunities to:

- deepen the bilateral relationship

- preserve and enhance market access

- increase technology and services trade

- attract investment

A number of provinces and territories support an inclusive approach to trade agreements to help ensure that the benefits of trade are more widely shared, citing the importance of chapters on gender, small and medium sized enterprises, and Indigenous peoples as mechanisms to achieve this. We also heard a recommendation to secure exceptions for Indigenous peoples similar to those in the CUSMA, and to support Indigenous communities to develop international markets for Indigenous-produced goods.

Provinces and territories emphasized the importance of ensuring equivalent tariff outcomes with CETA in most areas. At the same time, we heard interest in enhancing market access in certain areas, and in ensuring that long-standing tariff and non-tariff barriers to agriculture and agri-food trade are addressed. Some provinces and territories pointed to specific regulatory requirements and restrictive tariff rate quotas that impede trade. They also noted that CETA provides a good template for matters related to trade facilitation and regulatory aspects of trade, services and investment, though some noted the need for greater regulatory convergence in key areas. One province encouraged the government to pursue new and expanded access for business professionals with commitments given on a reciprocal basis. Some provinces highlighted emerging industries that should be taken into account during negotiations, such as:

- climate and environment-related technologies

- digital trade

- medical cannabis

Some provinces and territories emphasized the importance of ensuring that key reservations and exceptions are protected in a bilateral agreement, such as in the areas of services and investment, alcoholic beverages and culture. On government procurement, some requested that exceptions from CETA be maintained, and that the U.K. maintain its current level of liberalization.

Input from individuals

Of the 42 submissions from individuals, 28 suggested that any bilateral free trade agreement with the U.K. could constitute a step towards a broader trade agreement between Canada, Australia, New Zealand and the U.K., with free movement of people being cited as a key area of interest.

In addition, we received 22 individual submissions and a petition by the Canadian Alliance of British Pensioners, with signatures representing 1,266 people, on a non-trade issue requesting that Canada seek to secure a commitment from the U.K. to provide annual pension increases to U.K. state pensioners living in Canada.

Next steps

Despite the conclusion of the dedicated consultation period, the Government of Canada is committed to continue to hear the views of Canadians should a decision be taken to proceed with bilateral trade negotiations with the U.K. or accession by the U.K. to the CPTPP. The feedback received from stakeholders will help define Canada's interests and priorities in both sets of negotiations.

- Date Modified: