COVID-19 intensifies challenges for Canadian exporters: trade by exporter characteristics

June 2020

Nancy Blanchet

Julia Sekkel

Key findings

- The number of Canadian exporters declined 10.7% in March 2020 compared to March 2019, as the global impacts of COVID-19 took hold. This followed an already rough start to the year due to a number of trade disruptions.

- SMEs were hit slightly harder, with the number of exporters in this category dropping 10.7% in March 2020, compared to a decline of 8.3% for large companies.

- The number of exporters selling goods to China, France and Italy saw the sharpest declines in relative terms (more than 20% declines in each), while the rate of decline in firms exporting to the U.S. was less severe than other regions, dropping 9.1%.

- The decline in the number of exporters was widespread across all major sectors of the economy. However, the value of exports showed some bright spots, with Transportation and Online shopping in particular showing strong gains in March.

Background

The effects of rail blockades, disruptions in global supply chains, ongoing trade tensions, and early measures put in place in Asia to contain COVID-19 negatively impacted Canadian exporters over the first three months of the year. These challenges became more severe as larger efforts to contain COVID-19 were introduced in March.

The number of exporters had been decreasing in early 2020, but the decline intensified in March, which saw 10.7% less exporters compared to the year before. Meanwhile, the drop in the value of exports was mostly concentrated in March, which experienced an 8.7% decline year-over-year.

SMEs experienced a modestly steeper decline in the number of firms exporting (-10.7%) compared to large companies (-8.3%) year-over-year in March 2020 (Table 1). SMEs represent 96.2% of Canadian exporters, and include businesses with less than 500 employees. In value terms, both SMEs and large companies were impacted with respectively a 10.3% and 7.6% decrease in their exports value.

The observed decrease in the number of exporters in March affected all principal trading regions. However, the rate of the decline in firms exporting to the U.S. was generally less steep than to other regions, indicative of the strong and diverse existing trade connections. Though the rate of decline in the U.S. was less pronounced, it represented the largest decline in absolute terms, dropping by 1,650 firms.

There were regional differences for SMEs and large enterprises. The number of enterprises exporting to Europe (especially France and Italy) and Asia (China in particular) decreased more rapidly among SMEs, with declines intensifying in March. In contrast, large enterprises experienced sharper declines in the number of exporters to Latin America & Caribbean and Africa.

Table 1: Number of exporters, for SMEs and large enterprises

Destination | SMEs | Large | ||

|---|---|---|---|---|

| Mar-20: Total Exporters | March 20/19: ∆ % | Mar-20: Total Exporters | March 20/19: ∆ % | |

| All Countries | 18,957 | -10.7% | 749 | -8.3% |

| United States | 15,710 | -9.2% | 691 | -6.7% |

| Mexico | 534 | -16.7% | 133 | -6.3% |

| Europe | 3,290 | -15.9% | 293 | -10.1% |

| Asia | 2,971 | -16.4% | 273 | -7.1% |

| China | 1,148 | -21.9% | 152 | -4.4% |

| Latin America & Caribbean | 1,333 | -10.7% | 177 | -13.7% |

| Oceania | 996 | -10.6% | 134 | -10.1% |

| Middle East | 1,013 | -11.2% | 121 | 3.4% |

| Africa | 736 | -10.1% | 66 | -23.3% |

Source: Statistics Canada - International Accounts and Trade Division, Monthly Trade in Goods by Exporter Characteristics (Monthly TEC), January 2019 to March 2020 on a customs basis and unadjusted for seasonal variations.

Changes in export values during the first quarter of 2020 were more diverse. SME exports to Mexico, Europe, Asia and Latin America & the Caribbean dropped in Q1 2020, with stronger drops in March, ranging between 13% and 28%. Meanwhile, Middle East, Africa and Oceania experienced increased sales, and large enterprises had increased exports to China.

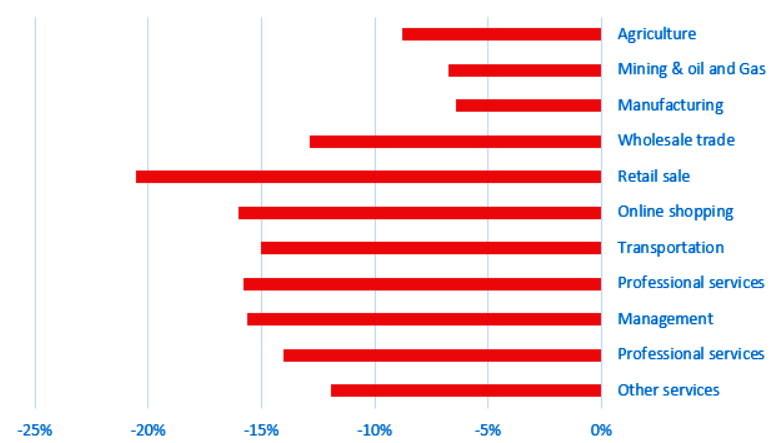

Manufacturing—the largest sector for SMEs—experienced a less severe decline in the number of exporters, with 6.4% fewer firms during the month of March compared to a year earlier. (Figure 1.) However, the number of SME exporters affected in the wholesale sector (which represents approximately 20% of all SME exporters) was more severe than the average, dropping 12.9%. Together, these sectors accounted for almost half of the decrease in exporting SMEs in March 2020 compared to a year ago, a decline of more than 1,275 exporting firms combined.

Figure 1: Number of Canadian SME exporters, % change March 2020 / March 2019

Text version

| Industry | % change |

|---|---|

| Other services | -12% |

| Professional services | -14% |

| Management | -16% |

| Professional services | -16% |

| Transportation | -15% |

| Online shopping | -16% |

| Retail sale | -21% |

| Wholesale trade | -13% |

| Manufacturing | -6% |

| Mining & oil and Gas | -7% |

| Agriculture | -9% |

Data: Statistics Canada - International Accounts and Trade Division, Monthly Trade in Goods by Exporter Characteristics (Monthly TEC), January 2019 to March 2020 on a customs basis and unadjusted for seasonal variations. Source: Office of the Chief Economist, Global Affairs Canada.

Although the declines in the number of firms were widespread, COVID-19’s impacts on the value of exports showed some bright spots. The value of exports in the Transportation sector increased 17.2% in the first quarter of 2020 and the increase in March reached 61.6%.

Online shopping saw an impressive 32.1% increase in the value of exports in Q1 2020, with the bulk of the increase occurring during the month of March alone. Retail and agricultural exports were the only other industry to experience growth during the first quarter of 2020.

On the other hand, although the value of Mining and Oil and gas exports increased in the Q1 2020, there was a 14.2% drop during the month of March as the combined impacts of lower demand due to COVID-19 and the oil glut took hold. All other sectors saw a decrease in exports during the first semester of 2020.

- Date Modified: