Country profile: Israel

Why Israel matters

- The Israeli economy is strong and continues to expand, with an estimate 6.5% growth reported in 2022.

- Two-way merchandise trade between Canada and Israel was valued at $2.1 billion in 2022.

- Two-way services trade was valued at $427 million in 2021.

- Science and technology are significant drivers of the Israeli economy. Canada and Québec maintain active science, and innovation agreements with Israel, providing funding for research and technology commercialization activities.

- Foreign multinational corporations, including Canadian firms, have established over 300 research and development centres in Israel, seeking to leverage the country’s highly skilled workforce and innovation strengths to advance their business objectives.

Modernized Canada-Israel Free Trade Agreement

- The original Canada-Israel Free Trade Agreement (CIFTA) entered into force in 1997.

- Through phases of negotiations, Canada and Israel agreed to multiple changes to the 1997 CIFTA to expand commercial opportunities for both countries.

- The modernized CIFTA, which entered into force on September 1, 2019, eliminates or reduces tariffs on virtually all products. It also includes chapters on gender and trade and on small- and medium-sized enterprises (SMEs), as well as new provisions on responsible business conduct and on labour and environmental protections.

- The modernized CIFTA demonstrates Canada’s commitment to a progressive trade agenda, one that ensures that the benefits and opportunities that flow from trade and investment are more widely shared by Canadians.

Canada-Israel trade snapshot

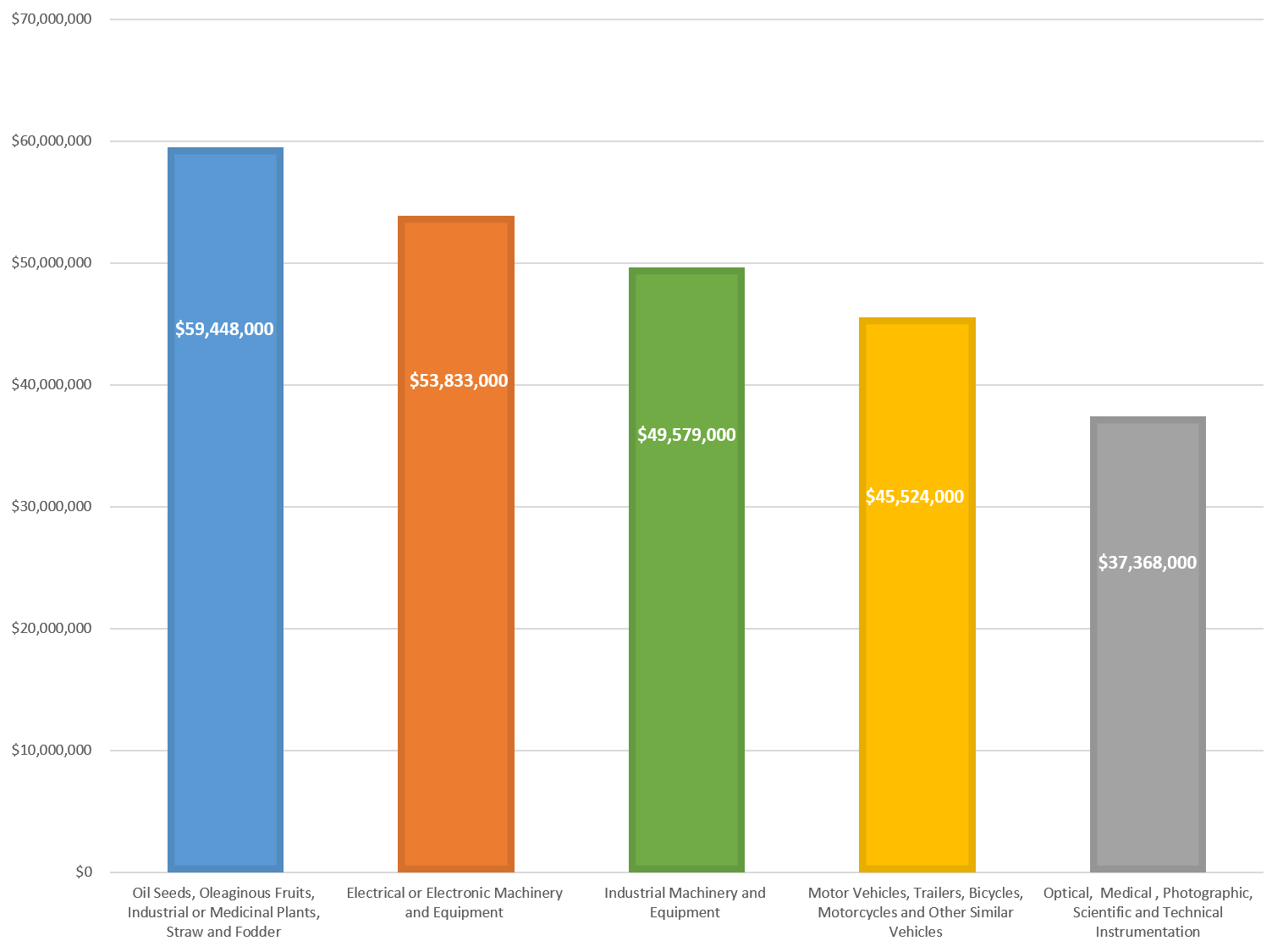

Figure 1 - Canada’s Top Exports to Israel (2019-22 average)

Figure 1 - Text version

| 2019-22 average | ($CAD) |

|---|---|

| Oil Seeds, Oleaginous Fruits, Industrial or Medicinal Plants, Straw and Fodder | $59,448,000 |

| Electrical or Electronic Machinery and Equipment | $53,833,000 |

| Industrial Machinery and Equipment | $49,579,000 |

| Motor Vehicles, Trailers, Bicycles, Motorcycles and Other Similar Vehicles | $45,524,000 |

| Optical, Medical, Photographic, Scientific and Technical Instrumentation | $37,368,000 |

Key facts and figures

Canada-Israel trade

- Canadian merchandise exports to Israel: $439.2 million (2019-2022 average)

- Canadian merchandise imports from Israel: $1.4 billion (2019-2022 average)

- Canadian service exports to Israel: $217 million (2021)

- Canadian service imports from Israel: $210 million (2021)

Canada-Israel investment

- Canadian direct investment in Israel: $537 million (2021).

- Israel investment in Canada: $3.1 billion (2021, immediate investor country basis).

- Israel investment in Canada: $610 million (2021, ultimate investor country basis).

Canada-Israel tourism

- In 2019, prior to the COVID-19 pandemic, Canada welcomed 70,890 visitors from Israel.

- In 2022, Canada welcomed 46,609 visitors from Israel.

- In 2019, prior to the COVID-19 pandemic, approximately 84,000 Canadians travelled to Israel.

- In 2021, 18,000 Canadians traveled to Israel.

Canada’s top merchandise imports from Israel (2019-2022 average)

- Industrial Machinery and Equipment: $222 million

- Optical, Medical, Photographic, Scientific and Technical Instrumentation: $189 million

- Plastics and Articles Thereof: $119 million

- Electrical or Electronic Machinery and Equipment: $118 million

- Pharmaceutical Products: $90 million

Canada’s service imports from Israel (2021)

- Commercial services: $135 million

- Travel: $9 million

- Transportation and government services: $65 million

Canada’s top merchandise exports to Israel (2019-2022 average)

- Oil Seeds, Oleaginous Fruits, Industrial or Medicinal Plants, Straw and Fodder: $59.4 million

- Electrical or Electronic Machinery and Equipment: $53.8 million

- Industrial Machinery and Equipment: $49.6 million

- Motor Vehicles, Trailers, Bicycles, Motorcycles and Other Similar Vehicles: $45.5 million

- Optical, Medical, Photographic, Scientific and Technical Instrument: $37.4 million

Canada’s service exports to Israel (2021)

- Commercial services: $154 million

- Travel: $32 million

- Transportation and government services: $31 million

How CIFTA helps Canada-Israel trade and investment

- With the modernized CIFTA in force, nearly all tariffs between Canada and Israel have been reduced or eliminated. In particular, agriculture, agri-food, and fish and seafood exports to Israel also now benefit from preferential tariff treatment.

- Since 1996, Bbilateral trade in agricultural and agrifood products with Israel have increased almost nine-fold since, amounting to $269.4 million in 2022.

- The modernized CIFTA also addresses non-tariff barriers and establishes mechanisms under which Canada and Israel can cooperate to address and seek to resolve unjustified non-tariff barriers that may arise.

- Additionally, the new chapters on Trade and Gender and SMEs provide a framework to undertake cooperation activities in these areas and establish a bilateral committee to oversee activities and review the operation of the relevant chapter. The modernized CIFTA also includes new provisions on responsible business conduct that affirms the Parties’ commitment to encourage the use of voluntary responsible business conduct standards by enterprises, with specific reference to the OECD Guidelines for Multinational Enterprises.

Sectoral opportunities

- Aerospace and defence

- Israel is one of the top ten defence exporters in the world. In 2021, military expenditures reached US$ 24.3 billion.

- Sales and partnership opportunities exist for Canadian firms in areas such as aircraft engines, advanced materials and manufacturing, special mission aircraft, remote sensing and detection (including sonar and lidar), ground systems, space robotics and sensors, satellite antennas and payloads, cybersecurity, and UAV components.

- Agriculture and agri-food

- Israel is a small but sophisticated food market, with a limited number of major companies that provide significant choice to an increasingly health-conscious consumer market.

- In addition to commodities such as grain and pulses, sales opportunities exist in a variety of areas, including: health and natural products (meatless and meat alternatives, reduced fat, reduces salt and sugar component, lactose- and gluten-free, dairy alternatives); vegan and vegetarian products; protein-enriched products; high-quality fish and seafood products; organic products; frozen products, including ready-to-cook and ready-to-eat meals and frozen berries; and vegetables and fruits (including fresh berries).

- Sustainable energy and effective water management are key priorities for Israel, given the country’s population density, lack of resources including fresh water, and challenging climate. Sales and partnership opportunities are available to Canadian firms active in number of cleantech areas, including solar, energy storage, biofuels, water disinfection, leak detection and wastewater reuse (including membrane filtration and ultraviolet disinfection systems). The Israeli cleantech sector has grown through a pervasive focus on research and development.

- Education

- Israel is home to a number of universities recognized for the quality of their research and teaching, particularly in science, technology, engineering and math.

- Israeli post-secondary institutions are increasing their focus on internationalization, providing fertile ground for institution-to-institution agreements that support joint research and faculty or student exchange in a wide variety of areas. Currently, Canadian and Israeli universities have signed approximately 60 such agreements. A number of new agreements have been signed in 2021, including a new cooperation agreement between the University of Toronto and Hebrew University, and an agreement between Mitacs and the Council of Higher Education regarding student mobility for research.

- Increased recruitment of graduate-level students represents an important education marketing opportunity for Canadian universities. . Given that the majority of Israeli citizens undertake two-three years of military service, Canadian institutions are likely to be less successful recruiting secondary school students, as in other markets.

- Information and communications technologies (ICT)

- As a global technology powerhouse, the Israeli technology ecosystem is home to a vibrant start-up culture, close cooperation between government, academia and business, significant foreign direct investment, and a large venture capital industry.

- ICT represents one of the leading sectors for business, technology partnerships and investment between Canada and Israel. Given the breadth of the market, opportunities exist in a large number of technology areas including cloud computing, artificial intelligence and big data, fintech, IoT, 5G technology, autonomous vehicles, and enterprise software.

- Health and life sciences

- The Israeli health and life sciences ecosystem is home to some 1,500 companies. Approximately half of these are medical devices firms, with the balance roughly split between pharmaceutical and digital health companies.

- The industry is characterized by strong cooperation between industry and academia, a thriving start-up culture, substantial private investment in research and development and an interest in international cooperation.

- Partnership opportunities exist for Canadian firms in a variety of areas, including digital health (including artificial intelligence), neuroscience, and complementing medical device technology.

- Date modified: