Benefits of the CPTPP for Quebec

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is a trading block that represents 580 million people with a combined gross domestic product of CAD $19 trillion – a full 15.6% of global GDP. Through the CPTPP, Canada has preferential access to more than half a billion consumers in the world’s most dynamic and fast-growing market – a move that will strengthen Canadian businesses, grow the economy, and create more well-paying jobs for middle class Canadians.

Main advantages for Quebec

- Tariff elimination: The CPTPP will provide new opportunities for Quebec exporters by eliminating tariffs on almost all of the province’s key exports, including:

- agricultural and agri-food products (pork, maple syrup and maple sugar, frozen blueberries, sugar and chocolate confectionery, and food preparations containing cacao)

- industrial goods (metals and minerals, aerospace, industrial machinery, automotive parts, and information and communications technology)

- forestry products and value-added wood products (newsprint, sanitary and household paper, uncoated paper and paperboard, lumber, oriented strand board).

- Services exports: The CPTPP will provide more transparent and predictable access for services suppliers in key sectors, including professional, environmental, financial, and research and development services.

- Temporary entry: The CPTPP will provide improved market access commitments for the temporary entry of high-skilled Canadian business professionals.

- Reduced non-tariff barriers: The CPTPP includes strong provisions on non-tariff measures, backed up by fast and effective dispute settlement provisions.

- Government procurement: The CPTPP establishes rules to ensure that Canadian suppliers of goods, services and construction services have access to open, fair and transparent government procurement processes.

- Investment: The CPTPP includes predictable, non-discriminatory rules for Canadian investors.

Quebec – Indo-Pacific trade snapshot

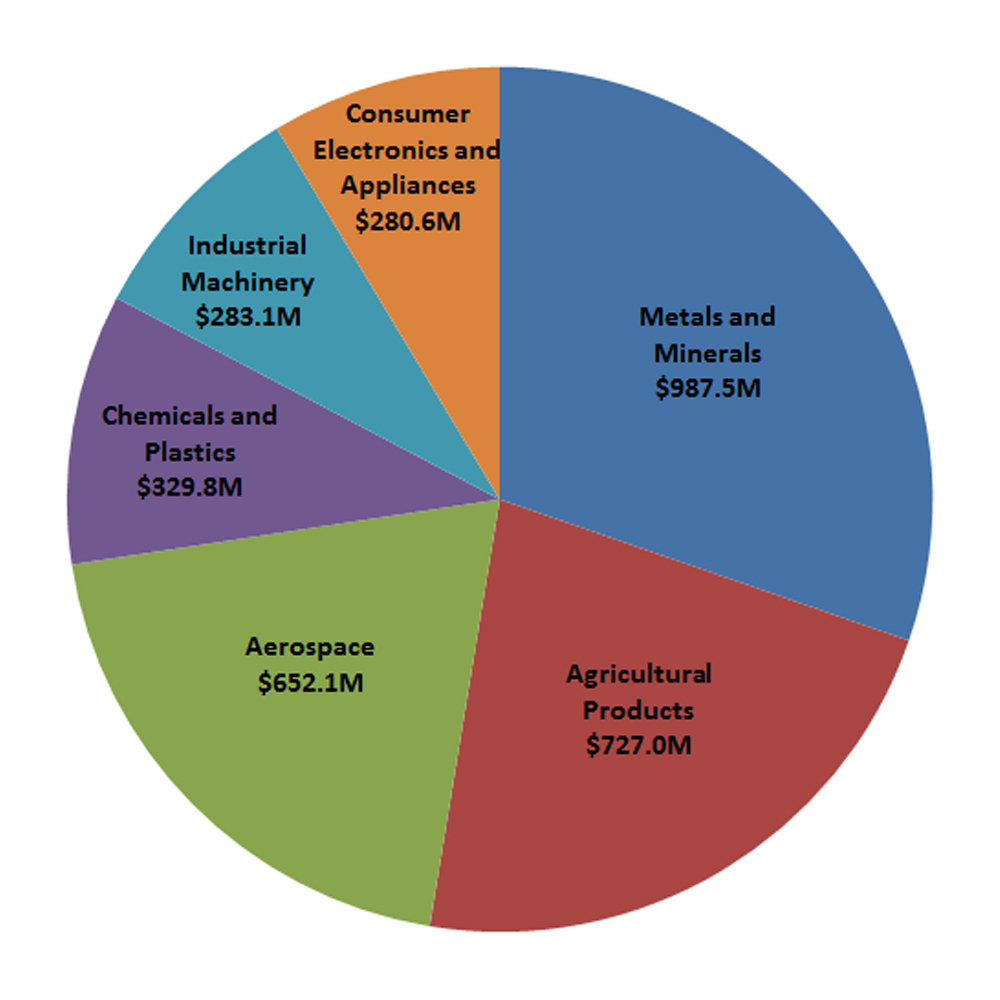

Top Quebec Merchandise Exports to CPTPP Markets (2015-2017 average)

Text version

Top Quebec Merchandise Exports to CPTPP Markets (2015-2017 average)

- Total: $4,164,846,711

- Metals and Minerals: $987,540,150

- Agricultural Goods: $727,020,252

- Aerospace: $652,124,650

- Chemicals and Plastics: $329,848,491

- Industrial Machinery: $283,105,295

- Consumer Electronics and Appliances: $280,625,837

Opening new markets for exports from Quebec to Indo-Pacific countries

The elimination of tariffs will help make exports from Quebec more price-competitive in CPTPP markets. Examples of Quebec products that will benefit from improved access include the following:

Metals and minerals products

Aluminum products

- In Japan, tariffs of up to 7.5% will be eliminated upon the Agreement’s entry into force.

- In Australia, tariffs of up to 5% will be eliminated upon the Agreement’s entry into force.

- In Malaysia, tariffs of up to 30% will be eliminated within 10 years.

- In Vietnam, tariffs of up to 27% will be eliminated within three years.

Iron and steel products

- In Japan, tariffs of up to 6.3% will be eliminated within 10 years.

- In Malaysia, tariffs up to 20% will be eliminated within 10 years.

- In Vietnam, tariffs of up to 40% will be eliminated within 10 years.

- In Australia, tariffs of up to 5% will be eliminated within four years.

Nickel

- In Japan, tariffs of up to 11.7%, or 44 yen/kilogram (kg), whichever is less, will be eliminated within 10 years.

Forestry products and value-added wood products

Newsprint

- In Vietnam, tariffs of 25% will be eliminated within three years.

- In Malaysia, tariffs of 10% will be eliminated within five years.

- In Australia, tariffs of 5% will be eliminated upon the Agreement’s entry into force.

Sanitary and household paper

- In Vietnam, tariffs of 24% will be eliminated within three years.

- In Malaysia, tariffs of up to 25% will be eliminated within five years.

- In Australia, tariffs of 5% will be eliminated upon the Agreement’s entry into force.

Uncoated paper and paperboard

- In Vietnam, tariffs of up to 27% will be eliminated within three years.

- In Malaysia, tariffs of up to 25% will be eliminated within 10 years.

- In Australia, tariffs of up to 5% will be eliminated upon the Agreement’s entry into force.

Worked wood

- In Japan, tariffs of up to 7.5% will be eliminated upon the Agreement’s entry into force.

- In Australia, tariffs of 5% will be eliminated upon the Agreement’s entry into force.

- In New Zealand, tariffs of up to 5% will be eliminated within seven years.

Lumber

- In Japan, tariffs of up to 6% will be eliminated within 15 years.

- In Australia, tariffs of up to 5% will be eliminated upon the Agreement’s entry into force.

- In Brunei, tariffs of up to 20% will be eliminated upon the Agreement’s entry into force.

Oriented strand board

- In Japan, tariffs of up to 6% will be eliminated within 15 years.

- In Malaysia, tariffs of 20% will be eliminated upon the Agreement’s entry into force.

- In Brunei, tariffs of 20% will be eliminated upon the Agreement’s entry into force.

- In Australia, tariffs of 5% will be eliminated upon the Agreement’s entry into force.

- In New Zealand, tariffs of 5% will be eliminated upon the Agreement’s entry into force.

Agricultural and agri-food products

Pork

- In Japan, tariffs of up to 20% on pork products, including sausages, which are subject to the gate price system, will be eliminated within 10 years.

- In Vietnam, tariffs of up to 27% on fresh, chilled and frozen pork will be eliminated within nine years.

Maple syrup and maple sugar

- In Japan, tariffs of more than 17.5% or 13.50 yen/kg will be eliminated within three years.

- In Vietnam, tariffs of 3% will be eliminated upon the Agreement’s entry into force.

Frozen blueberries

- In Japan, tariffs of up to 9.6% will be eliminated upon the Agreement’s entry into force.

- In Malaysia, tariffs of 5% will be eliminated upon the Agreement’s entry into force.

- In Vietnam, tariffs of 30% will be eliminated within two years.

Sugar and chocolate confectionery, and food preparations containing cacao

- In Japan, Canadian exports of these products currently face tariffs that range from 10% to 23.8% (plus a specific tariff of 679 yen/kg). The CPTPP will improve access through a combination of phase-outs, reductions and quotas.

- In Vietnam, tariffs of up to 25% will be eliminated within six years.

- In Malaysia, tariffs of 15% will be eliminated upon the Agreement’s entry into force.

- In Australia, tariffs of up to 5% will be eliminated upon the Agreement’s entry into force.

- In New Zealand, tariffs of up to 5% will be eliminated within five years.

Aerospace products

Aerospace goods

- In Australia, tariffs of up to 5% will be eliminated upon the Agreement’s entry into force.

- In New Zealand, tariffs of up to 5% will be eliminated upon the Agreement’s entry into force.

Chemicals and plastics products

Ethylene polymers

- In Japan, tariffs of up to 6.5% or 22.40 yen/kg, whichever is less, will be eliminated upon the Agreement’s entry into force.

- In Malaysia, tariffs of up to 15% will be eliminated within five years.

Safety fuses

- In Japan, tariffs of up to 6.4% will be eliminated upon the Agreement’s entry into force.

- In Australia, tariffs of 5% will be eliminated upon the Agreement’s entry into force.

Sodium chlorate

- In Japan, tariffs of 3.3% will be eliminated upon the Agreement’s entry into force.

Industrial machinery

Pumps for liquids

- In Vietnam, tariffs of up to 24% will be eliminated within three years.

- In Malaysia, tariffs of up to 25% will be eliminated within five years.

- In Australia and New Zealand, tariffs of up to 5% will be eliminated upon the Agreement’s entry into force.

Taps, cocks and valves for pipes and boilers

- In Vietnam, tariffs of up to 20% will be eliminated within three years.

- In Malaysia, tariffs of up to 25% will be eliminated within five years.

- In Australia, tariffs of up to 5% will be eliminated within three years.

- In New Zealand, tariffs of up to 5% will be eliminated within seven years.

Information and communications technology products

Certain types of headphones, loudspeakers and microphones

- In Vietnam, tariffs of up to 24% will be eliminated within three years.

- In Malaysia, tariffs of up to 15% will be eliminated upon the Agreement’s entry into force.

- In Australia, tariffs of up to 5% will be eliminated upon the Agreement’s entry into force.

- In New Zealand, tariffs of up to 5% will be eliminated within seven years.

- In Brunei, tariffs of up to 5% will be eliminated within seven years.

Certain types of monitors and projectors

- In Vietnam, tariffs of up to 37% will be eliminated within three years.

- In Malaysia, tariffs of up to 30% will be eliminated within two years.

Automotive parts products

Automotive parts

- In Vietnam, tariffs of up to 50% will be eliminated within 10 years.

- In Malaysia, tariffs of up to 30% will be eliminated within 10 years.

- In New Zealand, tariffs of up to 10% will be eliminated within seven years.

- In Australia, tariffs of up to 5% will be eliminated within three years.

Opening new markets for exports of services from Quebec to Indo-Pacific countries

The CPTPP provides Quebec’s services suppliers with greater predictability and enhanced market access across a broad range of sectors, including the following:

- professional services (e.g. legal, engineering and architectural) and transport services in all 10 CPTPP exports markets

- computer-related services in Australia, Chile, Malaysia and Mexico

- research and development in Australia, Chile, Japan, Malaysia, New Zealand, Singapore and Vietnam

- construction services in Australia, Mexico, New Zealand and Vietnam

- education services in Malaysia, New Zealand, Singapore and Vietnam

- environmental services in Australia, Brunei, Japan, Malaysia, Mexico, New Zealand, Peru and Vietnam

- mining-related services in Brunei, Chile, Malaysia and Singapore

- services incidental to energy distribution in Brunei, Chile, Malaysia, New Zealand and Singapore

- financial services in Malaysia, Vietnam and Singapore.

Quebec telecommunications services providers can expect the regulatory authorities of CPTPP countries to act impartially and in a transparent fashion.

Quebec enterprises that engage in electronic commerce as a means of trade will benefit from trade rules such as the prohibition on applying customs duties to content transmitted electronically, and ensuring the protection of online personal information.

Improving temporary entry for business people

The CPTPP will improve labour mobility for highly- skilled business persons, making it easier for professionals from Quebec to provide expertise in CPTPP markets. In particular, the CPTPP facilitates the temporary entry of Canadian business visitors, intra-corporate transferees, investors, highly-skilled professionals, technicians, as well as the spouses of some of these Canadian business persons—contributing to greater certainty and predictability for prospective business entrants.

Reducing non-tariff barriers

The CPTPP includes enforceable provisions to help secure market access gains for Canadian exporters so that exporters are not undermined by unnecessary measures that restrict trade, such as technical barriers to trade or sanitary and phytosanitary measures. As a result, the CPTPP will create a more predictable trading environment for Canadian exporters, without compromising the ability of the government to protect the health and safety of Canadians or safeguard animal and plant health.

Expanding access to government procurement

The CPTPP establishes clear rules to ensure that Canadian suppliers of goods, services and construction services have access to open, fair and transparent processes when bidding for procurement contracts in CPTPP countries. The Agreement expands government procurement commitments with existing free trade agreement partners, including Chile and Peru, and secures new access to procurement opportunities in Australia, Brunei, Malaysia and Vietnam.

Facilitating two-way investment between Quebec and the Indo-Pacific region

The CPTPP’s investment rules will provide greater stability and protection for investors, while preserving the rights of the federal, provincial and territorial governments to legislate and regulate in the public interest. In areas such as energy, mining, manufacturing, financial services and professional services, Canadian investors will enjoy transparent and predictable access to CPTPP markets. Strong rules will ensure that investors from Canada are treated in a fair, equitable and non-discriminatory manner, allowing them to compete on an equal footing with other investors in CPTPP countries. Canadian investors will also have access to a fair and transparent investor-state dispute settlement mechanism.

- Date Modified: