Minister of International Trade - Briefing book

2021-10

Table of contents

- A. Key portfolio responsibilities

- B. The department

- C. Global overview

- D. Geographic – Integrated regional overviews

- E. Top issues

- COVID-19 response and recovery

- International trade and investment during COVID-19

- Rules-based international system

- International trade

- Trade policy and negotiations key priorities

- Promoting the benefits of trade

- Trade litigation

- Responsible business conduct

- Digital economy and trade

- Trade and development

- Export controls

- Sanctions

- Climate and environment

- Feminist foreign policy

- China

- Trade engagement with Asia

- Canada-European Union Comprehensive Economic and Trade Agreement

- United Kingdom

- United States

- CUSMA

- F. Multilateral

- United Nations

- North Atlantic Treaty Organization

- G7

- G20

- World Trade Organization

- International financial institutions

- African Union

- Asia-Pacific Economic Cooperation

- Association of Southeast Asian Nations

- Inter-American multilateralism

- La Francophonie

- Commonwealth

- Organisation for Economic Co-operation and Development

- The World Economic Forum

A. Key portfolio responsibilities

Strategic overview

Issue

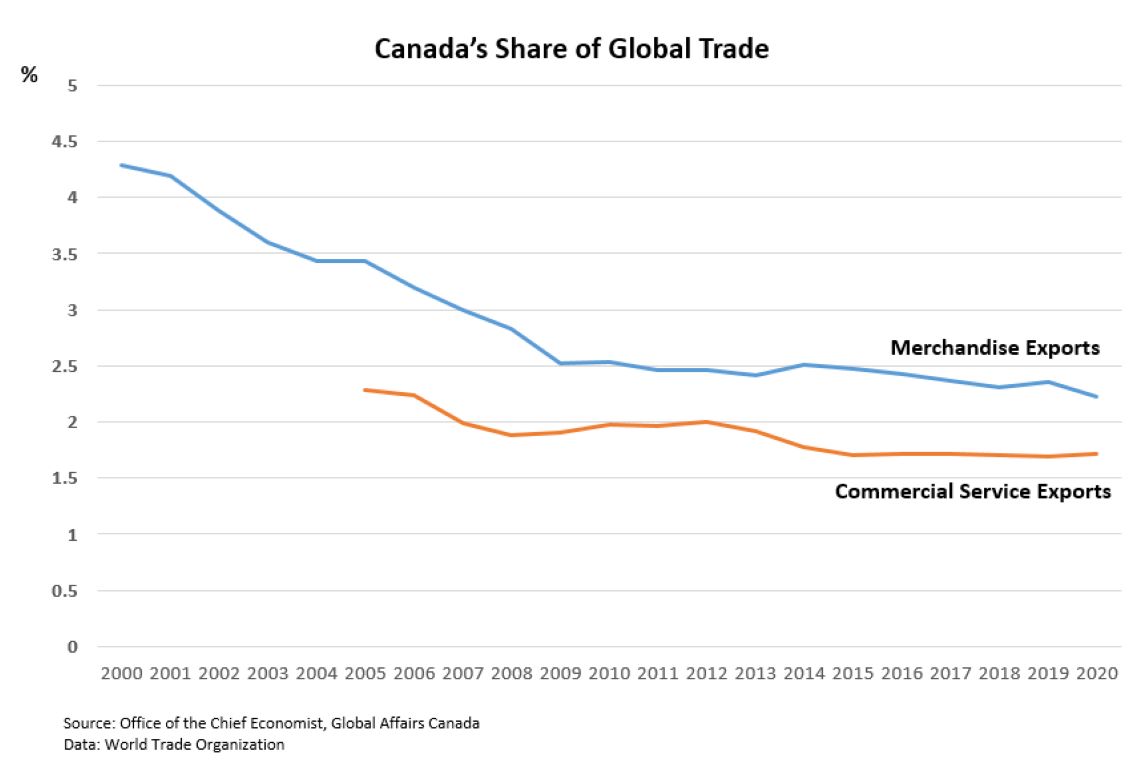

- The flow of goods, services, capital, technology and people is critical to Canada’s growth and improved living standards. Rising geopolitical tensions, growing protectionism and economic nationalism have strained the multilateral trading system and created heightened uncertainty.

- Supply chains and the wider international trade in goods have largely proven resilient during the pandemic, despite some well-documented disruptions, while many service exports remain depressed. Creating stable conditions for Canadian businesses, supporting trade rules, and solidifying key trading relationships are priorities in the ongoing recovery phase.

Context

In 2020, Canada exported over $638 billion worth of goods and services, and imported over $683 billion from the world; taken together, international trade is equivalent to over 60% of Canadian GDP. Foreign investment is also an important part of Canada’s economy; foreign multinationals employed 2.3 million Canadians in 2018 (accounting for 12% of jobs) and had a stock of more than $1 trillion invested in 2020.

Canada must continue to seize new trade and investment opportunities in what will become a greener and more digital global economy, whose overall centre of gravity is steadily shifting toward emerging and developing economies, especially in the Indo-Pacific. Your leadership is instrumental in this respect.

As Minister of International Trade, your key responsibilities will include: building and safeguarding an open and inclusive global trading system; supporting Canadian enterprises in their international business development efforts, including promoting the uptake of responsible business practices; negotiating new bilateral, regional, plurilateral and multilateral trade agreements; administering export and import controls; managing international trade disputes; facilitating and expanding foreign direct investment; and supporting international science, technology and innovation collaboration. This is done in support of the Minister of Foreign Affairs, who oversees all matters relating to Canada’s external affairs, including trade and commerce.

Your portfolio is complemented by the work of the Minister of International Development, whose focus on sustainable development and poverty reduction contributes to strengthening and stabilizing the economies of developing countries, creating opportunities for mutually beneficial trading partnerships.

To advance your mandate, you are supported by the Deputy Minister of International Trade. You can also rely on the deputy ministers of foreign affairs and of international development. As a team, the deputies and the wider Global Affairs Canada senior leadership work to ensure that the department’s 12,737 employees in Canada and 110 countries around the world deliver an integrated and coherent approach to Canada’s advantage.

Disrupted global trade context

Canada is endowed with an impressive range of competitive advantages including: its diverse, highly-skilled population; abundant natural resources; strong public institutions; globally-competitive companies; and a longstanding shared commitment to the fundamental values of a free, open and democratic society. As a trading nation, Canada’s prosperity depends on strong international trade rules, facilitating two-way foreign trade and investment and new market access for Canadian businesses, through negotiations at the World Trade Organization (WTO) and bilateral and free trade agreements (FTAs). Over the past several decades, Canada has brought into force 15 bilateral and regional FTAs) covering 49 countries and two thirds of global GDP.

The pandemic presented an unforeseen shock to the global trading system, stressing supply and demand in largely unpredictable ways. However, even before the pandemic, the global trading environment faced turbulence. Rising trade tensions, protectionism, and general economic uncertainty caused global trade volumes to decline modestly in 2019. While the pandemic has vividly illustrated the value of international cooperation and the realities of our global economic (and wider) interdependence, the crisis has also brought into sharp relief the lack of trust that exists between some states.

Growing trade and technological competition between the United States. and China is especially notable and appears entrenched. [REDACTED].

Current U.S. stimulus spending and the new administration’s planned reforms and investments have only increased its significance as a natural first market for most Canadian exporters. There are also longer‑term strategic opportunities created by its focus on working with trusted partners to shore up and create new critical supply chains. However, U.S. domestic priorities will continue to inform the administration’s approach to trade policy, and protectionist tendencies remain, including with respect to Buy America policies and softwood lumber. Regular engagement with U.S. stakeholders at the federal and sub-federal level remains crucial, leveraging a whole-of-Canada approach to protect Canadian interests.

As North American partners work together to support the effective implementation of CUSMA, there are unique opportunities for Canada-U.S. collaboration to advance shared objectives, including to support Mexico’s labour reform efforts and address global trade challenges that affect North American competitiveness, notably those related to China, climate change, the digital economy and WTO reform.

[REDACTED]. China is nevertheless Canada’s second‑largest trading partner. Canada, like other states, will need to find ways to support Canadian business and address market access irritants, while defending national interests. Canada is working with like-minded partners to address human rights concerns and China’s anti‑competitive and unfair trading practices, including actions that undermine the rules‑based trading system.

Globally, we are seeing renewed focus on industrial policy and identification of strategic sectors. Many of Canada’s key trading partners, including the United States, EU, United Kingdom, Japan and South Korea, have leveraged pandemic recovery spending to attempt to reorient strategic sectors to new geopolitical and structural realities. This includes an emphasis on gaining advantage in emerging technologies such as clean tech, electric vehicles, lithium-ion batteries, advanced manufacturing, artificial intelligence, and quantum computing, as well as tackling dependencies on critical minerals and single‑source suppliers of raw materials, semiconductors and pharmaceuticals. In parallel, a renewed focus on supply chains, tackling illegal trade practices such as distortive subsidies and implementing carbon border adjustment mechanisms (CBAM) are expected to be leveraged in developed jurisdictions as a way to level the playing field with countries with lower labour, environmental or institutional standards [REDACTED].

Many national strategies also include provisions for protecting strategic sectors, creating new foreign direct investment (FDI) reviews, tightening export controls (including for dual use goods and technologies) and limiting research collaboration. The result will likely be a less open and cooperative, and more fragmented trading environment in the medium term. The potential for new barriers and market distortions may prevent Canadian companies from competing on a level playing field.

Global emphasis on sustainability and climate change portend transformative effects on Canada’s economy and trade. The push for diversification away from less sustainable sources could present opportunities for Canadian raw material providers and suppliers of technologies in many markets. The responsible business conduct landscape is similarly evolving rapidly with important implications for Canadian companies, particularly given higher stakeholder expectations and calls for increased due diligence in supply chains. Canada’s North and Arctic is also increasingly a region of global interest, at once becoming more connected through technology and transportation links while also facing unique challenges.

To enable Canada to succeed in a more intangible, digital and data-driven, green (and blue) global economy, it will need to keep pace with the evolving global policy context. Cross-government efforts to modernize the Canadian economy, including regulatory and policy choices, will therefore carry big implications for the trade portfolio, including its ability to support nimble, innovative Canadian companies that can compete in shifting international markets; ensuring compliance with and consistent promotion of trade rules; heading off new trade barriers; and shaping new international standards to Canada’s advantage. A well-developed and coordinated approach between Global Affairs Canada and domestic line departments on trade-related matters will be vital to shape issues that will influence Canada’s global competitiveness.

Multilateral & regional trade

The WTO remains the pre-eminent international institution supporting the multilateral trading system. Active participation at the WTO has proven to be beneficial to Canada for opening, facilitating and regulating access to markets while providing mechanisms to resolve disputes as they arise. However, amidst competing world views and ongoing trade tensions, WTO rules have not kept pace with global economic developments. In addition, the U.S. blockage of new appointments to the Appellate Body to fill vacancies has resulted in the WTO’s dispute settlement system being unable to hear appeals, rendering panel decisions unenforceable. The long-term health and viability of this system nonetheless remains a strategic interest worthy of continued support.

The 12th WTO Ministerial Conference, which will be held November 29-December 3, 2021, is an opportunity for Canada and other members to lay the groundwork for future negotiations and institutional improvements.

Since 2019, Canada has led the Ottawa Group, a small group of diverse and representative members committed to supporting and strengthening the WTO. As chair, Canada will need to reassess how this group can play an even broader leadership role at the WTO.

More broadly, as the world economy grows, Canada cannot take for granted the ongoing centrality of a multilateral system anchored by the WTO. Difficult, often stalled discussions have heightened the attractiveness of regional arrangements, resulting in fragmentation of the global economy and a proliferation of competing trade rules found in a plethora of bilateral and regional FTAs. Canada needs to remain attentive to such shifts and engage accordingly.

G7 members agree on the importance of rules-based trade, and have vowed to play a role as global standard setters. Canada is well-placed to leverage regional and other groupings, such as the G7, G20, Asia-Pacific Economic Cooperation (APEC), CUSMA, Association of Southeast Asian Nations (ASEAN), the Organization for Economic Cooperation and Development (OECD) and various standard-setting bodies. Being active in these groupings allows Canada to influence the shape of new rules, counter-balance asymmetric relationships, and foster further trade opportunities. The recently announced EU-U.S. Trade and Tech Council, designed to deepen bilateral cooperation and build a more united transatlantic front on issues as diverse as technology standards, secure supply chains, information and communications technology (ICT) security, data governance and technology platforms, could also eventually present opportunities for triangulation or plurilateralization of cooperation in some sectors of common interest. While these efforts remain at an early stage, and will be focused on bilateral issues between the EU and the United States, Canada will need to carefully position itself for any trend‑setting action that could come out of these discussions between its 2 main partners.

Growing Canada’s trade – Actors

A longstanding focus for the Government of Canada has been enabling Canadian businesses to fully capitalize on international growth opportunities, including by providing robust and coordinated trade promotion services; supporting coordinated FDI attraction efforts; and expanding and enhancing Canada’s trade and investment agreements.

This demand will only increase as new global opportunities shift to more distant and challenging markets, and as ongoing disruptions to the global economy require increasingly sophisticated international growth strategies. Global Affairs Canada’s Trade Commissioner Service (TCS) is Canada’s leading trade promotion organization, with over 1,100 international business development professionals (trade commissioners) supporting Canadian businesses from 160 locations around the world and across Canada. The TCS provides customized market intelligence and advice, key contacts, problem-solving support and a growing suite of innovative programs and services. The TCS also promotes the uptake of responsible business conduct by providing guidance and advice to Canadian companies active abroad.

The TCS remains focused on expanding its digitally-enabled tools and providing a tailored and enhanced level of its key services to meet increasingly diverse client needs in today’s international business environment. Tailored services help to support the global growth of high-potential, high-growth companies and can accelerate the process of bringing their innovations to market.

Canada’s official export credit agency, Export Development Canada (EDC), is likewise a key enabler of Canadian trade, providing financial solutions for companies of all sizes to pursue international opportunities. EDC facilitated $102.3 billion in exports, foreign investment and trade development opportunities in 2020 alone. While EDC is a Crown corporation operating at arm’s length from government, it works closely with the TCS and other federal partners to support the government’s trade agenda and wider economic priorities.

Another Crown corporation, the Canadian Commercial Corporation, continues to fulfil an important role in certain areas of Canada’s trade, namely by facilitating export sales to foreign governments.

FDI is a key driver of economic growth and the attraction of FDI remains a priority for many enterprises and communities across Canada. In 2017, Parliament created Invest in Canada, a departmental corporation mandated to coordinate FDI promotion efforts in Canada and to lead the implementation of a national FDI attraction strategy. Invest in Canada collaborates with a variety of federal, provincial/territorial, municipal, and private-sector partners to pursue its mandate. Among these partners is the TCS, which manages a network of trade commissioners dedicated to identifying and cultivating FDI opportunities.

As Minister for International Trade, you will have a direct role in setting the strategic direction of these federal business services, both in support of the Government’s economic priorities and in response to the evolving global economic context described above. Partners such as the TCS will also provide key support for trade and investment promotion activities (e.g., trade missions) led by you and/or other government representatives.

Enabling growth through international agreements and trade policy initiatives

Despite the very real setbacks that the pandemic has dealt to economic growth in most emerging markets and developing economies, countries in the Indo-Pacific, Latin America and Africa are centres of long-term growth and opportunity, as well as being contested spaces for geopolitical influence.

The Indo-Pacific is one of the fastest growing regions in the world; many countries are aggressively positioning themselves to tap into the region’s growth. Canada will want to ensure it does not fall behind. Canada’s centrepiece engagement in the region is the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), a trade agreement built for expansion and provides Canada with the opportunity to actively encourage new economies to join the high‑standard agreement rules. Canada also has ongoing negotiations with India and Indonesia, and is exploring a possible FTA with ASEAN. [REDACTED].

In the Americas, Canada has been negotiating a comprehensive trade agreement with Mercosur (Argentina, Brazil, Paraguay and Uruguay) since 2018. [REDACTED].

Most economically significant parts of the Canada-EU CETA have been in force since the agreement was provisionally applied in 2017. Following the United Kingdom’s withdrawal from the EU, Canada and the United Kingdom concluded a Trade Continuity Agreement that preserves the main elements of CETA and commits both countries to negotiating a new FTA tailored to the bilateral relationship. The United Kingdom is also seeking accession to the CPTPP, and on July 1, 2021, Canada and the 6 other CPTPP parties agreed to initiate the process. Elsewhere in Europe, Canada is also exploring the modernization of its FTA with Ukraine.

Canada has been investing in initiatives that support the engagement and success of developing countries in regional and global trade. This has included providing support for the negotiation and implementation of the African Continental Free Trade Area to boost intra-African trade; and funding technical expertise and targeted interventions through the Global Alliance on Trade Facilitation, Expert Deployment Mechanism for Trade and Development, Canadian Trade and Investment Facility for Development, and Trade Facilitation Office (TFO) Canada. Consolidating and nurturing new opportunities may require greater flexibility to pursue tools and approaches that meet our mutual objectives.

Promoting shared benefits of trade

Canada has an interest in ensuring that the benefits of trade and investment are broadly shared and recognized by the Canadian and global public, mindful that trade policy and trade promotion tools can be used to advance important socio-economic goals and ultimately to create a more cooperative multilateral environment. Governments, investors and the public are increasingly attuned to the notion of building back a better economy that is more inclusive, fair and sustainable. Canada will have opportunities to work with businesses, investors and groups that have traditionally been underrepresented in trade, such as businesses owned or led by women, visible minorities, Indigenous peoples and small and medium-sized enterprises, to support their further participation in trade and widen positive impacts.

Minister of International Trade’s key portfolio responsibilities

Issue

- The Minister of Foreign Affairs has overall responsibility for conducting the external affairs of Canada, including international trade and commerce and international development, as outlined in the Department of Foreign Affairs, Trade and Development Act (2013).

- The act specifies that the Minister of International Trade’s role is to “assist the Minister of Foreign Affairs in carrying out his or her international trade responsibilities, and to promote the expansion of Canada’s international trade and commerce.”

Context

The health of the global economy impacts all Canadians. A fifth of all jobs in this country are directly linked to international trade. For Canadian companies to successfully compete on the international stage they rely on the support of the Minister of International Trade and the trade-related platform of Global Affairs Canada.

Indeed, your role is critical for enabling Canadian prosperity in an ever-evolving global landscape, including as a prominent part of supporting the COVID-19 economic recovery. In this capacity, your key responsibilities will include: building and safeguarding the open and inclusive rules‑based global trading system; programs, services and funding to support Canadian exporters and innovators in their international business development efforts; negotiation of bilateral, plurilateral and multilateral trade agreements; administration of export and import controls; responsible business conduct abroad; management of international trade disputes; facilitation and expansion of foreign direct investment; promotion of study in Canada; and support to international innovation, science and technology. You will work in close collaboration with the Minister of Foreign Affairs as the minister responsible for the department as a whole, and the Minister of International Development, responsible for Canada’s development and humanitarian assistance activities.

Experts across Global Affairs Canada support the international trade mandate. This includes dedicated expertise in the Trade Policy and Negotiations Branch, the International Business Development, Investment and Innovation Branch and staff in bilateral and functional branches and missions abroad.

In addition to the support provided by the department, the Minister of International Trade is also responsible for certain other arm’s length entities and statutory obligations, outlined below.

Portfolio responsibilities within Global Affairs Canada

Invest in Canada (IIC) is a departmental corporation mandated to: (1) promote, attract and facilitate foreign direct investment (FDI) in Canada; and (2) coordinate the efforts of the government, the private sector and other stakeholders with respect to FDI in Canada.

As a departmental corporation, IIC functions with greater autonomy from the core public administration than do departments. It must however comply with any general or special direction given by the Minister in carrying out its mandate, and prepare its departmental planning and reporting documents within the same framework as line departments.

IIC was formally established under the Invest in Canada Act in March 2018. Since then it has actively engaged with 540 potential investors, promoting Canada’s advantages in key sectors and markets attracting investments estimated at $3.2 billion. It is currently led by Acting CEO Katie Curran, appointed in May 2021 until August 2022, or until a permanent CEO is appointed, whichever comes first.

Canadian Ombudsperson for Responsible Enterprise (CORE)

As special adviser to the Minister of International Trade, the CORE is mandated to: promote the implementation of the UN Guiding Principles on Business and Human Rights and the Organisation for Economic Co-operation and Development (OECD) Guidelines for Multinational Enterprises; advise Canadian companies on their practices and policies with respect to responsible business conduct; review allegations of human rights abuses arising from the operations of Canadian companies abroad in the mining, oil and gas and garment sectors; offer informal mediation services; and provide advice to the Minister on any matter relating to her mandate.

The creation of the CORE was announced in 2018 to strengthen Canada’s approach to responsible business conduct (RBC). The current Ombudsperson, Sheri Meyerhoffer, was appointed in April 2019 and the office began to accept cases on March 15, 2021. In Budget 2021, the government increased the annual budget of the CORE to $4.3 million per year ongoing. The CORE is required to submit an annual report to the Minister for tabling in Parliament, though this has yet to occur.

The CORE is 1 of 2 Canadian non‑judicial dispute resolution mechanisms, and complements the National Contact Point for Responsible Business Conduct for the OECD Guidelines for Multinational Enterprises (NCP). The NCP applies to all sectors, and a broad range of issues, including human rights, employment, environment, disclosure and bribery. It can review cases in Canada and abroad. The CORE’s mandate differs from that of the NCP in that the CORE has the unique ability to initiate a review, undertake joint or independent fact-finding and report at any time in the course of a review.

The CORE’s mandate was the subject of study in spring 2021 by the Parliamentary Subcommittee on International Human Rights of the Standing Committee on Foreign Affairs and International Development.

Portfolio agencies

The Minister of International Trade is designated as the Minister with respect to Export Development Canada (EDC) as well as for the Canadian Commercial Corporation (CCC). Both are Crown corporations that operate at arm’s length from government. They follow a private‑sector model, but with a mixture of commercial and public policy objectives. The Minister provides them annually with a statement of priorities and accountabilities, which sets out the strategic direction that the Minister would like them to pursue, in line with Global Affairs Canada’s trade objectives.

EDC and its subsidiary, FinDev Canada

As Canada’s export credit agency, EDC’s mandate is to support and develop export trade between Canada and other countries, Canadian capacity to engage in that trade, and respond to international business opportunities. It is also mandated to provide development financing and other forms of development support, through its subsidiary FinDev Canada, in a manner consistent with Canada’s international development priorities. Its CEO is Mairead Lavery, appointed in February 2019.

In 2020, EDC reported facilitating $102.3 billion in exports, foreign investment and trade development opportunities. EDC has 20 offices across Canada and representation in 21 locations abroad. In 2020, it provided financial products to 12,200 customers. EDC supports Canadian exporters through a range of exporting solutions, including: trade financing; credit insurance; bonding and guarantees; equity investments; and, knowledge products.

EDC administered several programs as part of the government’s pandemic response in 2020, including the Canada Emergency Business Account (CEBA) and Business Credit Availability Program (BCAP). In particular, CEBA provided over 890,000 loans totalling over $48.8 billion to Canadian businesses impacted by the pandemic.

EDC also administers the Canada Account on behalf of the Government of Canada. The Canada Account is used to support transactions that are outside of EDC’s corporate policy framework, but that are determined by the Minister of International Trade to be in the national interest. Recent examples include CEBA; Trans-Mountain Pipeline Expansion; and Telesat Lightspeed.

FinDev Canada, established in 2018, is a development finance institution focused on supporting inclusive private sector growth and sustainability in developing markets. FinDev has signed commitments for over US$325.5 million, US$107 million of which were signed in 2020. A wholly owned subsidiary of EDC, FinDev Canada nevertheless has its own mandate, governance and investment strategy separate from EDC's. EDC is accountable to Parliament for FinDev Canada through the Minister of International Trade and in consultation with the Minister of International Development. FinDev Canada’s CEO is Lori Kerr, appointed in June 2021.

Canadian Commercial Corporation (CCC)

CCC has the mandate to help Canadian exporters sell to foreign government buyers through government-to-government contracting. Its business lines support Canadian companies by contracting in a variety of industries and sectors. Its President and CEO is Robert (Bobby) Kwon, appointed in March 2021.

Established in 1946 pursuant to the Canadian Commercial Corporation Act, CCC reported facilitating $2.92 billion in commercial transactions in 2020-2021. During that period CCC was active in 79 countries, providing government to government contracting expertise to 153 customers, among other service offerings.

CCC’s primary public policy mandate is to administer Canadian exporter sales to the U.S. Department of Defense under the Canada-U.S. Defence Production Sharing Agreement (DPSA). Pursuant to that agreement, CCC does not charge fees to administer DPSA contracts.

Following a comprehensive review of its mandate and operations completed in 2020, CCC was provided with renewed strategic direction, including: prioritizing its role in administering the DPSA; ensuring its international prime contracting business lines operate on a financially self-sustaining basis; and maintaining close alignment between the corporation’s export activities and Canada’s foreign policy. Budget 2021 included an annual parliamentary appropriation of $13 million to be used for the administration of the DPSA.

Trade portfolio collaboration

In the summer of 2020, the Business, Economic and Trade Recovery (BETR) team was established to leverage existing coordination, collaboration and innovation among the partners in the Minister of International Trade’s trade portfolio to maximize the impact of services for Canadian business during the post‑pandemic recovery period.

BETR partners collaborate to identify existing and emerging business needs, identify gaps, develop solutions, and reinforce coordination and coherence. BETR has developed three new cross‑cutting initiatives (in infrastructure, agtech, and health tech) to promote Canadian businesses internationally.

Success stories are being developed which demonstrate how enhanced collaboration between partner organizations helps strengthen support to Canadian business.

Other statutory obligations / parliamentary actions

While departmental reporting obligations lie primarily with the Minister of Foreign Affairs, the Minister of International Trade has a number of statutory obligations to table certain reports and parliamentary returns in the House of Commons and the Senate. These include: (1) Annual reports on operations and corporate plans on behalf of EDC and CCC, pursuant to the Financial Administration Act; (2) Annual reports on behalf of EDC, CCC and IIC on the administration of the Access to Information Act and Privacy Act, pursuant to those acts; and (3) Annual report on the operation of the Canada-Colombia Free Trade Agreement, pursuant to the agreement’s implementation act.

The Minister is typically responsible for introducing the implementing legislation for free trade agreements in Parliament (the Canada-United States-Mexico Agreement having been an exception). The Minister is also normally designated under implementing legislation for free trade agreements as Canada’s principal representative on the commissions of free trade agreements.

The Minister is responsible for order‑in‑council appointments for certain organizations (e.g. Canadian seats on the APEC Business Advisory Council).

Ministerial high-level events

November 2021

- Signature of Indigenous Peoples Economic Cooperation Arrangement, on margins of APEC Leaders’ Summit – November 8

- Toronto Global Forum – November 8 to 10

- APEC Ministers’ Meeting, Virtual - November 8 to 9

- Opening remarks at the 29th Annual Canadian Council for Public-Private Partnerships (CCPPP) Conference, Toronto-based, but being held virtually – November 18

- Ottawa Group Ministerial On the margins of MC12 – November 28

- WTO 12th Ministerial Conference (MC12) (hybrid vs. virtual TBC, Geneva, Switzerland) – November 30

Fall events to be confirmed

- Ad-hoc ASEAN Economic Ministers-Canada Consultations meeting [REDACTED] – October or November 2021

- Host the Canada-Turkey Joint Economic and Trade Committee in Canada – Fall 2021

- 2+2 Ministerial Dialogue with Mexico, Location to be confirmed – Fall 2021

- Virtual round table discussion with Central America trade ministers, co-hosted by the Minister of International Trade of Canada and the Minister of Economy of Guatemala – Fall 2021

- Minister of International Trade-led trade mission to the Caribbean(virtual or in-person) – Fall/winter 2021

- Canada-India Ministerial Dialogue on Trade and Investment, New Delhi, India – Fall 2021

- Canada-France Conseil des ministre – Location TBD

- Women entrepreneur trade mission to Africa, Sénégal, Côte-d’Ivoire, Botswana, South Africa – December 6 to 9 (virtual)

December 2021

- Canada-Australia Virtual Trade Ministers’ Dialogue – December

- Canada-EU CETA SME Forum – co-hosted by the Minister of International Trade of Canada and EU Executive Vice-President Dombrovskis – December (Early)

- Western Governors’ Association, Coronado, California – December 9 to 10, 2021

- Pacific Alliance Ministerial Meeting with Observer Countries, Buenaventura, Colombia – December 11

PM LEVEL EVENTS

Global Affairs Canada ministers may be asked to participate in the events with the Prime Minister

- North American Leaders’ Summit Meeting, Location TBC – Fall 2021

- ASEAN Leaders’ Summit and related meetings, Virtual – October 26 to 28

- G20 Leaders’ Summit, Rome, Italy – October 30 to 31

- Heads of State and Government Summit of the International Coalition for the Sahel – October or November

- COP26, Scotland, United Kingdom – November 1 to 12

- APEC Leaders’ Summit - November 11 to 12

- U.S.-hosted leaders’ Summit for Democracy, Virtual - December 9 to 10

B. The department

The department at a glance

Issue

- Global Affairs Canada is responsible for shaping and advancing Canada’s integrated foreign policy, trade and international assistance objectives, and supporting Canadian consular and business interests. We are a networked department with 12,737 employees working in Canada and 110 countries (at 178 missions), with a total budget of $6.7 billion.

Who We Are

Canada’s first foreign ministry was established in June 1909. At punctual moments since then, the department has been renewed to reflect the changing international environment. The most significant adaptations include its amalgamation with the Department of Trade and Commerce in 1982 and with the Canadian International Development Agency in 2013.

While its legal name remains the Department of Foreign Affairs, Trade and Development (as per the June 2013 act), its public designation under the Federal Identity Program is Global Affairs Canada.

What We Do

The department manages Canada’s diplomatic and consular relations with foreign governments and international organizations, engaging and influencing international players to advance Canadians’ security, prosperity and health in a dynamic global context. It advances a coherent approach to Canada’s political, trade and international assistance goals based on astute and evidence-based analysis, consultation and engagement with other government departments, Canadians and international stakeholders. The department is constantly monitoring global developments and assessing their potential implications on the government’s ability to deliver on its mandate.

The department’s work is focused on five core responsibilities:

- International advocacy and diplomacy: promote Canada’s interests and values through policy development, diplomacy, advocacy and engagement with diverse stakeholders. This includes building and maintaining constructive bilateral and multilateral relationships to Canada’s advantage, primarily through our network of missions; taking diplomatic leadership on select global issues and negotiations; and supporting efforts to build strong international institutions and respect for international law, including through the judicious use of sanctions.

- Trade and investment: support increased trade and investment to raise the standard of living for all Canadians. This includesbuilding and safeguarding an open and inclusive rules‑based global trading system; support for Canadian exporters and innovators in their international business development efforts; negotiation of bilateral, plurilateral and multilateral trade agreements; administration of export and import controls; management of international trade disputes; facilitation and expansion of foreign direct investment; and support to international innovation, science and technology.

- Development, humanitarian assistance, peace and security programming: contribute to reducing poverty and increasing opportunity for people around the world. This includes alleviating suffering in humanitarian crises;

reinforcing opportunities for inclusive, sustainable and equitable economic growth; promoting gender equality and women’s empowerment; improving health and education outcomes; and bolstering peace and security through programs that counter violent extremism and terrorism, support anti-crime capacity building, peace operations and conflict management. - Help for Canadians abroad: provide timely and appropriate travel information and consular services for Canadians abroad, contributing to their safety and security. This includes visits to places of detention; deployment of staff to evacuate Canadians in crisis situations; and provision of emergency documentation.

- Support for Canada’s presence abroad: deliver resources, infrastructure and services to enable a whole-of-government and whole-of-Canada presence abroad. This includes the management of our missions abroad and the implementation of a major duty of care initiative to ensure the protection of Government of Canada personnel, overseas infrastructure and information.

Through these 5 pillars of action, Global Affairs Canada provides an integrated and agile platform from which to deploy and leverage a strong and diverse toolkit, including those skills and assets that come from Canada’s Parliament, other orders of government, the judiciary, Canadian civil society, research institutions and the private sector. These efforts are aligned carefully with government priorities and are amplified through targeted public diplomacy, including on social media.

The department is also supported by a 24/7 Emergency Watch and Response Centre in Ottawa which is always on guard to assist Canadians in need of consular assistance abroad or to respond in real time to natural disasters and complex emergencies around the globe.

Legal responsibilities

The department is the principal source of advice on public international law for the Government of Canada, including international trade and investment law. Global Affairs Canada lawyers develop and manage policy and advice on international legal issues, provide for the interpretation and analysis of international agreements, and advocate on behalf of Canada in international negotiations and litigation. There are also a number of Department of Justice lawyers at the department, who provide legal services under domestic law, including on litigation and regulations such as sanctions implementation.

Our workforce

To deliver on its mandate, the department relies on a workforce that is flexible, competent, diverse and mobile.

The department counts 12,737 active employees; 7,235 of them are Canada‑based staff (CBS), serving either in Canada or at our missions abroad. The remaining 5502 employees are locally engaged staff (LES), usually foreign citizens hired in their own countries to provide support services at our missions. Currently, 56% of CBS are women (compared to 59% of LES) and 59% of the CBS population has English as their first official language (41% French).

A distinctive human resources system allows the department to meet its complex operational needs in a timely manner.

Our staff work in some of the most difficult places on earth, including in active conflict zones. Among the various occupational groups and assignment types, a cadre of rotational employees supports delivery of the department’s unique mandate through assignments typically ranging between 2 to 4-year periods, alternating between missions abroad and headquarters or Canadian regional offices. They are foreign service officers (in trade, political, economic, international assistance, and management and consular officer streams), administrative assistants, computer systems specialists, and executives, including our

heads of mission.

Heads of Mission serve the Minister further to a cabinet appointment. They develop deep expert knowledge of their countries

of accreditation, establish wide networks, and provide advice and guidance on pressing matters of bilateral and international concern. They are responsible for Canada’s “whole of government” engagement in their countries of accreditation and for the supervision of all federal programs present at mission.

Our finances

The department’s total funding requested in the 2021-22 main estimates was $6.7 billion. This amount is broken down as follows:

- Vote 1 (Operating): $1,878.2 million

- Vote 5 (Capital): $106.4 million

- Vote 10 (Grants and Contributions): $4,275.9 million

- Vote 15 (LES pension, insurance, social security programs): $85.5 million

- Statutory items (e.g. direct payments

to international financial institutions; contributions to employee benefit plans): $377.3 million.

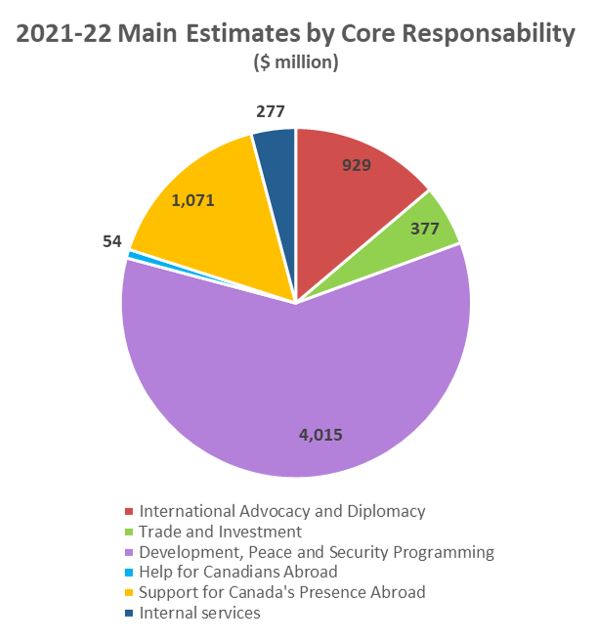

The budget distribution by core responsibility of the department in the 2021-22 Main Estimates was reported as follows:

Alternative Text

| International Advocacy and Diplomacy | 929 |

| Trade and Investment | 377 |

| Development, Peace and Security Programming | 4015 |

| Help for Canadians Abroad | 54 |

| Support for Canada's Presence Abroad | 1071 |

| Internal Services | 277 |

Chart summarizing 2021-2022 planned spending by core responsibility:

International Advocacy and Diplomacy: $929 million

Trade and Investment: $377 million

Development, Peace and Security Programming: $4015 million

Help for Canadians abroad: $54 million.

Support for Canada’s presence abroad: $1071 million

Internal services: $277 million

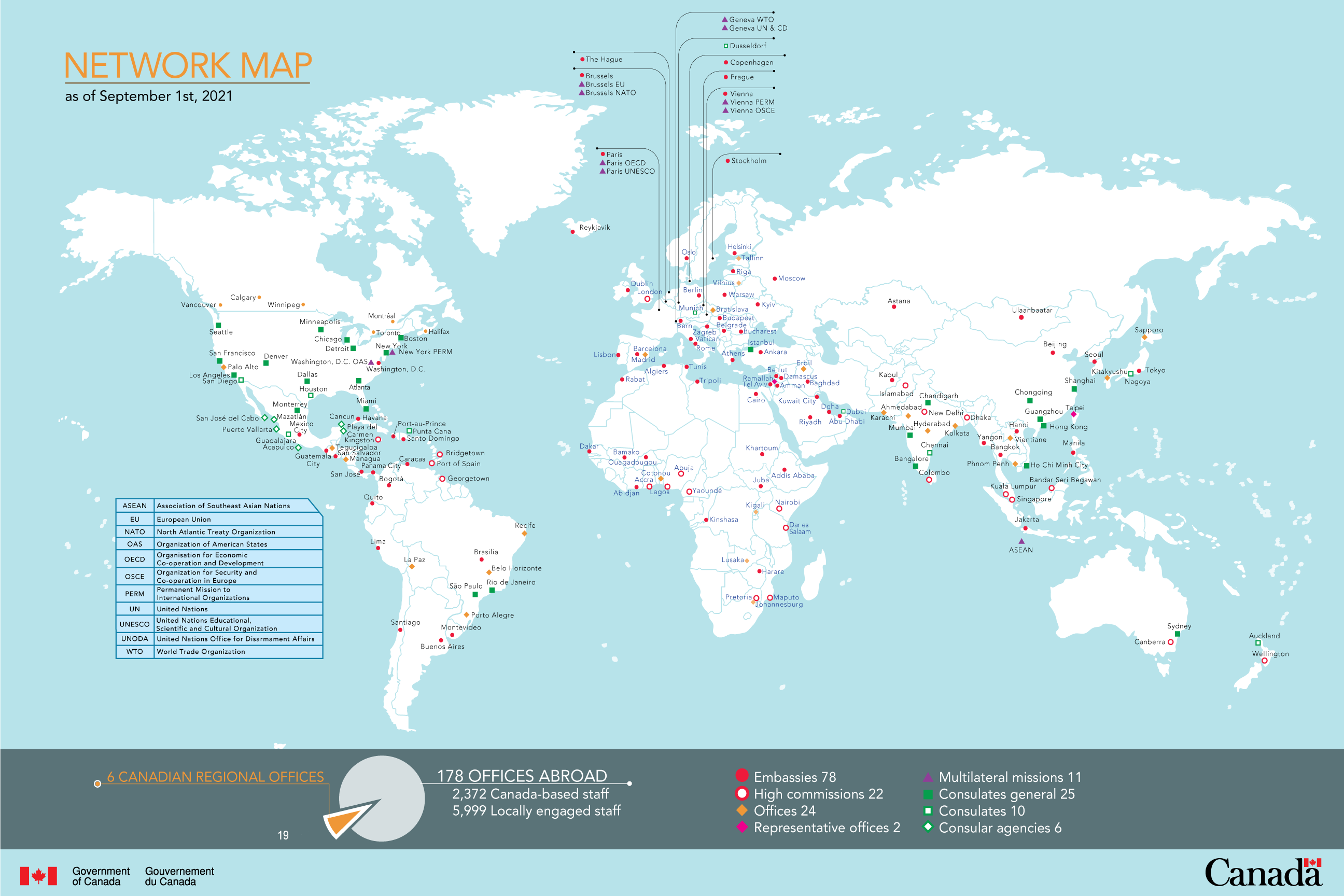

Our network

The department’s extensive network abroad counts 178 missions in 110 countries (see attached placemat for an overview of the network). They range in type and status from large embassies, to small representative offices and consulates.

The department’s network of missions abroad also supports the international work of 37 Canadian partner departments, agencies and co-locators (such as Immigration, Refugees and Citizenship Canada; National Defence; Canada Border Services Agency; Public Safety; Royal Canadian Mounted Police; Export Development Canada), and provinces and territories.

The department’s headquarters offices are located in the Ottawa-Gatineau region. Most staff are located in the first 3 buildings:

- Lester B. Pearson Building (125 Sussex)

- John G. Diefenbaker Building

(111 Sussex) - Place du Centre (200 Promenade du Portage)

- Queensway Corporate Campus

(4200 Labelle) - Cooperative House (295 Bank)

- National Printing Bureau

(45 Sacré-Coeur) - Fontaine Building (200 Sacré-Coeur)

- Bisson Centre (the Canadian Foreign Service Institute Bisson Campus)

The department also has six Canadian regional officesto engage directly with Canadians, notably Canadian businesses, located in Vancouver, Calgary, Winnipeg, Toronto, Montréal and Halifax.

Senior leadership and corporate governance

In support of ministers, the department’s most senior officials are the Deputy Minister of Foreign Affairs (USS); the Deputy Minister of International Trade (DMT); the Deputy Minister of International Development (DME); and the Associate Deputy Minister of Foreign Affairs (DMA). See attached biographies for USS, DMT and DMA.

Sixteen branches, headed by assistant deputy ministers, report to the deputy ministers and are responsible for providing integrated advice across all portfolios, ranging from geographic regions to functional and corporate issues.

The department has a robust corporate governance framework with specific committees for audit, evaluation, security, financial operations, corporate management, policy and programs, and diversity and inclusion. Senior managers from headquarters and the mission network manage and integrate the department’s policies and resources in this context to maximize our assets, and ensure accountability for the delivery of departmental programs and results.

Alternative Text

Chart summarizing 2021-2022 Corporate Governance Committee Structure:

External Committee: Departmental Audit Committee

DM-chaired committees: Executive Committee; Performance Management and Evaluation Committee

ADM-chaired Committees: Security Committee; Financial & Operations Management Committee; Corporate Management Committee; Policy & Programs Committee; Diversity & Inclusion Council. (All 5 ADM-chaired committees report to the Executive Committee)

Planning and reporting

The department’s annual planning and reporting process is structured around its Departmental Results Framework.

A Departmental Plan establishes the government’s foreign affairs, international trade and development agenda for the coming year. It provides a strategic overview of the policy priorities, planned results and associated resource requirements for the coming fiscal year. The document is approved by the ministers and tabled in Parliament (usually in March/April). The plan also presents the performance targets against which the department will report its final results at the end of the fiscal year through

a Departmental Results Report, typically tabled in Parliament in the fall.

The department’s top corporate priorities are identified each year to ensure that the enabling functions of the department (human resources, finance, IM/IT, accommodations, etc.) are able to provide optimal services to support the department’s mandate. As well, top departmental risks are identified and communicated in the Enterprise Risk Profile. For 2021-22, the department is focusing on mitigating risks related to its workforce (i.e. health, safety and wellbeing of staff, and human resources capacity), IM/IT capacity (i.e. digital transformation and cyber/digital security and resilience), and to the management and security of its real property and assets. Both the corporate priorities and risks are managed through the department’s governance system and re-evaluated on an annual basis.

In the context of COVID-19, there has been an intensified focus on advancing the digital transformation agenda. In particular, the pandemic has highlighted the need for the department to focus on transitioning towards newer digital solutions to enable the nimbleness and effectiveness required to deliver on its mandate and service Canadians. Investments in data driven decision-making, strong collaboration and engagement platforms, and a solid digital foundation will help the department move away from the traditional bricks and mortar and embrace more modern engagement methods to drive diplomacy, trade and international development.

Deputy ministers

Deputy Minister of Foreign Affairs, Marta Morgan

On April 18, 2019, Prime Minister Justin Trudeau appointed Marta Morgan to the position of Deputy Minister of Foreign Affairs, effective May 6, 2019.

Prior to joining Global Affairs Canada, Ms. Morgan was Deputy Minister of Immigration, Refugees and Citizenship for three years. In that role she led the development of immigration policies and programs to support Canada’s economic growth, developed strategies to manage the significant growth in asylum claims and improved client service.

Ms. Morgan has had extensive leadership experience throughout her career in a range of economic policy roles both at Industry Canada and the Department of Finance. She provided leadership in telecommunications policy, spectrum policy, aerospace and automobile sectoral policy, and the development of two federal Budgets.

Ms. Morgan has also held positions at the Forest Products Association of Canada, the Privy Council Office, and Human Resources Development Canada.

Ms. Morgan attended Lester B. Pearson College of the Pacific, she has a Bachelor of Arts (Honours) in Economics from McGill University and a Master in Public Policy from the John F. Kennedy School of Government at Harvard University.

Deputy Minister of International Trade, John F.G. Hannaford

On December 7, 2018, the Prime Minister appointed John F.G. Hannaford as Deputy Minister of International Trade at Global Affairs Canada, effective January 7, 2019.

From January 2015 to January 2019, Mr. Hannaford was the foreign and defence policy adviser to the Prime Minister and Deputy Minister in the Privy Council Office of the Government of Canada.

Until December 2014, Mr. Hannaford was the assistant secretary to the Cabinet for foreign and defence policy in the Privy Council Office. Prior to December 2011, Mr. Hannaford was Canada’s ambassador to Norway. Before that, for two years, Mr. Hannaford was director general of the Legal Bureau of the Department of Foreign Affairs and International Trade. As a member of Canada’s foreign service, he had numerous assignments in Ottawa and at the Canadian embassy in Washington, D.C., during the early years of his career.

Mr. Hannaford graduated from Queen’s University in Kingston, Ontario, with a Bachelor of Arts (First Class) in history. After earning a Master of Science in international relations at the London School of Economics, he completed a Bachelor of Laws at the University of Toronto and was called to the bar in Ontario in 1995.

In addition to his work as a public servant, Mr. Hannaford has been an adjunct professor in both the Faculty of Law and the Graduate School of Public and International Affairs at the University of Ottawa.

Associate Deputy Minister of Foreign Affairs, Christopher MacLennan

On February 7, 2020, the Prime Minister appointed Christopher MacLennan as the Associate Deputy Minister of Foreign Affairs. Since May 28, 2021, he has also served as the Personal Representative (Sherpa) to the Prime Minister on the G20. Prior to this, Mr. MacLennan was the Assistant Deputy Minister for Global Issues and Development at Global Affairs Canada. In that role, he led on Canada’s development assistance efforts through multilateral and global partners, humanitarian assistance and priority foreign policy relationships with the United Nations, the Commonwealth and La Francophonie. In addition to this, Mr. MacLennan served concurrently as Canada’s G7 foreign affairs sous-Sherpa.

Previously, Mr. MacLennan was acting Assistant Secretary to the Cabinet for Priorities and Planning and Assistant Deputy Minister of Policy Innovation at the Privy Council Office. Prior to that, Mr. MacLennan was Director General for Health and Nutrition at Foreign Affairs, Trade and Development Canada. Mr. MacLennan led the team that organized the Prime Minister’s Saving Every Woman, Every Child Summit on maternal, newborn and child health (MNCH) in 2014. This work followed his previous role on the G8 Muskoka Initiative on MNCH in 2010. Prior to this, Mr. MacLennan worked in various capacities at the Canadian International Development Agency, Environment Canada and Human Resources and Skills Development Canada.

Mr. MacLennan holds a Ph.D. from Western University specializing in constitutional development and international human rights and has written numerous publications including Toward the Charter: Canadians and the Demand for a National Bill of Rights, 1929-1960.

Organizational structure

Global Affairs Canada Executive (EX) Organizational Structure

Level 1 – Deputy Ministers and Coordinator

Deputy Minister of International Development – Vacant (DME)

Deputy Minister of Foreign Affairs – Marta Morgan (USS)

Associate Deputy Minister of Foreign Affairs – Christopher MacLennan (DMA)

Deputy Minister of International Trade – John Hannaford (DMT)

Level 2 – Assistant Deputy Ministers and Directors General

Reports to the Deputy Minister of International Development:

International Assistance Operations – E. Wega (DPD)

Reports to all Deputy Ministers:

Assistant Deputy Minister Human Resources – Francis Trudel (HCM)

Assistant Deputy Minister International Platform – Dan Danagher (ACM)

Assistant Deputy Minister Corporate Planning, Finance and IT (Chief Financial Officer) – Anick Ouellette (SCM)

Assistant Deputy Minister Public Affairs – Stéphane Levesque (LCM)

Assistant Deputy Minister Strategic Policy – Heidi Hulan (PFM)

Assistant Deputy Minister Global Issues and Development – Peter MacDougall (MFM)

Assistant Deputy Minister International Security and Political Affairs (Political Director) – Dan Costello (IFM)

Assistant Deputy Minister Partnership for Development Innovation – Caroline Leclerc (KFM)

Assistant Deputy Minister International Business Development and Chief Trade Commissioner – Sara Wilshaw (BFM)

Assistant Deputy Minister Trade Policy and Negotiations and Chief Trade Negotiator NAFTA – B. Christie (TFM)

Assistant Deputy Minister Consular, Security and Emergency Management (Chief Security Officer) – Cindy Termorshuizen (CFM)

Legal Advisor – Alan Kessel (JFM) – Special Deployment Position

Assistant Deputy Minister Sub-Saharan Africa – Mala Khanna (WGM)

Assistant Deputy Minister Europe, Arctic, Middle East and Maghreb – Sandra McCardell (EGM)

Assistant Deputy Minister Americas – Michael Grant (NGM)

Assistant Deputy Minister Asia Pacific – Paul Thoppil (OGM)

Executive Director and General Counsel – P. Hill (JUS)

Chief Audit Executive – J. B. Stephens (A) (VBD)

Director General, Inspection, Integrity and Values and Ethics – R. Sinclair (A) (ZID)

Corporate Secretary and Director General – C. Calvert (A) (DCD)

Chief of Protocol – S. Wheeler (XDD)

Ambassador for Women, Peace and Security – J. O’Neill (WPSA)

Head of the Anti-Racism Secretariat – M. Montrat (Sec) (DMAX)

Planning International Summits and Major Events – Vacant (DSMO)

Level 3 – Directors General

Reports to the Assistant Deputy Minister Human Resources

HR Corporate Strategies and Operational Services – M. P. Jackson (HSD)

Assignments and Executive Management – V. Alexander (A) (HFD)

Workplace Relations and Corporate Healthcare – C. Houde (HWD)

Canadian Foreign Service Institute – L. Marcotte (CFSI)

Foreign Service Directives – M. Cameron (A) (HED)

Locally Engaged Staff – P. Kitnikone (A) (HLD)

Reports to the Assistant Deputy Minister International Platform

Client Relations and Mission Operations – L. Almond (AFD)

Planning and Stewardship – D. Schwartz (ARD)

Platform Corporate Services – D. Bélanger (AAD)

Platform Planning, Engagement and Results – A. Stirling (ABD)

Project Delivery, Professional and Technical Services – G. Stephens (A) (AWD)

Reports to the Assistant Deputy Minister Corporate Planning, Finance and IT (Chief Financial Officer)

Financial Planning and Management – A. Boyer (SWD)

Financial Operations – S. Bainbridge (SMD)

Grants and Contributions Management – M. Collins (SGD)

Information Management and Technology (CIO) – K. Casey (SID)

Corporate Procurement, Asset Management and National Accommodation – D. Pilon (SPD)

Corporate Planning, Performance and Risk Management – L. Smallwood (SRD)

Senior IM/IT Project Executive – R. Dussault (SED)

Reports to the Assistant Deputy Minister Public Affairs

Development Communications – L. Belmahdi (LCA)

Public Affairs – Charles Mojsej (LCD)

Corporate and E Communications – C. Brisebois (LDD)

Trade Communications – V. Sharma (LCC)

Reports to the Assistant Deputy Minister Strategic Policy

Evaluation and Results – T. Denham (A) PRD)

Foreign Policy – P. Pena (POD)

International Assistance Policy – A. Smith (A) (PVD)

International Economic Policy – M. McDonald (PED)

Reports to the Assistant Deputy Minister Global Issues and Development

International Humanitarian Assistance – S. Salewicz (MHD)

Economic Development – C. Urban (MED)

Food Security and Environment – C. Campbell (MSD)

Health and Nutrition – J. Tabah (MND)

Social Development – L. Holts (A) (MGD)

International Organizations – A. Lalani (MID)

Innovative and Climate Finance Bureau – S. Szabo (MLD)

International Summits Programs – M. G. Mounier (DWD)

Reports to the Assistant Deputy Minister International Security and Political Affairs (Political Director)

International Security Policy – K. Hamilton (A) (IGD)

Peace and Stabilization Operations Program – G. Kutz (IRD)

Counter-Terrorism, Crime and Intelligence – M. Benjamin (IDD)

Human Rights, Freedom and Inclusion – C. Godin (A) (IOD)

International Crime and Counter-Terrorism – J. Loten (ICD)

Reports to the Assistant Deputy Minister Partnership for Development Innovation

Engaging Canadians – S. Savage (KED)

Inclusive Growth, Governance and Innovation Partnerships – C. Hogan Rufelds (KGD)

Canadian Partnership for Health and Social Development – J.B. Parenteau (KSD)

Reports to the Assistant Deputy Minister International Business Development and Chief Trade Commissioner

Trade Portfolio Strategy and Coordination – C. Moran (BPD)

Trade Commissioner Service - Operations – S. Goodinson (A) (BTD)

Trade Sectors – R. Kwan (BBD)

Investment and Innovation – E. Kamarianakis (BID)

Regional Trade Operations and Intergovernmental Relations – F. Rivest (A) (BSD)

Chief Economist – M.F. Paquet (BED)

Reports to the Assistant Deputy Minister Trade Policy and Negotiations and Chief Trade Negotiator NAFTA

Associate Assistant Deputy Minister, Trade Policy and Negotiations – A. Alexander (A) (TFMA)

Trade Negotiations – K. Hembroff (TCD)

North America, Trade Policy and Negotiations – A. Renart (TND)

Market Access – D. Forsyth (TPD)

Chief Air Negotiator and Director General for Services, Intellectual Property and Investment – M. Shendra (A) (TMD-ANA)

Trade and Exports Control – S. Anand (TID)

Reports to the Assistant Deputy Minister Consular, Security and Emergency Management

Consular Policy – A-K. Asselin (CPD)

Consular Operations – B. Szwarc (A) CND)

Security and Emergency Management (Departmental Security Officer) – J. Sunday (CSD)

Security & Emergency Management Strategy and Policy – D. Stewart (A) (CED)

Reports to the Legal Adviser

Trade Law – S. Spelliscy (A) (JLT)

Legal Affairs – K. Knobel (A) (JLD)

Reports to the Assistant Deputy Minister Sub-Saharan Africa

West and Central Africa – M. Lebleu (WWD)

Southern and Eastern Africa – T. Guttman (WED)

Pan-Africa – T. Khan (A) (WFD)

Reports to the Assistant Deputy Minister Europe, Arctic, Middle East and Maghreb

European Affairs – R. Fry (EUD)

Middle East – J. Dutton (ESD)

Maghreb, Egypt, Israel and West Bank and Gaza – A. F. Whalen (A) (ELD)

Senior Arctic Official and Director General, Polar, Eurasia and European Affairs – H. Kutz (ECD)

Reports to the Assistant Deputy Minister Americas

North America Strategy – E. Walsh (NGD)

North America Advocacy and Commercial Programs – L. Blais (NND)

South America and Inter-American Affairs – S. Cohen (A) (NLD)

Central America and Caribbean – S. Cesaratto (A) (NDD)

Geographic Coordination and Mission Support – S. Thissen (NMD)

Reports to the Assistant Deputy Minister Asia Pacific

Southeast Asia – P. Lundy (OSD)

North Asia and Oceania – W. Epp (OPD)

South Asia – D. Hartman (OAD)

Level 4 – Outside of Main Organizational Structure

Canadian Ombudsperson for Responsible Enterprise – Sheri Meyerhoffer (CORE)

Source of information: Human resources Management System (HRMS)

In some cases, adjustments have been made by HFR to reflect the most current employee or positional information

Link to Global Affairs Canada Corporate Governance Structure

http://intra/department-ministere/assets/pdfs/committees-comites/CG_GC_OrgChart_Jan2017-EN.PDF

Updated on October 31, 2021

Network map

Alternative Text

| Canadian Regional Offices | 6 |

| Offices Abroad | 178 |

| Canada-based Staff | 2372 |

| Locally engaged staff | 5999 |

| Embassies | 78 |

| High Commissions | 22 |

| Offices | 24 |

| Representative Offices | 2 |

| Multilateral Missions | 11 |

| Consulates General | 25 |

| Consulates | 10 |

| Consular Agencies | 6 |

The Trade Commissioner Service

Issue

- Global Affairs Canada’s (GAC) Trade Commissioner Service (TCS) helps Canadians identify, pursue and secure export sales; conclude innovation partnerships; and recruit international students.

- The TCS provides advice on international markets, regulatory issues, foreign investment, innovation and responsible business conduct. It also promotes Canada as a top destination for foreign direct investment (FDI).

Context

Since 1895, the TCS has helped Canadian businesses grow through export sales, foreign investment and other forms of international commercial partnership.

The TCS is a network of over 1,000 trade and business development professionals working from more than 160 locations around the world. In addition to 977 TCS personnel abroad, 140 trade commissioners are located in 18 cities across Canada to serve clients in their home regions. Every day, they help Canadian businesses prepare for international markets; assess market potential; find qualified contacts; and resolve business problems. Trade commissioners are also continually identifying and referring new commercial opportunities to TCS clients.

The TCS had 10,882 active Canadian business clients in fiscal year (FY) 2020/21. Clients are surveyed regularly and report a 92% client satisfaction rate. The vast majority of TCS clients are small and medium-sized enterprises (SMEs), including 93% of new clients in FY 2020/21.

On average, TCS clients export 19.8% more in value and to 24.8% more markets compared to non-clients. It is estimated that every dollar invested in the TCS results in $26 in increased exportsFootnote 1.

The TCS delivers 1,200 initiatives annually (including events and activities in which Canadian companies participate directly) to support business development in a range of sectors.

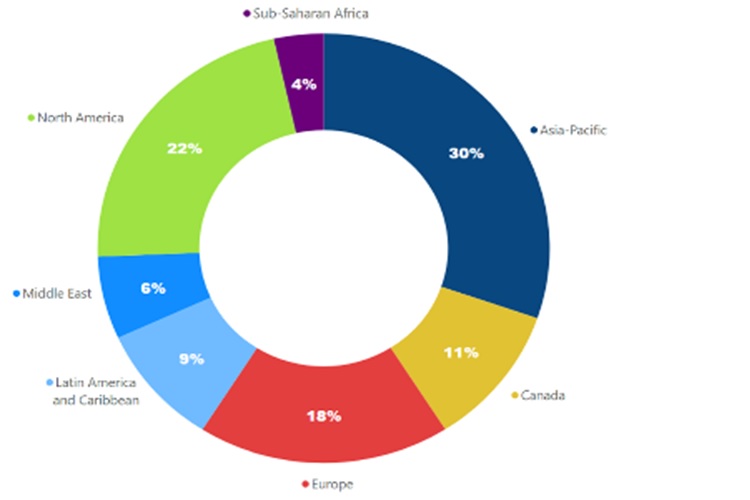

Chart summarizing the share of Trade Commissioner Service services by region delivered

Text version

- Canada: 11%

- Europe: 18%

- Latin America and Caribbean: 9%

- Middle East: 6%

- North America: 22%

- Sub-Saharan Africa: 4%

- Asia-Pacific: 30%

The TCS also administers CanExport, a suite of grants and contributions programs that provide $33 million per year in financial assistance to Canadian SMEs, innovators, national industry associations and communities. The programs assist recipients in diversifying to new international markets; developing research and development (R&D) collaborations; pursuing international business development activities; and attracting FDI.

CanExport SMEs, the largest CanExport program, offers funding to SMEs undertaking international market development activities. Since 2016, CanExport SMEs has approved $133 million in funding for over 4,100 projects targeting 151 markets around the world, contributing to more than $672 million in new export revenue generated.

The TCS is complemented by other federal trade and investment agencies: Export Development Canada, the Canadian Commercial Corporation and Invest in Canada. The TCS also collaborates with a range of other federal partners to help Canadian businesses succeed globally. These include Innovation, Science and Economic Development Canada, Agriculture and Agri‑Food Canada, the federal regional development agencies, the Business Development Bank of Canada and Natural Resources Canada, among others.

The TCS engages with provinces and territories on a regular basis, both formally and informally, on international trade policy and trade promotion. This includes working with provincial representatives who are co‑located in 47 GAC missions abroad.

The TCS continues to play an important role in Canada’s COVID-19 response. From the onset of the pandemic, the TCS has provided support to lead departments in sourcing medical supplies from abroad; troubleshooting supply chain disruptions; supporting international vaccine procurement and deployment; and promoting Canadian companies with COVID-19 solutions.

The TCS is focused on continually adapting and innovating to give clients the tools and support they need across a broad range of increasingly complex global commercial activity. In recent years this has meant:

- Accelerating the TCS’s digital transformation, with more online tools to help businesses quickly access the information they need on market opportunities and government services.

- Providing more tools and services focused on client needs related to e-commerce and intellectual property.

- Pursuing greater service differentiation, to ensure clients get support tailored to their particular needs and stages of growth.

- Enhancing capacity to recruit and retain the right talent, while also providing training and skills development essential for trade commissioners to keep up with a fast-moving business environment.

The TCS is also building on service-delivery innovations developed during the pandemic, particularly the use of virtual events and tools to increase reach and impact for clients.

Key TCS initiatives

High-intensity services

The TCS is expanding its offering of enhanced services to support high-potential, high-growth firms.

The Canadian Technology Accelerator (CTA) program helps companies accelerate their growth by providing customized market entry support in major global technology hubs. Expanding on the program's success in 4 U.S. markets, CTAs are now operating from Canadian missions in Asia, Europe and Mexico. Since the program’s inception in 2013, over 574 participants have reported $646 million in capital raised, $238 million in new revenue, 1,128 strategic partnerships and 2,529 new jobs created.

The TCS is also piloting a key account management model for its high-potential, high-growth clients and is in the soft launch phase of the Global Mentor Program (GMP). The GMP assigns experienced business leaders living abroad as mentors for targeted TCS clients, providing them with unique advice and insights to succeed in foreign markets.

FDI attraction

The TCS plays a leading role in attracting job-creating FDI into Canada, in partnership with Invest in Canada and other government departments. The TCS facilitated 121 FDI “wins” in 2020-2021, representing more than $2.1 billion and creating more than 5,825 new jobs. These results were achieved despite the challenges brought about by COVID-19, which saw a decline of 50% in FDI flows to Canada compared to 2019.

Responsible business conduct (RBC)

The TCS helps Canadian companies understand and manage risks, solve problems related to responsible business practices, and demonstrates the competitive advantage of doing business with Canadian companies with strong RBC policies and practices.

Science, technology and innovation (STI)

The TCS supports the competitiveness of Canadian firms by helping them establish international innovation partnerships, and access technology, foreign intellectual property and technology-related expertise, as well as venture capital. The TCS facilitated 148 international STI partnerships for 128 Canadian companies and organizations in FY 2020/21, and helped raise $185 million in venture capital for Canadian SMEs.

Exporter diversity

The TCS supports women-owned and women-led, Indigenous, visible minority, LGBTQ2+ and youth SMEs, through group-focused business delegations and other opportunities oriented toward international business development. The TCS has built a variety of partnerships and trade‑development initiatives and missions focused on those exporters in recent years.

International education

Despite the pandemic, in 2020 Canada welcomed 533,370 international students who contributed an estimated $21.4 billion to the Canadian economy and supported over 280,000 full-time jobs. In FY 2020/21, the TCS organized and participated in 226 education events worldwide, helping over 1,300 Canadian education clients meet with over 60,000 foreign contacts to develop new commercial partnerships and recruit international students.

Current TCS priorities

Deliver modern, high-impact services through recovery and beyond

- Foster a highly-skilled, client-oriented network of employees who contribute to economic prosperity by directly supporting businesses, primarily SMEs, and other clients.

- Innovate new methods, platforms, and tools to deliver services, and enhance TCS impact and reach through an online suite of offerings, virtual events and digital networking, ensuring services remain well adapted to business needs in today’s increasingly virtual and online economy.

Support economic growth and resiliency

- Ensure the TCS is optimized to help Canadian firms expand into new markets amid transformation and disruption in technology, business practices and international trade. This includes new offerings for businesses targeting international markets through e-commerce.

- Promote the competitive advantages presented by Canada’s trade agreements.

- Provide services tailored to the needs of companies seeking to grow internationally on the basis of their technological innovations, digital services and intangible assets such as intellectual property.

- Help ensure Canadian cleantech and green infrastructure companies thrive globally as international buyers look to “build back better” with more sustainable products and infrastructure.

- Promote the uptake of RBC principles by Canadian companies as a way to help them manage risks, including those related to production and supply chains.

Support a diverse exporter base

- Ensure TCS services are geared to supporting the international scale-up of firms across key growth sectors.

- Continue developing partnerships, competencies and approaches to ensure TCS services support the success of diverse businesses owned/led by members of groups underrepresented in Canada’s international trade.

Leverage partnerships to maximize impact

- Build further on strong collaboration with partners in Canada’s business and innovation ecosystem to maximize the impact of federal trade and investment promotion efforts for Canadians.

Litigation update

Issue

Havana Syndrome

- A group of government employees and their dependants have commenced litigation against the Crown with respect to ‘Havana Syndrome’.

- The plaintiffs allege the Crown failed in its duty of care to them by not protecting their health and safety while at Canada’s embassy in Havana; [REDACTED].

- [REDACTED]

[REDACTED]

- [REDACTED]

- [REDACTED]

- [REDACTED]

Context

Havana Syndrome

In February 2019, an action commenced against the Crown in Federal Court by 9 employees of Global Affairs Canada and 18 of their dependants seeking damages in excess of $20 million as a result of what they referred to as ‘Havana Syndrome.’ The Attorney General has delivered a Statement of Defence on behalf of the Crown, denying any liability.

[REDACTED]

C. Global overview

Global trends

Issue

- A complex and destabilizing global landscape has repercussions for Canada’s international agenda. COVID‑19 has introduced further uncertainty, accentuating challenges to institutions, alliances, practices and norms, while demonstrating the importance of international cooperation. As Canada contributes to fighting the pandemic and promoting an inclusive, equitable and sustainable global recovery, it must do so with an eye to the geostrategic environment, and identify opportunities to shape the rules‑based system in a manner that supports its values and long-term national interests.

Context

Overview

Diverse inter-related geostrategic trends are imposing new strategic choices on Canada’s foreign policy. Four stand out. First, there has been a sharpening of great power competition, most importantly the rivalry between the United States and China, which affects the strategic choices of every country. Second, authoritarianism and illiberal populism persist in many countries, while even robust democratic systems are experiencing strains. Third, deepening inequality within and across countries is driving questions about who shapes and benefits from current national and global systems. This is occurring in tandem with deliberate action to roll back progress on human rights and gender equality in all regions and across some international bodies. Fourth, therole of technology, and those who develop and deploy it, is evolving rapidly. A more digital world offers significant potential to improve lives, but is also leading to increasing disruption across a wide range of economic, social and political spheres.

COVID-19 introduced new uncertainty to a global system already in flux, exposing the risks and opportunities of our interconnected world. The pandemic has exacerbated inequities and vulnerabilities, and significantly reversed poverty reduction and development gains, notably for women, children and marginalized groups. It has also demonstrated the importance of cooperation, and the key role played by multilateral bodies, including international financial institutions and many UN agencies, funds and programs. There has also been cooperation on global health and vaccines, such as the COVAX Facility, and for economic recovery, such as the World Bank COVID-19 Strategic Preparedness and Response Program. And yet, COVID-19 has also accentuated challenges facing institutions (such as the United Nations Security Council (UNSC), World Health Organization (WHO) and World Trade Organization (WTO)), and sparked reflections about self-reliance in strategic sectors. With the development of new vaccines, though inequitably distributed, there is a new focus among policy makers on the future strategic landscape and opportunities to revitalize a strained rules-based system.

Geopolitical competition, peace and security

The historic shift of geopolitical and economic power from the Atlantic to the Pacific is still underway as emerging Asian countries (including China and India) are projected to continue growing at a faster rate than advanced transatlantic economies. This is occurring at a moment when the system of agreed international laws and institutions that govern inter-state behaviour are under strain due to a confluence of factors, all of which contributes to an unpredictable international strategic environment. Shaping this environment is a key focus of the Biden administration, which has swiftly sought to re-establish U.S. leadership on a range of international issues, including by re-joining the Paris Agreement, re-engaging with the UN Human Rights Council, arranging high-level meetings with China and Russia, initiating nuclear discussions with Iran, hosting a climate summit, planning a summit for democracy and seeking to improve transatlantic cooperation. The quick agreement on a Roadmap for a Renewed Canada-U.S. Partnership outlines how our 2 countries can face a range of challenges, including on multilateral issues. While these shifts are welcome, [REDACTED]

For its part, China continues its economic, political and military ascent, overtly using levers of influence [REDACTED]. China is becoming a systemic actor in some areas, including technology, outer space, climate and energy, [REDACTED] while seeking to shape the context across multiple issues, regions and forums to align with the goals of the ruling regime. [REDACTED] (China was viewed unfavourably by majorities in every country in a 2020 Pew survey of 14 advanced economies).

The pandemic has sharpened a U.S.-China rivalry, and both are increasing pressure on third countries to align on key issues. While some bilateral cooperation and much trade will continue, the United States and China are seeking some degree of strategic decoupling, especially in advanced technology, putting the world on a path towards less digital and technological interoperability. [REDACTED]

Increased rancor between democratic and authoritarian states is another key trend whereby assertive authoritarian states such as [REDACTED]interfere in democratic processes abroad, seek to weaken multilateral work on democracy, human rights and media, and use coercive tactics for diplomatic and economic leverage, including arbitrary detentions of foreign citizens. Illiberal populists in [REDACTED] also weaken democratic institutions in the pursuit of nationalist goals [REDACTED]