This is a past issue of the State of Trade. For the latest report, please visit Canada’s State of Trade reports.

ISSN 2562-8321

Canada's State of Trade 2019

20th Edition

About this document

This report provides a comprehensive summary of the main developments in Canada’s commercial activities during the previous year. It describes the events that took place in the global economy and trade in 2018, the main developments in Canada’s economy and those of its most important partner economies and regions. It reports the developments in Canada’s trade in goods and services, as well as flows and stocks of foreign direct investment and Canadian direct investment abroad.

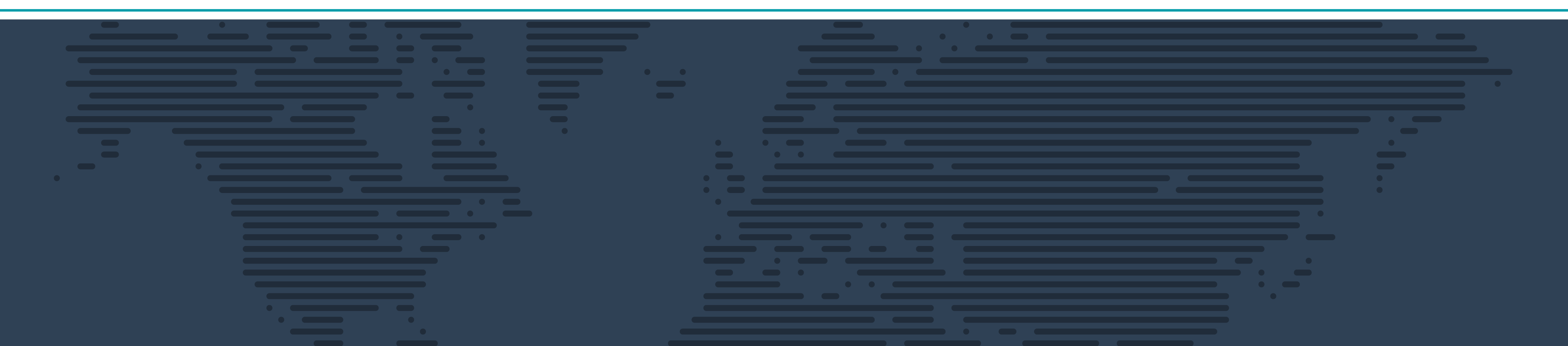

A special chapter is dedicated to Canada’s trade diversification effort, its importance, evolution and prospects, as well as the different dimensions of trade diversification. In addition, the chapter describes various potential paths for further diversification, by summarizing the numerous research and analyses undertaken by the Office of the Chief Economist at Global Affairs Canada and elsewhere.

Copyrights

Cette publication est aussi disponible en français sous le titre : Le point sur le commerce 2019 – 20e édition

Information contained in this publication or product may be reproduced, in part or in whole, and by any means, for personal or public non-commercial purposes without charge or further permission, unless otherwise specified. Commercial reproduction and distribution are prohibited except with written permission from Global Affairs Canada.

For more information, contact:

Global Affairs Canada

125 Sussex Drive

Ottawa ON K1A 0G2

Canada

Website: www.international.gc.ca

Email: info@international.gc.ca

© Her Majesty the Queen in Right of Canada, as represented by Global Affairs Canada, 2019.

Cat. No.: FR2-8E-PDF

ISSN: 2562-8321

Table of Contents

- Message from the Minister

- Executive Summary

- Part 1.0 Global performance highlights

- Part 2.0 Canada’s performance highlights

- Part 3.0 Diversifying Canadian exports

As Canada’s Minister of International Trade Diversification, I am delighted to present the 20th annual edition of the State of Trade Report for 2019.

Trade has been at the centre of the world’s attention during the past year. Globally, trade tensions, tariffs and uncertainty among many economies led to weaker economic growth and a slight slowdown in merchandise trade growth last year. However, in the midst of all this turbulence, Canada’s exports and imports both rose in 2018, with the total value of trade in goods and services reaching a record high of $1.5 trillion.

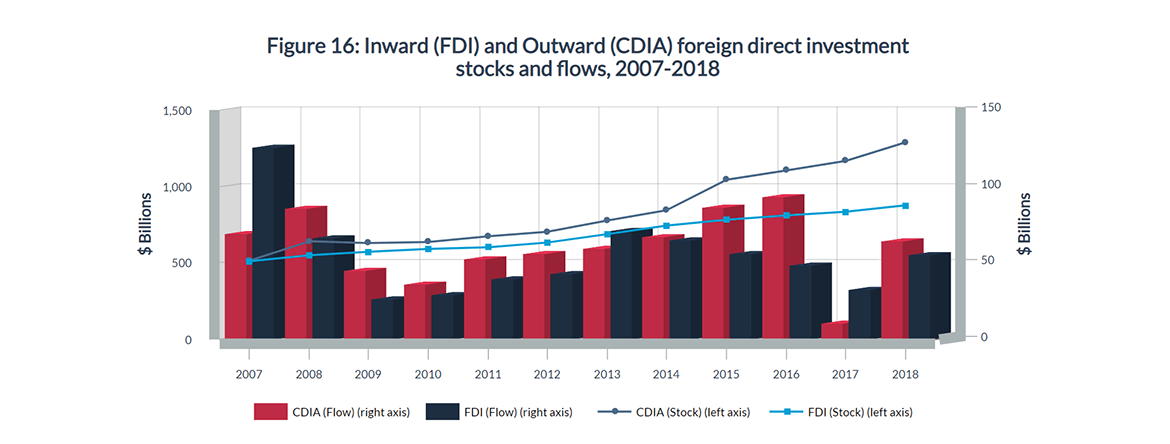

More trade and investment means more economic growth and good-paying jobs to help further strengthen Canada’s middle class. While Canadian investment flows abroad fell, total inflows of foreign direct investment into Canada increased by 70% to $55 billion.

This year’s State of Trade Report reflects our government’s efforts to expand and diversify Canada’s trade and investment and build bridges to dynamic markets. While the United States continues to be our most important trading partner, trade with other countries grew at a quicker pace. This bodes well for expanding global partnerships.

Diversification abroad means not only expanding our trading efforts with all regions, but also taking advantage of opportunities in emerging sectors. At home, diversification means making sure all regions of Canada and all members of our society can compete and succeed on international markets. Canada has led the way in advancing gender equality and women’s empowerment through our international engagement. Our government is also playing a leading role in helping more Indigenous people, members of the LGBTQ2+ community and youth succeed in today’s economy.

The 2019 State of Trade Report highlights results for both women- and Indigenous-owned exporting businesses: the numbers are very encouraging, with gains from trade spreading throughout Canada to all Canadians.

We strongly support free trade as a means to open foreign markets to Canadian goods and services, grow Canadian businesses, create good-paying jobs and contribute to middle-class prosperity. For this reason, we are working on increasing our overseas exports by 50% by 2025

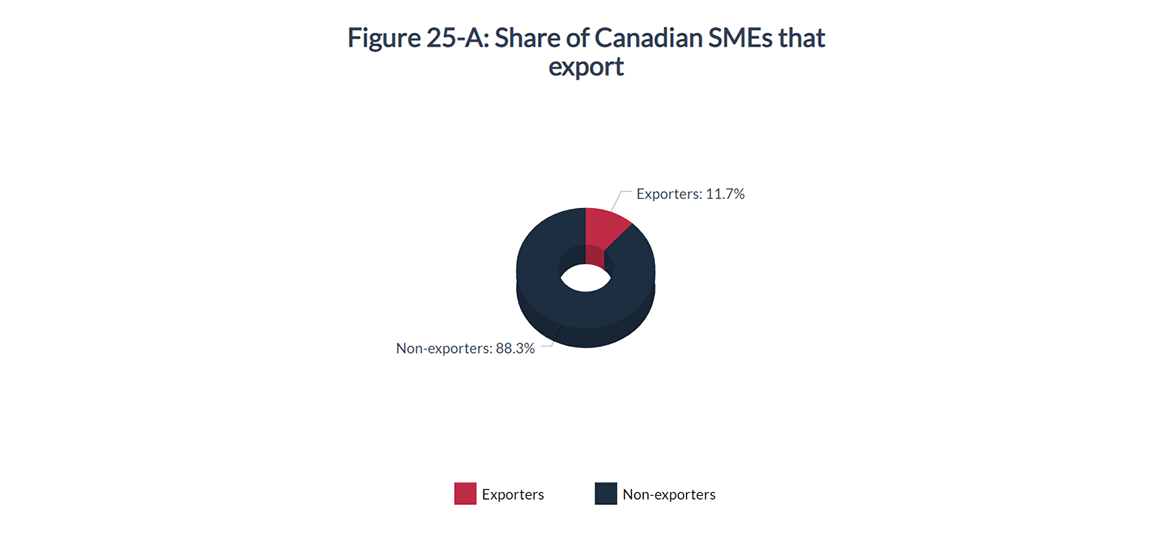

The numbers for small and medium-sized businesses (SMEs) exporting goods and services outside of Canada show the most potential for expansion. As part of Canada’s trade diversification strategy, we want to help SMEs navigate international markets and capitalize on market access gains achieved under Canada’s trade agreements.

Canada currently has 14 free trade agreements in force with 51 countries, totalling a combined gross domestic product of US$52 trillion. When the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) came into force at the end of last year, Canada became the only G7 country with free trade links to all of the other partners. The impacts of the CPTPP as well as the Canada-European Union Comprehensive Economic and Trade Agreement (CETA) are highlighted in this report. For both agreements, the report shows Canadian exports expanding after they came into force.

Our approach is to ensure that increased trade and investment and our trade diversification strategy support meaningful and sustainable growth for Canadian citizens, businesses and communities.

The Honourable Jim Carr, Minister of International Trade Diversification

Executive summary

After a period of broad-based and synchronized growth that lasted throughout 2017 and into early 2018, the global economy started to ease up. Global trade tensions combined with waning cyclical forces reduced economic momentum worldwide. Deceleration was widespread, even in countries like China and India. A notable exception was the United States, where tight labour market conditions and broad-based expansion bolstered the economy.

Against this backdrop of weaker economic growth, the expansion in global merchandise trade volumes slowed across both developed and emerging markets. Global merchandise trade value grew 10% in 2018, a slight slowdown from the 11% increase in the previous year. However, annual world merchandise trade still grew faster than at any time between 2012 and 2016, and global commercial services trade expanded by 7.4% in 2018, a little more than an extra one percentage point over 2017.

This backdrop coupled with global trade tensions, political uncertainty and U.S. tax reforms had an important impact on global foreign direct investment (FDI) flows. FDI flows declined by 13% in 2018, with developed European economies experiencing the largest regional decrease at 55%.

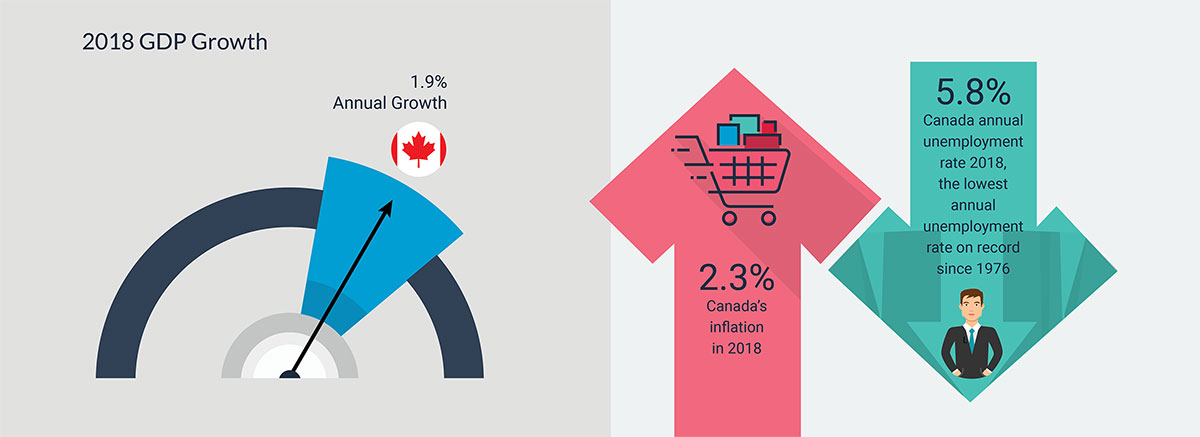

As with most major economies, Canada’s growth cooled to 1.9% in 2018, after reaching 3% in 2017. A major factor was the slowdown in household consumption growth, weighed down by household debt. Non-residential business investment made a very small positive contribution, while residential investment negatively impacted growth due to tighter mortgage guidelines. An acceleration in the growth of real exports along with a deceleration in real imports allowed trade to contribute marginally to growth in 2018, after being a drag in 2017. The Canadian labour market continued to display tight conditions, with the annual unemployment rate (5.8%) reaching record lows dating back to at least 1976, while inflation stood at 2.3% for 2018, its highest level since 2011.

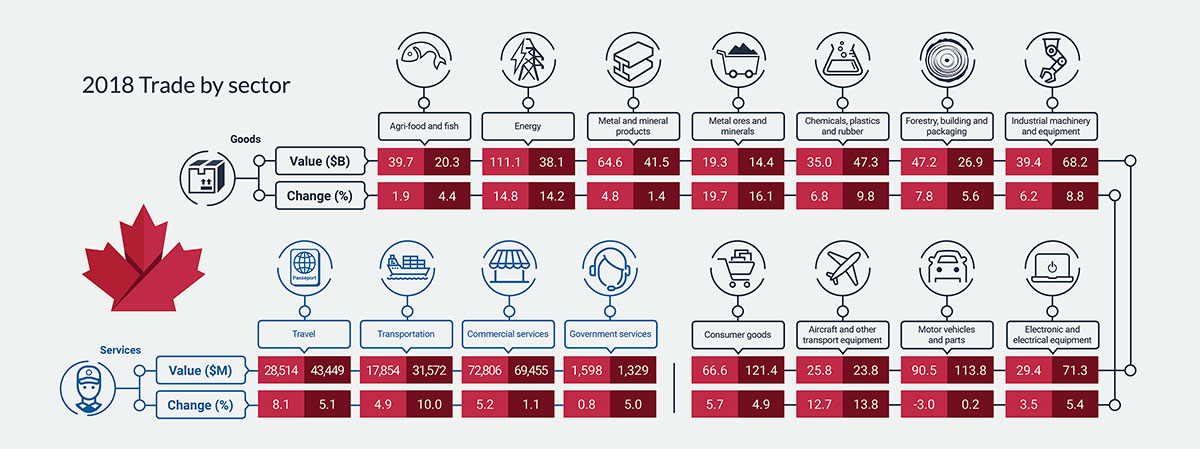

On the trade front, Canada’s exports of goods and services increased 6.2% in 2018, while imports rose 5.4%. The total value of trade in goods and services reached a record high of $1.5 trillion. Canada’s goods exports played an important role in the increase, growing at 6.5% in 2018 to reach $585 billion. Energy led the way, advancing $14 billion (15%) to $111 billion, followed by consumer goods ($3.6 billion) and forestry, building and packaging products ($3.4 billion). By destination, goods exports to the United States climbed 5.4% to $433 billion in 2018. However, exports to non-U.S. destinations grew even faster, up 9.8% to $153 billion. Canadian services exports grew for the ninth consecutive year, up 5.8% to $121 billion.

Canada’s goods imports rose 5.8% to $607 billion in 2018, with increases in all sectors, led by metal ores and minerals, energy products, and aircraft and other transportation equipment. Regionally, goods imports from the United States were up 5.4% to $391 billion in 2018, while imports from non-U.S. sources grew 6.5% to $216 billion. Since Canadian goods exports expanded at a faster rate than Canadian goods imports, the goods trade deficit narrowed by $2.7 billion to $22 billion. Services imports expanded by 4.2% to reach $146 billion. Canada continued to run a services trade deficit with every broad region and most major trading partners; nearly half of the deficit was due to the United States.

Total inflows of FDI into Canada for 2018 increased by 70% to $55 billion, in contrast to the decrease experienced by most other developed economies, due to a $24-billion increase in FDI from non-U.S. sources. Strong inflows of investment in Canada’s manufacturing sector (+45%) made up for declines in trade and transportation (-41%) and finance and insurance (-13%).

By contrast, Canadian direct investment abroad (i.e. FDI from Canada to other countries) fell by 38% to $64 billion, notably due to investment in the United States contracting by 60%. CDIA flows to the rest of the world increased by 48% or $10 billion. Overall, Canadian investors favoured the energy and mining, and manufacturing sectors, which were up by $13 billion and $10 billion, respectively.

Looking forward, continued weakness in Western Canada’s resource sector, elevated household debt, and a backlash against trade and globalization are factors that could dampen Canadian economic, trade, and investment growth. However, the Bank of Canada expects economic growth to pick up in the second half of 2019 and be sustained into 2020.

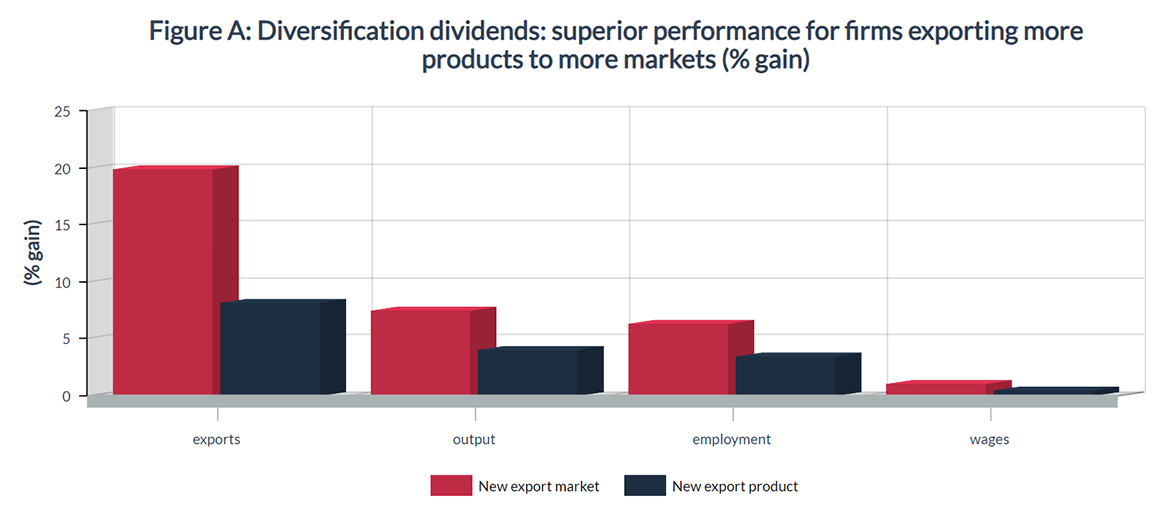

Whether the global economic context is stable or uncertain, having multiple export destinations and/or many different products to export can certainly help Canadian companies prosper by hedging risk and taking advantage of high-growth markets. This year’s State of Trade report also takes stock of research undertaken by the Office of the Chief Economist on trade diversification, both in its conventional sense as well as from the angle of diversity among exporter firms. It also features results from Export Development Canada’s research.

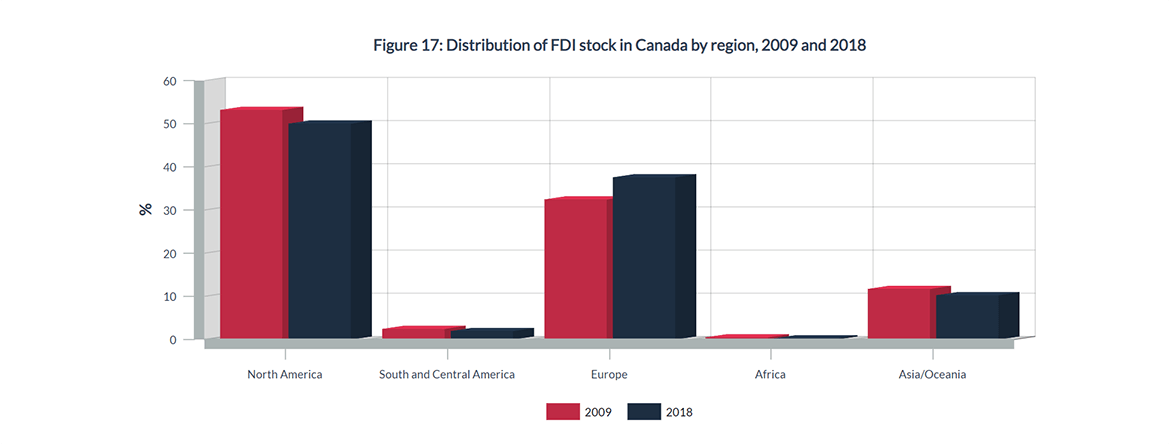

In terms of geographic diversification (e.g. destinations of exports), Canada has room to further diversify, as Canadian exports are currently considered to be concentrated. In fact, data show that Canada’s exports are the fourth most concentrated by destination out of 113 countries, principally due to a large share of exports going to the United States. This is not particularly surprising given Canada’s close trade connections with its Southern neighbour. Recognizing the country’s high export concentration, the federal government has set a target of increasing Canada’s overseasFootnote 1 exports by 50% to $284 billion by 2025. This objective requires an annual average growth rate of 5.2% from 2017, which is higher than the trend from recent years (2011-2017).

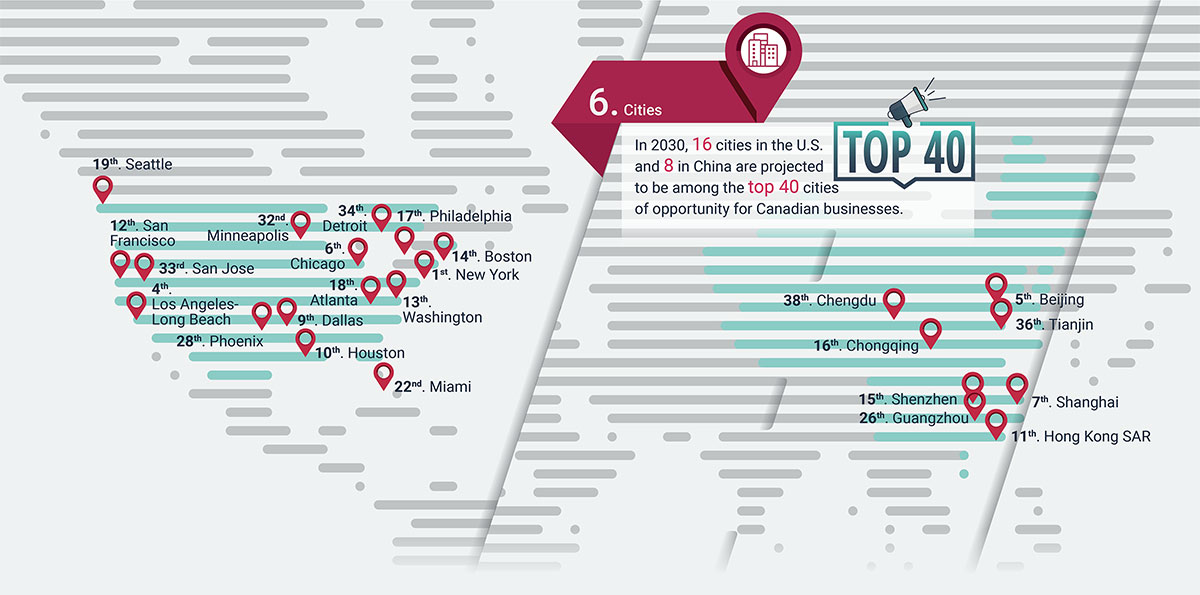

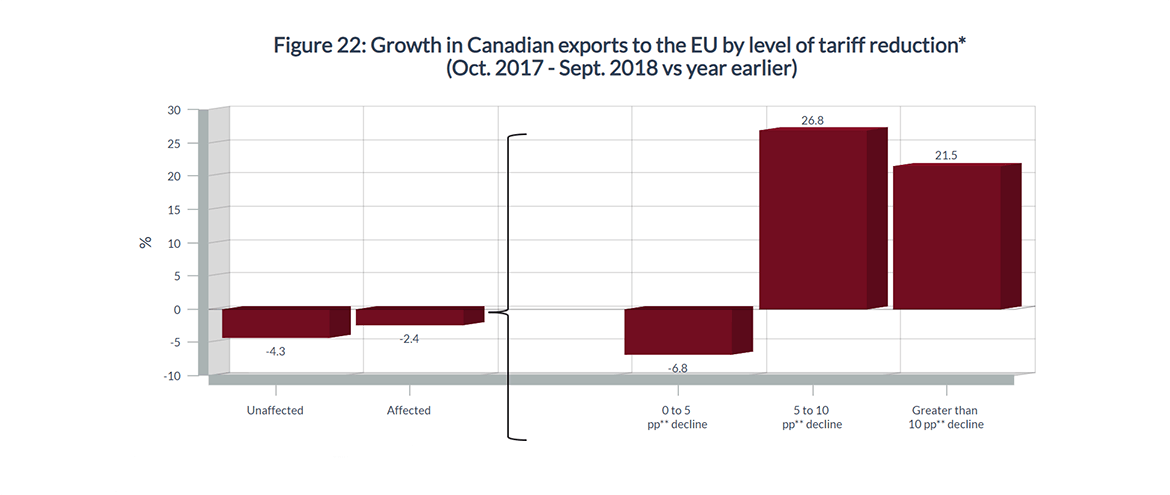

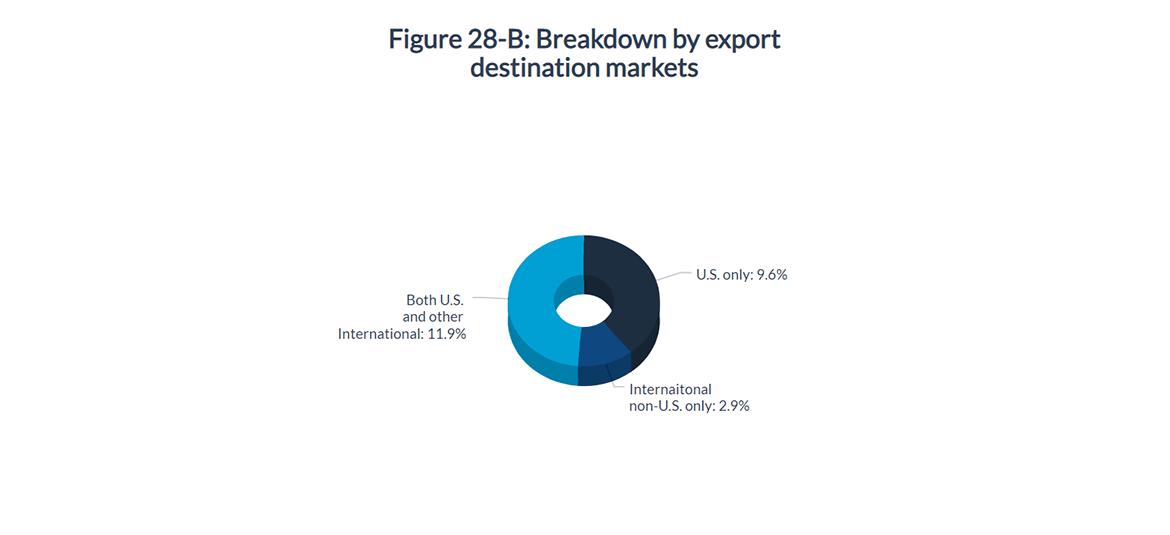

Free trade agreements (FTAs) are one way the government can help and encourage Canadian exporters to diversify into new markets as FTAs open opportunities by reducing trade barriers such as tariffs, quotas, and non-tariff barriers. Analysis shows Canadian exports increase after FTAs come into effect, especially for products benefiting from higher tariff declines. While Canada already has an extensive list of FTA partners,Footnote 2 signing new agreements and deepening existing FTAs could help further diversify Canadian trade, particularly in faster-growing emerging markets. Preliminary research results indicate that a one percentage point increase in the growth rate of an import market caused the level of Canadian exports to expand by 0.11%, with an additional gain of 0.16% if Canada was already active in that market prior to the growth. That said, encouraging Canadian firms to first export to emerging markets may not always be appropriate. A large majority of new exporters start with the U.S. and only later expand beyond that market. It is estimated that 20% of exporters to the United States expand or move into new markets each year on average. Therefore, encouraging firms to explore overseas markets might require them to first test the waters of the closer and more familiar U.S. market. Incidentally, some sixteen American cities are projected to be among the top 40 cities worldwide for Canadian business opportunities by 2030.

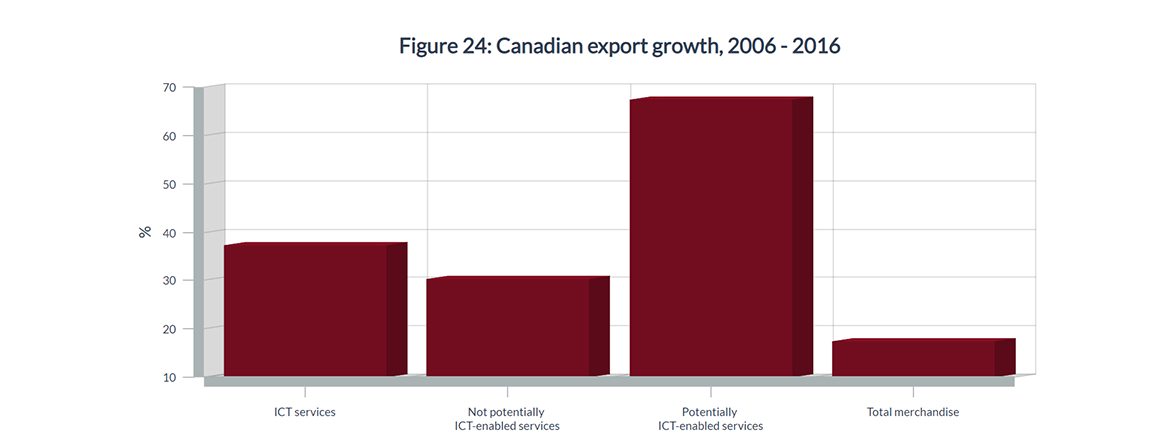

Although some traditional destinations will remain, the ways firms can sell their goods and services are changing with the Internet and digital technologies. Digital technologies facilitate transactions and reduce costs, for example, by optimizing route planning, reducing storage time, and improving distribution networks. Such improvements reduce the distance barrier for exporters. On the other hand, the Internet is increasingly being exploited for cross-border delivery of digital products.

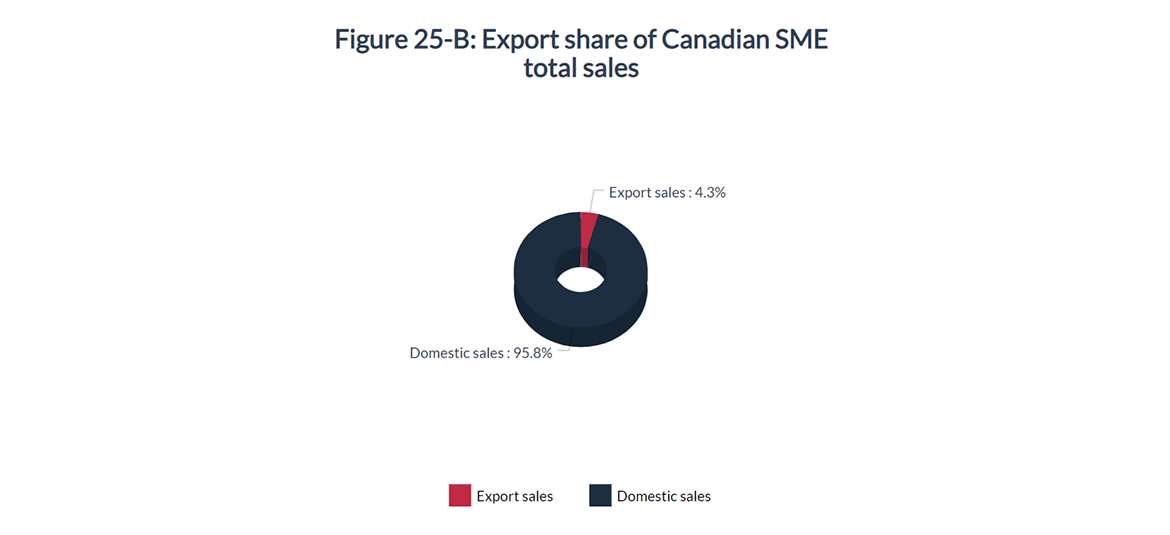

Encouraging the use of these technologies could further advance the diversification agenda. This could be particularly important for small and medium-sized enterprises (SMEs). Despite accounting for 99.8% of employer businesses and 89% of all private-sector jobs, only 12% of SMEs exported goods and services outside of Canada. Government programs aimed at helping SMEs navigate international markets could be another way to reach Canada’s 2025 overseas exports exports goal.

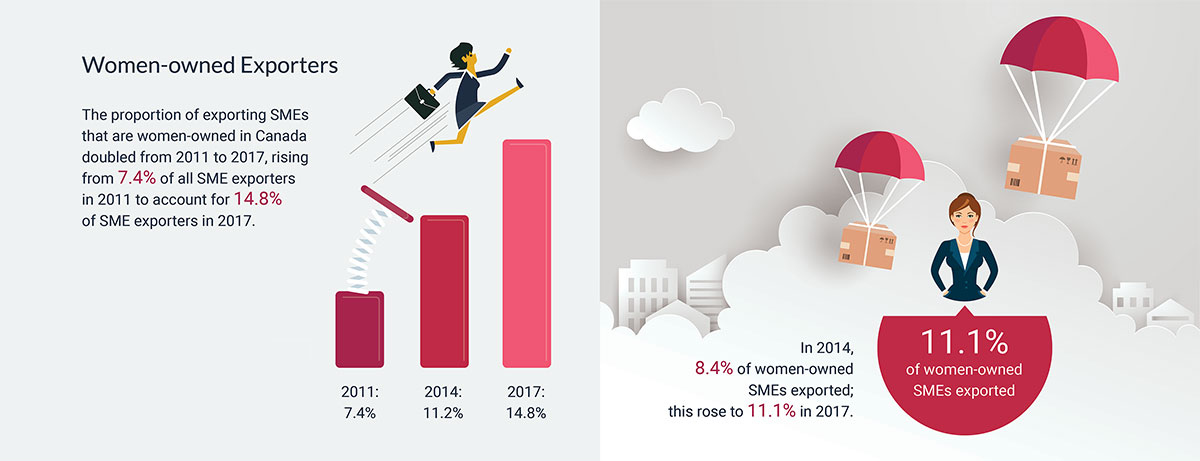

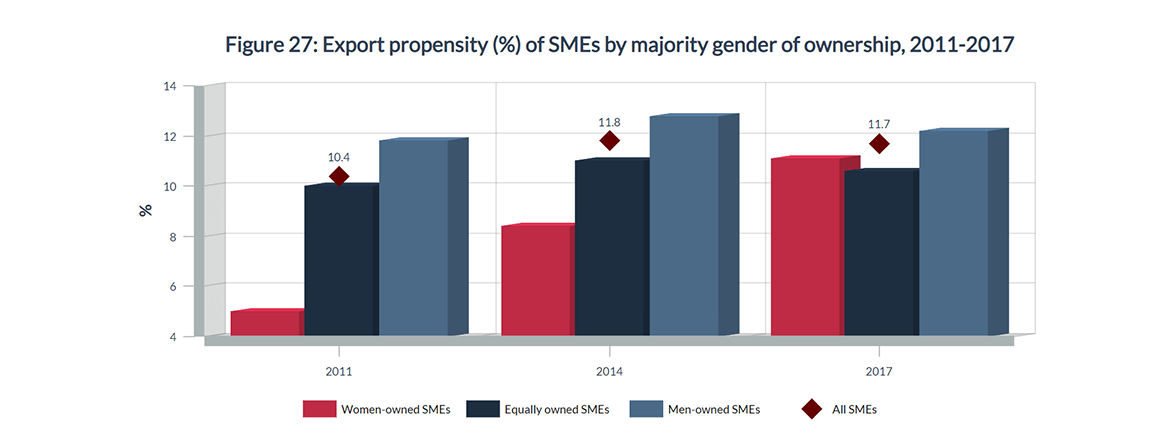

As mentioned above, diversity in who exports is also worth paying attention to. Diversification in ownership of Canadian exporters is important to ensure that gains from trade are spread throughout Canada to all Canadians. One dimension is women-owned exporting firms. Research shows that the proportion of women-owned exporting SMEs in Canada doubled from 7.4% of all SME exporters in 2011 to 15% in 2017. Furthermore, within women-owned SMEs in Canada, the share of firms that export rose from 8.4% in 2014 to 11% in 2017. The other ownership dimension explored is that of Indigenous-owned exporters. The results of a survey of Indigenous entrepreneurs show that in 2014, the proportion of Indigenous exporting SMEs was twice that of Canadian non-Indigenous exporting SMEs—24% versus 12%, respectively. Diversity thus exists within the exporting community and this diversity is slowly growing.

Diversification hedges risks from shocks to Canada from abroad and allows Canadian businesses to take advantage of opportunities in fast-growing markets. There are various avenues to greater geographical diversification. These include using free trade agreements to give Canadian exporters better access to foreign markets; accessing fast-growing markets early; using the U.S. market as a stepping stone to overseas markets; leveraging digital technologies; increasing SME participation in international trade; and focusing on the future growth of cities to identify new export opportunities. Moreover, the gains from trade can be spread more evenly throughout Canada, notably through diversification of exporter ownership.

Global performance highlights

Global economic performance

At a

glance

Long description

2018 economic indicators for selected regions and economies

| GDP Growth (%) | Unemployment (%) | Real Exports Growth* (%) | Real Imports Growth* (%) | |

|---|---|---|---|---|

| Advanced Economies | ||||

| Canada | 1.8 | 5.8 | 3.3 | 2.9 |

| Japan | 0.8 | 2.4 | 3.1 | 3.2 |

| United Kingdom | 1.4 | 4.1 | 0.1 | 0.7 |

| United States | 2.9 | 3.9 | 3.9 | 4.6 |

| France | 1.5 | 9.1 | 3.0 | 1.2 |

| Germany | 1.5 | 3.4 | 2.2 | 3.4 |

| Italy | 0.9 | 10.6 | 1.9 | 2.3 |

| Emerging Markets and Developing Economies | ||||

| Brazil | 1.1 | 12.3 | 7.1 | 6.8 |

| Mexico | 2.0 | 3.3 | 5.7 | 6.2 |

| China | 6.6 | 3.8 | 4.0 | 7.9 |

| India | 7.1 | 9.1 | 9.6 | |

| Russia | 2.3 | 4.8 | 6.3 | 3.8 |

| Sub-Saharan Africa | 3.0 | 3.0 | 6.2 |

Long description

| 2018 Energy Price Index | |

|---|---|

| January, 2018 | 156.1 |

| February, 2018 | 148.2 |

| March, 2018 | 148.0 |

| April, 2018 | 152.7 |

| May, 2018 | 163.6 |

| June, 2018 | 163.9 |

| July, 2018 | 165.3 |

| August, 2018 | 163.9 |

| September, 2018 | 174.1 |

| October, 2018 | 173.8 |

| November, 2018 | 149.3 |

| December, 2018 | 133.3 |

| January, 2019 | 133.3 |

| February, 2019 | 136.0 |

| March, 2019 | 138.3 |

| April, 2019 | 143.8 |

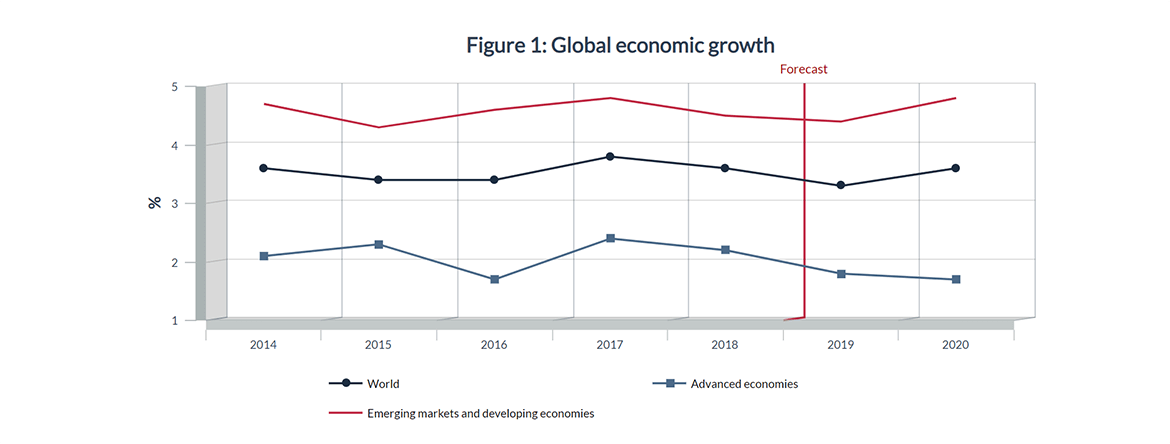

After a broad-based upswing in growth that lasted nearly two years, the global economy started to decelerate in the second half of 2018, causing global growth in 2018 (3.6%) to be slightly lower than that for 2017 (3.8%). The deceleration in 2018 was fairly evenly spread between advanced economies and emerging economies.

Rising trade tensions, lower business confidence, tightening of financial conditions, higher policy uncertainty across many economies and waning cyclical forces were some of the factors behind the slowdown in global activities.

Source: International Monetary Fund, World Economic Outlook, April 2019; retrieved on 20-06-2019

Long description

Figure 1: Global economic growth (in %)

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|

| World | 3.6 | 3.4 | 3.4 | 3.8 | 3.6 | 3.4 | 3.6 |

| Advanced economies | 2.1 | 2.3 | 1.7 | 2.4 | 2.2 | 1.8 | 1.7 |

| Emerging markets and developing economies | 4.7 | 4.3 | 4.6 | 4.8 | 4.5 | 4.4 | 4.8 |

Growth among major advanced economies slowed in 2018, with the exception of the United States. Weakening consumer and business sentiment throughout 2018, along with other country-specific issues, caused 2018 gross domestic product (GDP) growth in the Euro area to decline to 1.8% from 2.4% in 2017. Germany grew 1.5% in 2018, compared to 2.5% in 2017, as subdued foreign demand from major trading partners and delays related to new fuel emission standards for diesel vehicles weighed on economic activity. In Italy, an elevated sovereign spreadFootnote 3 continued to put downward pressure on the economy, and growth declined to 0.9% in 2018 from 1.6% in 2017.

In France, street protests against rising fuel prices and high costs of living disrupted retail sales and consumption growth, and France’s economic growth slipped to 1.5% in 2018 from 2.2% in 2017. Uncertainty surrounding Brexit negotiations weighed on the United Kingdom, and growth weakened to 1.4% in 2018, down from 1.8% a year earlier. In Japan, economic growth declined to 0.8% in 2018 from 1.9% in 2017. Notably, however, the United States bucked the trend of decelerating growth, advancing 2.9% last year compared to 2.2% a year earlier. A tight labour market, strong consumption growth, and fiscal stimulus from tax reforms supported the acceleration in economic growth.

Table 1: 2018 Economic indicators for selected regions and economies

| GDP Growth (%) | Unemployment (%) | Real Exports Growth* (%) | Real Imports Growth* (%) | |

|---|---|---|---|---|

| Advanced economies | 2.2 | 5.1 | 3.1 | 3.3 |

| Canada | 1.8 | 5.8 | 3.3 | 2.9 |

| Japan | 0.8 | 2.4 | 3.1 | 3.2 |

| United Kingdom | 1.4 | 4.1 | 0.1 | 0.7 |

| United States | 2.9 | 3.9 | 3.9 | 4.6 |

| Euro area | 1.8 | 8.2 | 3.1 | 3.0 |

| France | 1.5 | 9.1 | 3.0 | 1.2 |

| Germany | 1.5 | 3.4 | 2.2 | 3.4 |

| Italy | 0.9 | 10.6 | 1.9 | 2.3 |

| Emerging markets and developing economies | 4.5 | 4.3 | 5.6 | |

| Commonwealth of Independent States | 2.8 | 5.6 | 3.9 | |

| Russia | 2.3 | 4.8 | 6.3 | 3.8 |

| Emerging and developing Asia | 6.4 | 5.5 | 8.5 | |

| China | 6.6 | 3.8 | 4.0 | 7.9 |

| India | 7.1 | 9.1 | 9.6 | |

| ASEAN-5 | 5.2 | 7.3 | 9.7 | |

| Emerging and developing Europe | 3.6 | 6.5 | 2.6 | |

| Latin America and the Caribbean | 1.0 | 3.0 | 4.3 | |

| Brazil | 1.1 | 12.3 | 7.1 | 6.8 |

| Mexico | 2.0 | 3.3 | 5.7 | 6.2 |

| Middle East and North Africa | 1.4 | -1.0 | -0.6 | |

| Sub-Saharan Africa | 3.0 | 3.0 | 6.2 | |

| Nigeria | 1.9 | 22.6 | -0.7 | 17.7 |

| South Africa | 0.8 | 27.1 | 1.4 | 2.5 |

Source: International Monetary Fund, World Economic Outlook, April 2019; retrieved on 20-06-2019

*Volume of exports and imports of goods and services

Growth in emerging markets and developing economies also slowed slightly in 2018, dropping to 4.5% from 4.8% in 2017. In China, economic growth slowed to 6.6% in 2018 from 6.8% the previous year. The slowdown was due to regulatory tightening, which led to slower growth in fixed asset investment, as the government attempted to put economic growth on a more sustainable path. Declines in automobile sales, along with U.S. tariff actions also weighed on the Chinese economy in 2018. India experienced a slight slowdown in economic growth in 2018 (7.1%) relative to 2017 (7.2%). Mexico, Canada’s third-largest merchandise trade partner, saw a slight decline in economic growth in 2018, at 2.0%, from 2.1% in 2017. By the end of 2018, Mexico’s sovereign spreadFootnote 4 rose as economic sentiment weakened due to policy uncertainty from the new administration that cancelled a planned airport, in addition to the lack of clarity with regard to energy and education reforms.

According to the International Monetary Fund (IMF) in April 2019, the momentum of slower growth globally in the second half of 2018 is expected to carry over into the first half of 2019, with a pickup in economic activity afterward. The IMF expects economic growth to slow to 3.3% in 2019, from 3.6% in 2018, before returning to 3.6% in 2020. The outlook reflects waning cyclical forces, a return to weak potential growth from advanced economies, and an uncertain recovery in emerging markets. Risks to the forecast tilt toward the downside as trade tensions between United States and various trading partners, uncertainty surrounding Brexit negotiations, stress on Italian banks, and other geo-political issues weigh heavily on the economic outlook. On the other hand, with growing evidence of slowing activity, many central banks have signalled a less aggressive path of monetary policy tightening.

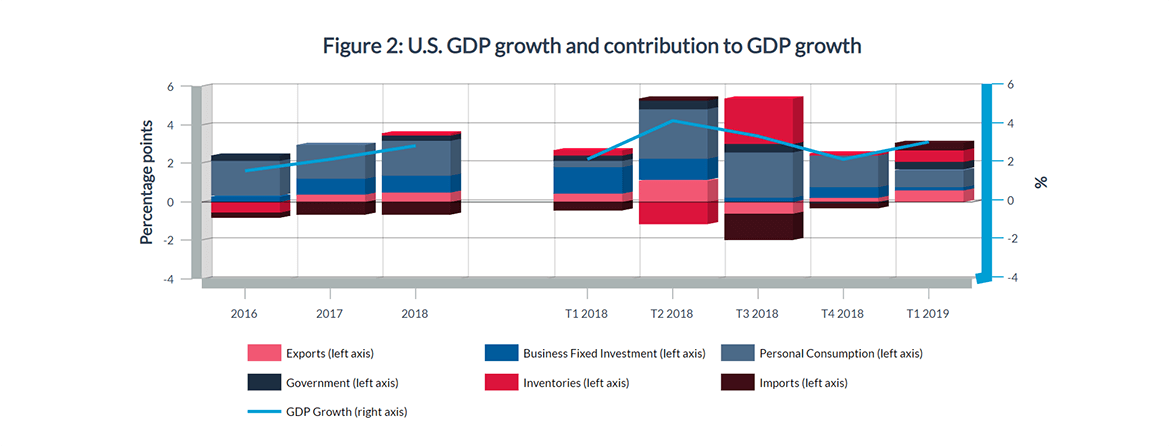

In 2018, while economic growth slowed in many advanced economies, it accelerated in the United States over the previous year. The U.S. expansion was broad-based, as personal consumption, investment, and exports all contributed to growth.

However, beginning in the second half of 2018, there were signs of softening investment brought about by increased uncertainty surrounding rising trade tensions with China.

Source: U.S. Bureau of Economic Analysis, May 30, 2019; retrieved on 20-06-2019

Long description

Figure 2 : U.S. GDP growth and contribution to GDP growt

| 2016 | 2017 | 2018 | _ | T1 2018 | T2 2018 | T3 2018 | T4 2018 | T1 2019 | |

|---|---|---|---|---|---|---|---|---|---|

| Exports (Percentage Point) | -0.01 | 0.36 | 0.47 | 0.43 | 1.12 | -0.62 | 0.22 | 0.58 | |

| Business Fixed Investment (Percentage Point) | 0.29 | 0.81 | 0.9 | 1.34 | 1.10 | 0.21 | 0.54 | 0.18 | |

| Personal Consumption (Percentage Point) | 1.85 | 1.73 | 1.8 | 0.36 | 2.57 | 2.37 | 1.66 | 0.90 | |

| Government (Percentage Point) | 0.25 | -0.01 | 0.26 | 0.27 | 0.43 | 0.44 | -0.07 | 0.42 | |

| Inventories (Percentage Point) | -0.53 | 0 | 0.12 | 0.27 | -1.17 | 2.33 | 0.11 | 0.6 | |

| Imports (Percentage Point) | -0.28 | -0.67 | -0.68 | -0.45 | 0.1 | -1.37 | -0.3 | 0.39 | |

| GDP Growth (%) | 1.6 | 2.2 | 2.9 | 2.2 | 4.2 | 3.4 | 2.2 | 3.1 |

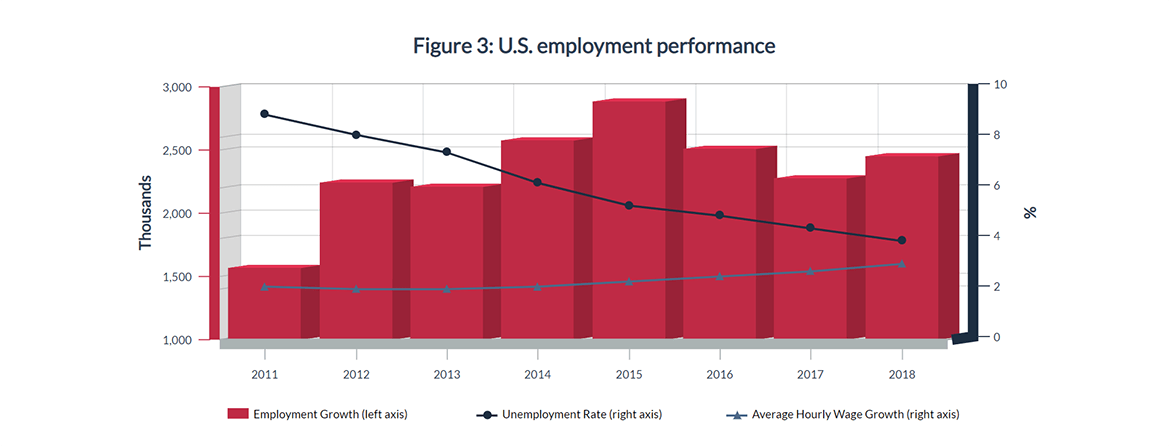

Consumption in the United States continued to be supported by a tight labour market (3.9% unemployment rate in 2018) and a slight pickup in wage growth (3.0% in 2018). According to the IMF forecast released in April 2019, U.S. economic growth is expected to decelerate to 2.3% in 2019 and 1.9% in 2020. The decline in growth reflects the negative impact of trade and political uncertainties, global cyclical forces and the waning positive impacts of fiscal stimulus.

Furthermore, there are risks to U.S. economic growth, which include further escalation of trade tensions with China and the slow ratification process for the new Canada-United States-Mexico Agreement (CUSMA). The U.S. economic outlook from the Organisation for Economic Co-operation and Development (OECD, May 2019) is slightly more positive, 2.8% in 2019 and 2.3% in 2020. The OECD believes that a strong labour market and increasing wages will support consumption growth.

Source: U.S. Bureau of Labor Statistics and IMF, World Economic Outlook, April 2018; retrieved on 20-06-2019

Long description

Figure 3 : U.S. employment performance

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|---|---|---|

| Employment Growth (in thousands) | 1570 | 2243 | 2206 | 2577 | 2885 | 2509 | 2272 | 2450 |

| Unemployment Rate (in %) | 8.93 | 8.08 | 7.36 | 6.16 | 5.28 | 4.88 | 4.35 | 3.89 |

| Average Hourly Wage Growth (in %) | 2.08 | 2.00 | 2.00 | 2.13 | 2.25 | 2.48 | 2.69 | 2.96 |

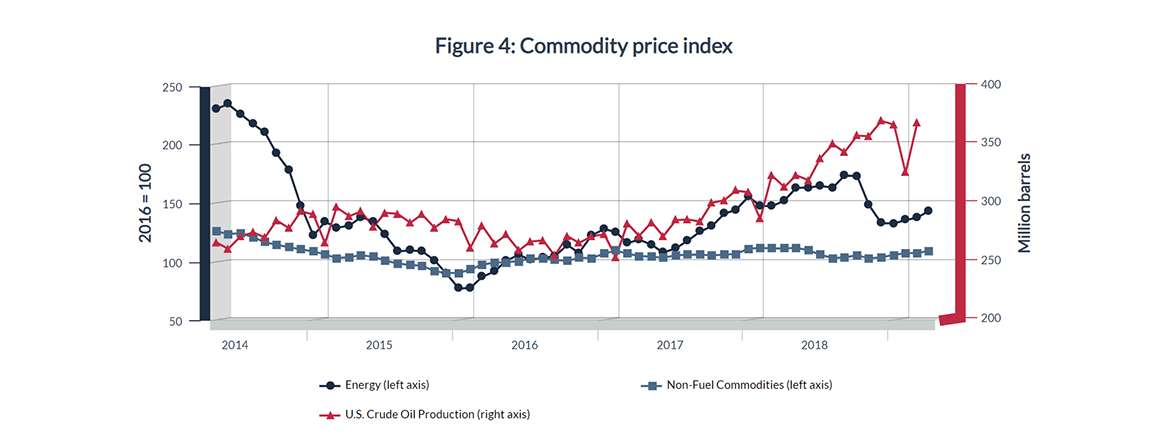

Global energy prices started to decline in the latter part of 2018; the IMF energy price index dropped 23% between September and December 2018. Slowing global growth, supply factors such as the temporary waiver of U.S. sanctions on Iranian oil exports to certain countries, and record high U.S. crude oil production were the main reasons for the decline.

The average monthly West Texas Intermediate crude oil price was US$70.75 per barrel in October 2018, but plunged to US$49.52 per barrel in December 2018. In recent months, crude oil prices have picked up slightly (to US$60.83 per barrel in May 2019), but still remain below their October 2018 level. Excluding energy, overall commodity prices have remained relatively stable.

Source: IMF Primary Commodity Price System and U.S. Energy Information Administration; retrieved on 20-06-2019

Long description

Figure 4: Commodity price index

| Mai 2014 | Juin 2014 | Juillet 2014 | Aug 2014 | Sept. 2014 | Oct. 2014 | Nov. 2014 | Déc. 2014 | Janv. 2015 | Feb 2015 | Mars 2015 | Apr 2015 | Mai 2015 | Jun 2015 | Juillet 2015 | Aug 2015 | Sept. 2015 | Oct 2015 | Nov. 2015 | Dec 2015 | Janv. 2016 | Feb 2016 | Mars 2016 | Apr 2016 | Mai 2016 | Jun 2016 | Juillet 2016 | Aug 2016 | Sept. 2016 | Oct 2016 | Nov. 2016 | Dec 2016 | Janv. 2017 | Feb 2017 | Mars 2017 | Apr 2017 | Mai 2017 | Jun 2017 | Juillet 2017 | Aug 2017 | Sept. 2017 | Oct 2017 | Nov. 2017 | Dec 2017 | Janv. 2018 | Feb 2018 | Mars 2018 | Apr 2018 | Mai 2018 | Jun 2018 | Juillet 2018 | Aug 2018 | Sept. 2018 | Oct 2018 | Nov. 2018 | Dec 2018 | Janv. 2019 | Feb 2019 | Mars 2019 | Apr-2019 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Energy (2016 is set as baseline at 100) | 231.32 | 235.19 | 226.54 | 218.06 | 210.91 | 193.02 | 178.46 | 148.55 | 122.68 | 134.81 | 129.40 | 131.38 | 138.45 | 135.12 | 123.66 | 109.45 | 110.02 | 109.52 | 101.65 | 90.45 | 77.53 | 78.14 | 87.46 | 92.26 | 101.39 | 106.42 | 102.00 | 103.77 | 105.17 | 114.81 | 108.00 | 123.05 | 128.33 | 126.00 | 116.32 | 119.42 | 114.94 | 108.24 | 112.04 | 118.29 | 126.23 | 130.80 | 141.56 | 144.91 | 156.13 | 148.24 | 147.97 | 152.74 | 163.58 | 163.93 | 165.27 | 163.92 | 174.09 | 173.77 | 149.34 | 133.35 | 133.30 | 136.05 | 138.256 | 143.768 |

| Non-Fuel Commodities (in millions of barrels) | 126.3 | 124.3 | 124.7 | 121.3 | 117.2 | 114.9 | 112.9 | 111 | 109.3 | 106.6 | 103.6 | 104.4 | 106 | 104.7 | 101.4 | 99 | 97.7 | 97.1 | 92.4 | 90.8 | 90.8 | 93.8 | 97.9 | 99.7 | 100 | 100.9 | 103.4 | 102.9 | 102.1 | 101.1 | 103.8 | 103.6 | 107.4 | 110 | 107.3 | 105.4 | 104.7 | 103.9 | 106 | 106.4 | 106.5 | 105.9 | 106.5 | 107.1 | 111.6 | 112.3 | 111.8 | 111.8 | 112.4 | 110.3 | 106.4 | 103.6 | 104.1 | 106 | 103.4 | 104.3 | 106.3 | 107.8 | 107.8 | 109.8 |

| U.S. Crude Oil Production (in millions of barrels) | 267 | 261.5 | 272.3 | 275.5 | 271.2 | 285.8 | 279.1 | 293.5 | 290.9 | 266.3 | 296.9 | 289.5 | 293.4 | 280.3 | 292.3 | 291.4 | 283.8 | 291 | 279.5 | 286.8 | 285.1 | 262.6 | 281.5 | 266 | 273.5 | 260.1 | 267.7 | 268.8 | 255.6 | 272.4 | 266.6 | 272.1 | 274 | 254.3 | 283.3 | 272.5 | 284.2 | 272.2 | 286.1 | 286.6 | 284.9 | 300.8 | 303.1 | 311.3 | 309.8 | 287 | 324.3 | 314.3 | 324.4 | 320.2 | 339 | 351.1 | 344.1 | 358.3 | 357.8 | 370.9 | 367.7 | 326.6 | 369 | 0 |

Chapter 1.2

Global trade performance

At a

glance

Long description

2018 Merchandise Exports and Imports Volume Growth

| Exports Volume Growth (%) | Imports Volume Growth (%) | |

|---|---|---|

| World | 2.8 | 3.2 |

| Advanced economies | 2.1 | 2.5 |

| Emerging markets and developing economies | 3.5 | 4.1 |

Long description

2018 Merchandise Exports

| Value (US$B) | World share (%) | Growth (%) | |

|---|---|---|---|

| World | 19,475 | 100 | 9.8 |

| North America | 2,565 | 13.2 | 7.9 |

| South and Central America and the Caribbean | 635 | 3.3 | 8.2 |

| Europe | 7,112 | 36.5 | 9.3 |

| Africa | 479 | 2.5 | 13.6 |

| Commonwealth of Independent States | 640 | 3.3 | 23.5 |

| Middle East | 1,140 | 5.9 | 21.5 |

| Asia | 6,905 | 35.5 | 8.2 |

2018 Merchandise Imports

| Value (US$B) | World share (%) | Growth (%) | |

|---|---|---|---|

| World | 19,866 | 100.0 | 10.1 |

| North America | 3,561 | 17.9 | 8.4 |

| South and Central America and the Caribbean | 645 | 3.2 | 11.2 |

| Europe | 7,151 | 36.0 | 9.5 |

| Africa | 574 | 2.9 | 11.1 |

| Commonwealth of Independent States | 435 | 2.2 | 8.4 |

| Middle East | 737 | 3.7 | 0.9 |

| Asia | 6,764 | 34.0 | 12.7 |

2018 Commercial Services Exports

| Value (US$B) | World share (%) | Growth (%) | |

|---|---|---|---|

| World | 5,770 | 100.0 | 7.7 |

| North America | 930 | 16.1 | 4.1 |

| South and Central America and the Caribbean | 159 | 2.8 | 1.0 |

| Europe | 2,764 | 47.9 | 8.1 |

| Africa | 112 | 1.9 | 9.9 |

| Commonwealth of Independent States | 117 | 2.0 | 12.1 |

| Middle East | 219 | 3.8 | 5.4 |

| Asia | 1,470 | 25.5 | 9.9 |

2018 Commercial Services Imports

| Value (US$B) | World share (%) | Growth (%) | |

|---|---|---|---|

| World | 5,485 | 100.0 | 7.4 |

| North America | 686 | 12.5 | 3.2 |

| South and Central America and the Caribbean | 181 | 3.3 | 0.8 |

| Europe | 2,346 | 42.8 | 8.4 |

| Africa | 170 | 3.1 | 13.4 |

| Commonwealth of Independent States | 144 | 2.6 | 7.4 |

| Middle East | 300 | 5.5 | 6.1 |

| Asia | 1,659 | 30.2 | 8.2 |

International trade overview

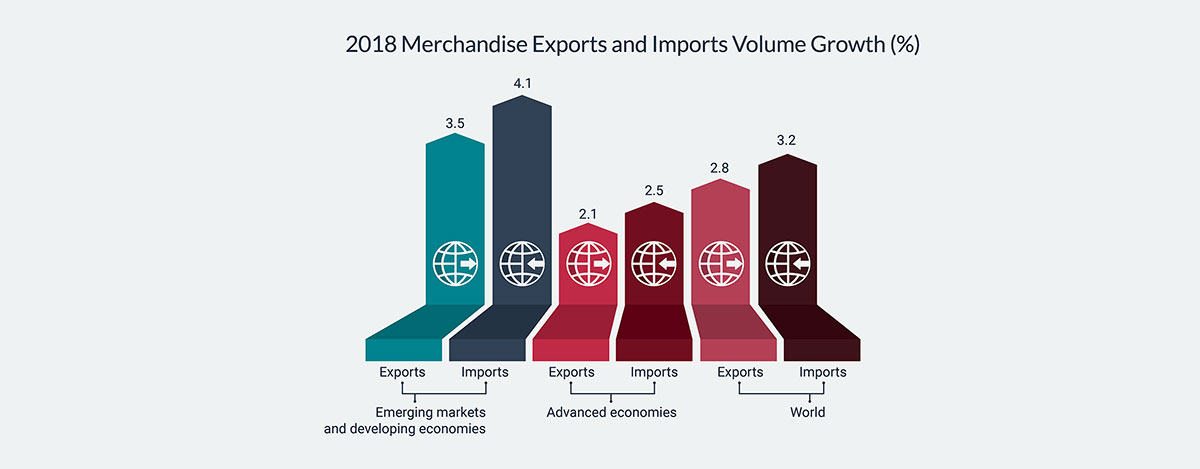

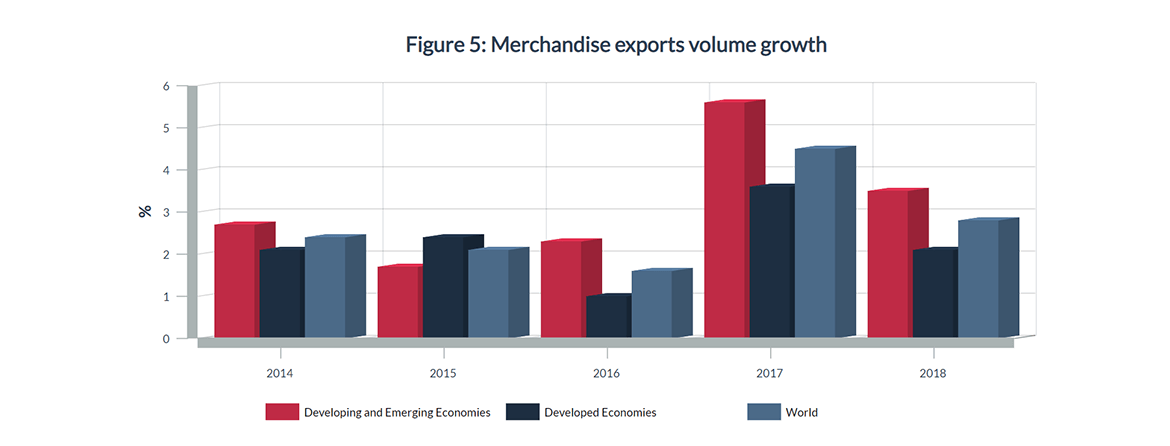

As global economic growth lost momentum in 2018, growth in the volume of world merchandise exports also slowed in both developed economies and emerging markets.

Since the 2009 recession, export volume growth in developing and emerging economies has been outpacing growth in developed economies, with the exception of 2015.

Source: WTO Database; retrieved on 21-06-2019

Long description

Merchandise exports volume growth (in %)

| 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|

| Developing and Emerging Economies | 2.7 | 1.7 | 2.3 | 5.6 | 3.5 |

| Developed Economies | 2.1 | 2.4 | 1 | 3.6 | 2.1 |

| World | 2.4 | 2.1 | 1.6 | 4.5 | 2.8 |

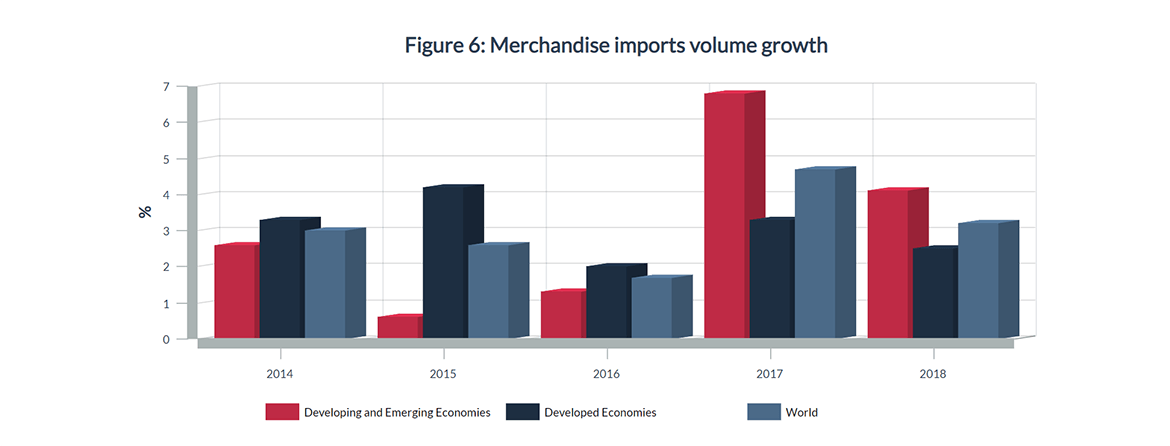

Similar to exports, the growth in the volume of imports also slowed in 2018 across both developed economies and emerging markets.

Merchandise import volumes grew faster in developed economies from 2014 to 2016, but the trend reversed beginning in 2017.

Source: WTO Database; retrieved on 21-06-2019

Long description

Merchandise imports volume growth (in %)

| 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|

| Developing and Emerging Economies | 2.60 | 0.60 | 1.30 | 6.80 | 4.10 |

| Developed Economies | 3.30 | 4.20 | 2.00 | 3.30 | 2.50 |

| World | 3.00 | 2.60 | 1.70 | 4.70 | 3.20 |

World merchandise exportsFootnote 5 grew 9.8% in 2018 to reach over US$19 trillion. Regionally, exports from the Commonwealth of Independent States grew the fastest at 24%, followed by the Middle East at 21%. North America had the lowest rate of merchandise export growth in 2018, at 7.9%. Among the major North American economies, Mexico had the highest rate of merchandise export growth, and Canada the lowest.

As a result, Mexican exports surpassed those of Canada, causing the two countries to switch rank (12th to 13th for Canada and 13th to 12th for Mexico) among the largest merchandise exporters to the world. The other change in ranking among top merchandise exporters was France overtaking Hong Kong SARFootnote 6 and moving into 7th place.

Table 2: Regional and selected countries merchandise exports

| 2018 Merchandise Exports Value (US$B) | 2018 Merchandise Exports Share (%) | 2018 Merchandise Exports Growth (%) | 2018 Merchandise Exports Rank | Rank 2017 | |

|---|---|---|---|---|---|

| World | 19,475 | 100.0 | 9.8 | ||

| North America | 2,565 | 13.2 | 7.9 | ||

| Canada | 450 | 2.3 | 6.9 | 13 | 12 |

| United States | 1,664 | 8.5 | 7.6 | 2 | 2 |

| Mexico | 451 | 2.3 | 10.1 | 12 | 13 |

| Europe | 7,112 | 36.5 | 9.3 | ||

| United Kingdom | 486 | 2.5 | 10.1 | 10 | 10 |

| European Union (27) | 6,448 | 33.1 | 9.4 | ||

| Euro area (19) | 4,986 | 25.6 | 9.2 | ||

| Belgium | 467 | 2.4 | 8.4 | 11 | 11 |

| France | 582 | 3.0 | 8.7 | 7 | 8 |

| Germany | 1,561 | 8.0 | 7.8 | 3 | 3 |

| Italy | 547 | 2.8 | 7.7 | 9 | 9 |

| Netherlands | 723 | 3.7 | 10.8 | 5 | 5 |

| Commonwealth of Independent States | 640 | 3.3 | 23.5 | ||

| Russia | 444 | 2.3 | 25.6 | 14 | 15 |

| Middle East | 1,140 | 5.9 | 21.5 | ||

| Asia | 6,905 | 35.5 | 8.2 | ||

| China | 2,487 | 12.8 | 9.9 | 1 | 1 |

| Hong Kong SAR | 569 | 2.9 | 3.4 | 8 | 7 |

| India | 326 | 1.7 | 8.8 | 19 | 20 |

| Japan | 738 | 3.8 | 5.8 | 4 | 4 |

| Korea, Republic of | 605 | 3.1 | 5.4 | 6 | 6 |

| South and Central America and the Caribbean | 635 | 3.3 | 8.2 | ||

| Brazil | 240 | 1.2 | 10.0 | 27 | 25 |

| Africa | 479 | 2.5 | 13.6 | ||

| Nigeria | 61 | 0.3 | 36.4 | 50 | 52 |

| South Africa | 94 | 0.5 | 5.9 | 39 | 38 |

Source: WTO Database; retrieved on 21-06-2019

World merchandise imports grew 10%Footnote 7 in 2018 to reach US$20 trillion, with Asia leading growth at 13%, followed by South and Central America and the Caribbean (11%) and Africa (11%). Merchandise imports in North America grew by 8.4%, with Mexico growing the fastest (10%) among the major economies, and Canada the slowest (6.1%).

As a result, Canada and Mexico switched places in the ranking of global merchandise importers. Other movements among the top merchandise importers include the Netherlands overtaking Hong Kong SAR in 7th place, and India overtaking Italy in 10th place.

Table 3: Regional and selected countries merchandise imports

| 2018 Merchandise Imports Value (US$B) | 2018 Merchandise Imports Share (%) | 2018 Merchandise Imports Growth (%) | 2018 Merchandise Imports Rank | Rank 2017 | |

|---|---|---|---|---|---|

| World | 19,866 | 100.0 | 10.1 | ||

| North America | 3,561 | 17.9 | 8.4 | ||

| Canada | 469 | 2.4 | 6.1 | 13 | 12 |

| United States | 2,614 | 13.2 | 8.5 | 1 | 1 |

| Mexico | 477 | 2.4 | 10.3 | 12 | 13 |

| Europe | 7,151 | 36.0 | 9.5 | ||

| United Kingdom | 674 | 3.4 | 4.7 | 5 | 5 |

| European Union (27) | 6,466 | 32.5 | 10.4 | ||

| Euro area (19) | 4,727 | 23.8 | 10.9 | ||

| Belgium | 450 | 2.3 | 10.1 | 14 | 14 |

| France | 673 | 3.4 | 8.7 | 6 | 6 |

| Germany | 1,286 | 6.5 | 10.6 | 3 | 3 |

| Italy | 501 | 2.5 | 10.5 | 11 | 10 |

| Netherlands | 646 | 3.3 | 12.4 | 7 | 8 |

| Commonwealth of Independent States | 435 | 2.2 | 8.4 | ||

| Russia | 249 | 1.3 | 4.6 | 22 | 20 |

| Middle East | 737 | 3.7 | 0.9 | ||

| Asia | 6,764 | 34.0 | 12.7 | ||

| China | 2,136 | 10.8 | 15.8 | 2 | 2 |

| Hong Kong SAR | 628 | 3.2 | 6.4 | 8 | 7 |

| India | 511 | 2.6 | 13.9 | 10 | 11 |

| Japan | 749 | 3.8 | 11.4 | 4 | 4 |

| Korea, Republic of | 535 | 2.7 | 11.9 | 9 | 9 |

| South and Central America and the Caribbean | 645 | 3.2 | 11.2 | ||

| Brazil | 189 | 0.9 | 19.8 | 28 | 29 |

| Africa | 574 | 2.9 | 11.1 | ||

| Nigeria | 42 | 0.2 | 33.9 | 59 | 63 |

| South Africa | 114 | 0.6 | 12.4 | 35 | 35 |

Source: WTO Database; retrieved on 21-06-2019

At 7.7%, world commercial services exports grew slightly slower than the 9.8% pace of world merchandise exports in 2018. By region, the Commonwealth of Independent States led growth in commercial services exports at 12%, followed by Asia and Africa at 9.9% each. North America was the second-slowest growing region (4.1%), expanding only faster than South and Central America and the Caribbean (1.0%). Canada’s commercial services exports grew 5.6% in 2018 and dropped one place to the 18th spot among the world’s top commercial services exporters.

Both India and Japan dropped a place in the rankings as Ireland leapfrogged over them into 7th place, due to high growth (14%). China and India, the two largest emerging economies, experienced strong commercial services exports growth in 2018, at 17% and 11%, respectively. Among developed economies, the Netherlands increased its commercial services exports by 11% to US$241 billion.

Table 4: Regional and selected countries services exports

| 2018 Commercial Services Exports Value (US$B) | 2018 Commercial Services Exports Share (%) | 2018 Commercial Services Exports Growth (%) | 2018 Commercial Services Exports Rank | 2017 Rank | |

|---|---|---|---|---|---|

| World | 5,770 | 100.0 | 7.7 | ||

| North America | 930 | 16.1 | 4.1 | ||

| Canada | 92 | 1.6 | 5.6 | 18 | 17 |

| United States | 808 | 14.0 | 3.8 | 1 | 1 |

| Mexico | 28 | 0.5 | 5.1 | 40 | 38 |

| Europe | 2,764 | 47.9 | 8.1 | ||

| Belgium | 121 | 2.1 | 3.0 | 13 | 13 |

| France | 291 | 5.0 | 6.2 | 4 | 4 |

| Germany | 326 | 5.6 | 7.3 | 3 | 3 |

| Italy | 121 | 2.1 | 9.0 | 14 | 14 |

| Netherlands | 241 | 4.2 | 11.4 | 6 | 6 |

| United Kingdom | 373 | 6.5 | 5.6 | 2 | 2 |

| Commonwealth of Independent States | 117 | 2.0 | 12.1 | ||

| Russia | 64 | 1.1 | 12.3 | 26 | 26 |

| Middle East | 219 | 3.8 | 5.4 | ||

| Asia | 1,470 | 25.5 | 9.9 | ||

| China | 265 | 4.6 | 17.1 | 5 | 5 |

| Hong Kong SAR | 114 | 2.0 | 9.3 | 15 | 15 |

| India | 204 | 3.5 | 10.7 | 8 | 7 |

| Japan | 187 | 3.2 | 3.1 | 9 | 8 |

| Korea, Republic of | 95 | 1.7 | 10.4 | 17 | 18 |

| South and Central America and the Caribbean | 159 | 2.8 | 1.0 | ||

| Brazil | 33 | 0.6 | -1.3 | 36 | 36 |

| Africa | 112 | 1.9 | 9.9 | ||

| Nigeria | 4 | 0.1 | -4.3 | 85 | 81 |

| South Africa | 16 | 0.3 | 1.4 | 49 | 48 |

Source: WTO Database; retrieved on 21-06-2019

World commercial services imports grew 7.4% in 2018, with Africa leading the way at 13% and accounting for 3.1% of overall world commercial services imports. In North America, commercial services imports increased 3.2%, recording the second-slowest regional growth rate. The United States remained the top importer of commercial services, at US$536 billion.

Canada’s imports grew 4.6%, to remain in 14th place among the leading commercial services importers. The large and fast-growing emerging economies of China and India saw high growth in commercial services imports, at 12% and 14%, respectively. Notable among developed economies, the Netherlands (11%), the United Kingdom (11%) and Belgium (12%) all saw high levels of growth in their commercial services imports.

Table 5: Regional and selected countries services imports

| 2018 Commercial Services Imports Value (US$B) | 2018 Commercial Services Imports Share (%) | 2018 Commercial Services Imports Growth (%) | 2018 Commercial Services Imports Rank | 2017 Rank | |

|---|---|---|---|---|---|

| World | 5,485 | 100.0 | 7.4 | ||

| North America | 686 | 12.5 | 3.2 | ||

| Canada | 112 | 2.0 | 4.6 | 14 | 14 |

| United States | 536 | 9.8 | 3.0 | 1 | 1 |

| Mexico | 37 | 0.7 | 0.7 | 32 | 32 |

| Europe | 2,346 | 42.8 | 8.4 | ||

| Belgium | 129 | 2.3 | 11.8 | 11 | 12 |

| France | 257 | 4.7 | 4.7 | 4 | 4 |

| Germany | 350 | 6.4 | 6.2 | 3 | 3 |

| Italy | 123 | 2.2 | 8.5 | 12 | 13 |

| Netherlands | 229 | 4.2 | 10.9 | 6 | 6 |

| United Kingdom | 230 | 4.2 | 10.9 | 5 | 5 |

| Commonwealth of Independent States | 144 | 2.6 | 7.4 | ||

| Russia | 93 | 1.7 | 6.8 | 16 | 16 |

| Middle East | 300 | 5.5 | 6.1 | ||

| Asia | 1,659 | 30.2 | 8.2 | ||

| China | 521 | 9.5 | 12.2 | 2 | 2 |

| Hong Kong SAR | 81 | 1.5 | 4.9 | 19 | 18 |

| India | 175 | 3.2 | 14.0 | 10 | 10 |

| Japan | 198 | 3.6 | 3.8 | 8 | 8 |

| Korea, Republic of | 123 | 2.2 | 2.1 | 13 | 11 |

| South and Central America and the Caribbean | 181 | 3.3 | 0.8 | ||

| Brazil | 66 | 1.2 | -0.9 | 24 | 23 |

| Africa | 170 | 3.1 | 13.4 | ||

| Nigeria | 31 | 0.6 | 70.1 | 37 | 43 |

| South Africa | 16 | 0.3 | 2.2 | 50 | 49 |

Source: WTO Database; retrieved on 21-06-2019

Global investment performance

At a

glance

Long description

2018 FDI flows

| Value (US$B) | Growth (%) | World share (%) | |

|---|---|---|---|

| World | 1,297 | -13 | 100 |

| Europe | 172 | -55 | 13 |

| North America | 291 | -4 | 23 |

| Africa | 46 | 11 | 4 |

| Latin America and the Caribbean | 147 | -6 | 11 |

| Developing Asia | 512 | 4 | 39 |

| Transition economies | 34 | -28 | 3 |

Long description

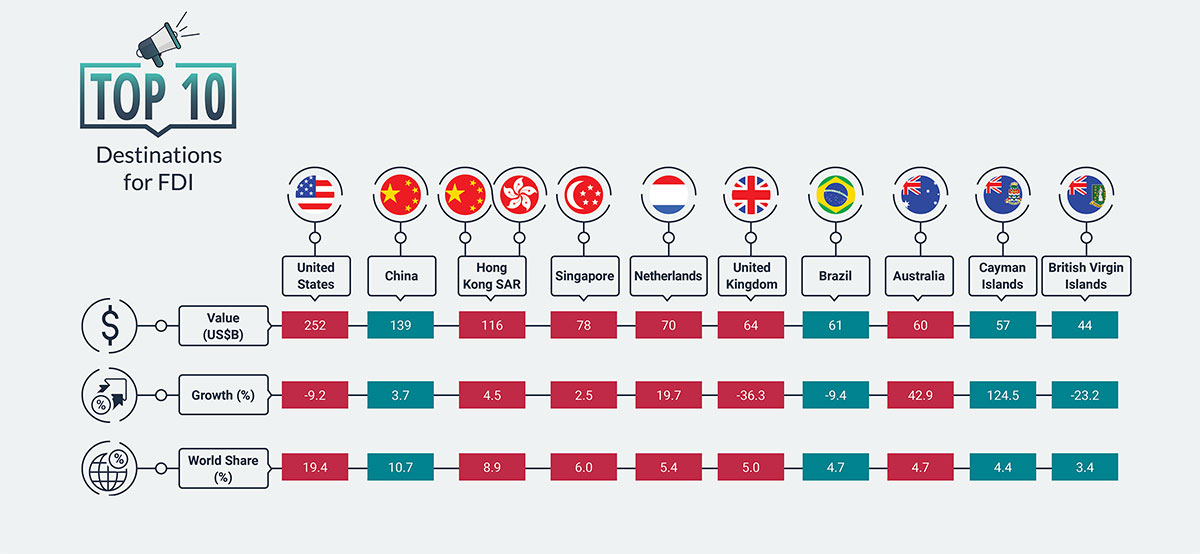

Destination for FDI

| Value (US$B) | Growth (%) | World share (%) | |

|---|---|---|---|

| United States | 252 | -9.2 | 19.4 |

| China | 139 | 3.7 | 10.7 |

| Hong Kong SAR | 116 | 4.5 | 8.9 |

| Singapore | 78 | 2.5 | 6.0 |

| Netherlands | 70 | 19.7 | 5.4 |

| United Kingdom | 64 | -36.3 | 5.0 |

| Brazil | 61 | -9.4 | 4.7 |

| Australia | 60 | 42.9 | 4.7 |

| Cayman Islands | 57 | 124.5 | 4.4 |

| British Virgin Islands | 44 | -23.2 | 3.4 |

Foreign direct investment overview

Global foreign direct investment (FDI) inflows decreased for the third consecutive year, from US$1.5 trillion in 2017 to US$1.3 trillion in 2018. As a result, annual global FDI inflows are near their low point, reached after the global financial crisis in 2009.

Developed economies received an estimated US$557 billion in new FDI in 2018, or 43% of global FDI inflows. However, this was down 27%, or US$202 billion, from the previous year. European countries were responsible for almost the entire decrease, falling by an unprecedented 55% to only US$172 billion, mainly due to large repatriations of retained earnings by U.S. multinational enterprises following the Tax Cuts and Jobs Act enacted by the U.S. government in 2017. FDI inflows fell for the second consecutive year in the transition economies (Southeast Europe and the Commonwealth of Independent States), down 28% to about US$34 billion, mainly due to a 49% decline in Russia.

In contrast, inward FDI flows to developing economies remained resilient, advancing 2%, or US$15 billion, to reach an estimated US$706 billion. Combined with the sharp decline in developed economies, the share of developing economies in global FDI flows jumped from 46% in 2017 to 54% in 2018. Developing Asia (+4%) and Africa (+11%) were mainly responsible for this growth, while a decline in Latin America and the Caribbean (-6%) partially offset the gains.

The United States remained the top economic destination for FDI inflows in 2018, in spite of a 9.2% decline. China (+3.7%), Hong Kong SAR (+4.5%), and Singapore (+2.5%) experienced relatively modest increases in 2018. Among the top European economies, the Netherlands registered a 20% increase in FDI inflows, while the United Kingdom saw its FDI inflows decline by 36% in 2018, likely due to uncertainty about the Brexit negotiations.

Table 6: World FDI inflows by major region, 2017 and 2018 (estimated)

| 2017 (US$B) | 2018 (US$B) | Change (%) | Share 2018 (%) | |

|---|---|---|---|---|

| World | 1,497 | 1,297 | -13 | 100 |

| Developed economies | 759 | 557 | -27 | 43 |

| Europe | 384 | 172 | -55 | 13 |

| North America | 302 | 291 | -4 | 23 |

| Developing economies | 691 | 706 | 2 | 54 |

| Africa | 41 | 46 | 11 | 4 |

| Latin America and the Caribbean | 155 | 147 | -6 | 11 |

| Developing Asia | 493 | 512 | 4 | 39 |

| Transition economies | 48 | 34 | -28 | 3 |

Source: UNCTAD, World Investment Report, June 2019; retrieved on 21-06-2019

Table 7: FDI inflows, top 10 host economies

| 2017 (US$B) | 2018 (US$B) | Change (%) | Share (%) | |

|---|---|---|---|---|

| World | 1,497 | 1,297 | -13.4 | 100.0 |

| United States | 277 | 252 | -9.2 | 19.4 |

| China | 134 | 139 | 3.7 | 10.7 |

| Hong Kong SAR | 111 | 116 | 4.5 | 8.9 |

| Singapore | 76 | 78 | 2.5 | 6.0 |

| Netherlands | 58 | 70 | 19.7 | 5.4 |

| United Kingdom | 101 | 64 | -36.3 | 5.0 |

| Brazil | 68 | 61 | -9.4 | 4.7 |

| Australia | 42 | 60 | 42.9 | 4.7 |

| Cayman Islands | 26 | 57 | 124.5 | 4.4 |

| British Virgin Islands | 58 | 44 | -23.2 | 3.4 |

Source: UNCTAD, World Investment Report, June 2019; retrieved on 21-06-2019

Canada’s performance highlights

Chapter 2.1

Canada’s economic performance

At a

glance

Long description

Canada's Annual GDP Growth 1.9%

Canada's inflation in 2018 2.3%

5.8 % Canada's annual unemployment rate in 2018, the lowest annual unemployment rate on record since 1976

Long description

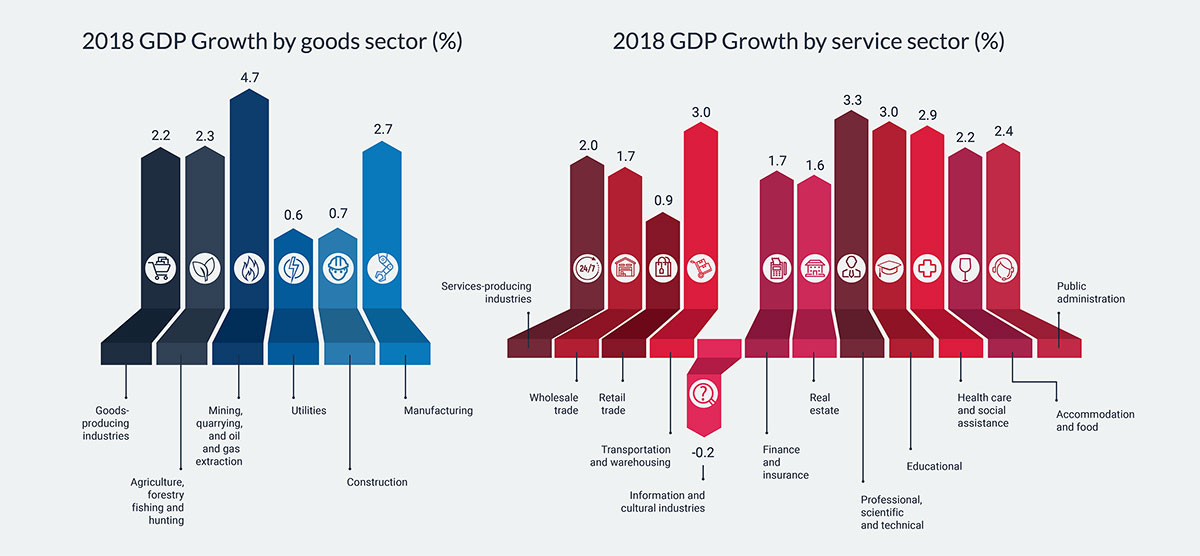

| 2018 GDP Growth, by good sectors in% | |

|---|---|

| Goods-producing industries | 2.2 |

| Agriculture, forestry, fishing and hunting | 2.3 |

| Mining, quarrying, and oil and gas extraction | 4.7 |

| Utilities | 0.6 |

| Construction | 0.7 |

| Manufacturing | 2.7 |

| 2018 GDP Growth, by service sectors in% | |

|---|---|

| Services-producing industries | 2.0 |

| Wholesale trade | 1.7 |

| Retail trade | 0.9 |

| Transportation and warehousing | 3.0 |

| Information and cultural industries | -0.2 |

| Finance and insurance | 1.7 |

| Real estate | 1.6 |

| Professional, scientific and technical | 3.3 |

| Educational | 3.0 |

| Health care and social assistance | 2.9 |

| Accommodation and food | 2.2 |

| Public administration | 2.4 |

National overview

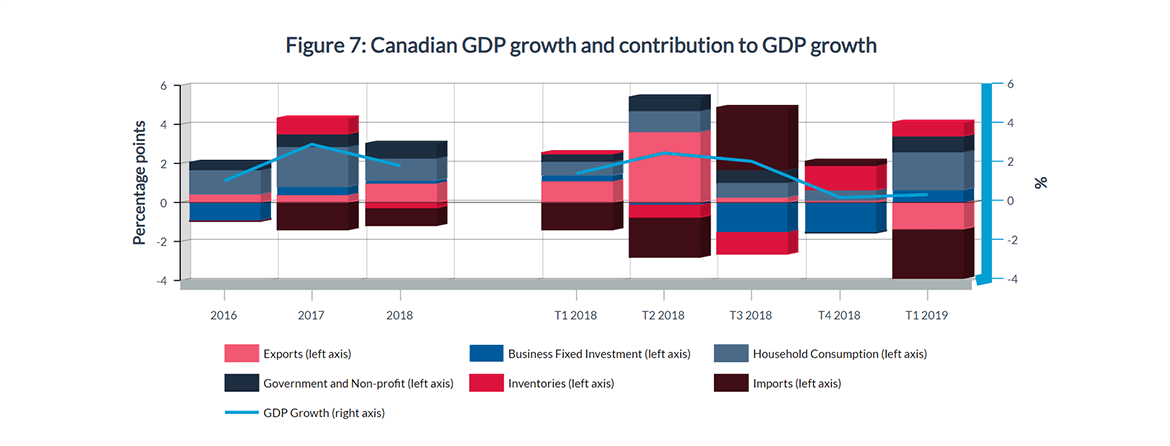

After expanding by 3% in 2017, the Canadian economy grew by a more modest 1.9% in 2018. Household consumption was the leading contributor to growth, but that contribution declined to 1.2 percentage points from 2.0 percentage points in 2017. High household debt relative to disposable income played a role in slowing down household consumption. The introduction of tighter mortgage financing guidelines weighed heavily on the housing sector last year as investment in residential structures declined and was a negative contributor to growth. Non-residential business investment contributed positively to growth, but its contribution was low at 0.2 percentage point.

Trade, which had been a drag on growth in 2017, made a marginally positive contribution in 2018. An acceleration in the growth of real exports along with a deceleration in real imports combined to make the turnaround possible.Economic output rose by 1.5% (seasonally adjusted at annual rates) in Q1 2018, then to 2.5% in Q2, before trailing off in the second half of the year (2.1% in Q3 and 0.3% in Q4). With high levels of uncertainty in global affairs (for example, Brexit, NAFTA/ CUSMA negotiations and the global trade tensions), non-residential business investment was lacklustre, contributing negatively to growth over the final three quarters of 2018.

Source: Statistics Canada, Table 36-10-0104-01 and Table 36-10-0128-01; retrieved on 21-06-2019

Long description

Figure 7: Canadian GDP growth and contribution to GDP growth

| 2016 | 2017 | 2018 | _ | T1 2018 | T2 2018 | T3 2018 | T4 2018 | T1 2019 | |

|---|---|---|---|---|---|---|---|---|---|

| Exports (Percentage Point) | 0.449 | 0.36 | 0.996 | 1.102 | 3.642 | 0.271 | 0.084 | -1.33 | |

| Business Fixed Investment (Percentage Point) | -0.919 | 0.443 | 0.128 | 0.282 | -0.105 | -1.487 | -1.534 | 0.637 | |

| Personal Consumption (Percentage Point) | 1.246 | 2.041 | 1.155 | 0.72 | 1.059 | 0.762 | 0.545 | 1.96 | |

| Government (Percentage Point) | 0.395 | 0.671 | 0.759 | 0.406 | 0.679 | 0.621 | -0.033 | 0.793 | |

| Inventories (Percentage Point) | -0.016 | 0.821 | -0.265 | 0.028 | -0.646 | -1.157 | 1.273 | 0.729 | |

| Imports (Percentage Point) | -0.059 | -1.413 | -0.927 | -1.384 | -2.068 | 3.205 | 0.224 | -2.536 | |

| GDP Growth in % | 1.107 | 2.979 | 1.879 | 1.48 | 2.533 | 2.11 | 0.251 | 0.401 |

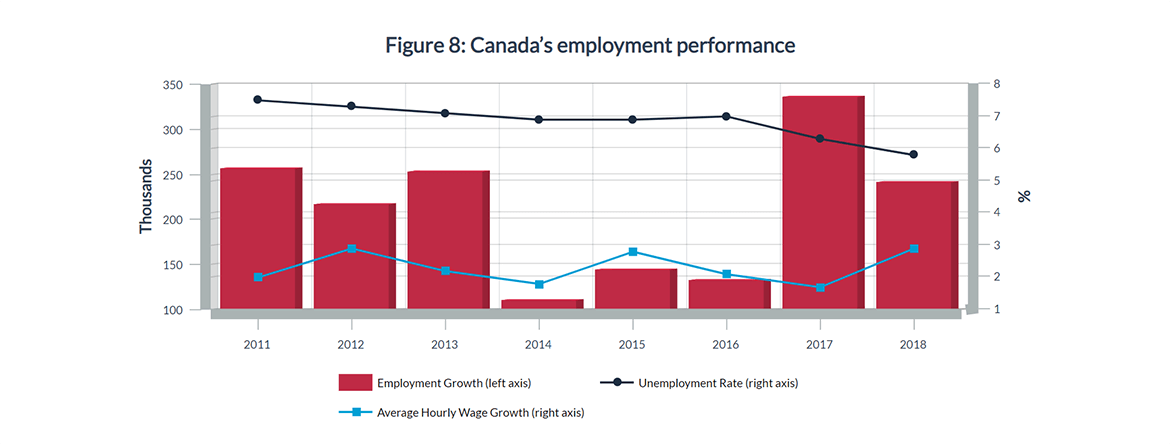

Similar to economic growth, Canadian employment growth moderated in 2018—up by 241,100 jobs compared to 336,500 jobs in 2017. Despite the smaller increase in employment, the unemployment rate fell in 2018, averaging 5.8%, the lowest annual unemployment rate on record since 1976 (and declined to 5.6% in November and December 2018, the lowest monthly rate on record as of the end of 2018).

Concomitantly, average hourly wages grew by 2.9% in 2018, the highest growth since 2012 (2.9%), responding to tighter labour market conditions.

Source: Statistics Canada, Table 14-10-0064-01 and Table 14-10-0327-01; retrieved on 21-06-2019

Long description

Figure 8: Canada’s employment performance

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|---|---|---|

| Employment Growth (in thousands of employed) | 256.7 | 217 | 253.1 | 111.1 | 144.4 | 133.3 | 336.5 | 241.1 |

| Unemployment Rate (in %) | 7.5 | 7.3 | 7.1 | 6.9 | 6.9 | 7.0 | 6.3 | 5.8 |

| Average Hourly Wage Growth (in %) | 2.0 | 2.9 | 2.2 | 1.8 | 2.8 | 2.1 | 1.7 | 2.9 |

Inflation, as measured by the Consumer Price Index (CPI), grew by 2.3% in 2018, the highest growth since 2011, but within the Bank of Canada’s targeted range of 1–3% for inflation. Leading the growth was the transportation category (4.7%), dominated by the gasoline (13%) and air transportation (15%) sub-categories.

Despite this growth, gasoline and energyFootnote 8 costs were slightly lower than in 2014, a peak year. Excluding energy, the CPI grew by 1.9% in 2018.

Table 8: Percentage change in the Consumer Price Index (%)

| 2016 | 2017 | 2018 | |

|---|---|---|---|

| All items | 1.4 | 1.6 | 2.3 |

| Food | 1.5 | 0.1 | 1.8 |

| Shelter | 1.6 | 1.7 | 2.0 |

| Household operations | 1.7 | 0.2 | 1.1 |

| Clothing and footwear | -0.2 | -0.7 | 0.9 |

| Transportation | 1.1 | 3.9 | 4.7 |

| Gasoline | -6.0 | 11.8 | 12.6 |

| Air transportation | 4.0 | 6.8 | 15.3 |

| Health and personal care | 1.4 | 1.7 | 1.3 |

| Recreation and education | 1.7 | 2.4 | 1.1 |

| Alcohol and tobacco | 3.2 | 2.7 | 4.2 |

| Special tabulations | |||

| All items excluding food and energy | 1.9 | 1.6 | 1.9 |

| All items excluding energy | 1.8 | 1.3 | 1.9 |

| Energy | -3.0 | 5.3 | 6.7 |

| All goods | 0.9 | 0.8 | 1.9 |

| All services | 1.8 | 2.2 | 2.7 |

Source: Statistics Canada, Table 18-10-0005-01; retrieved on 21-06-2019

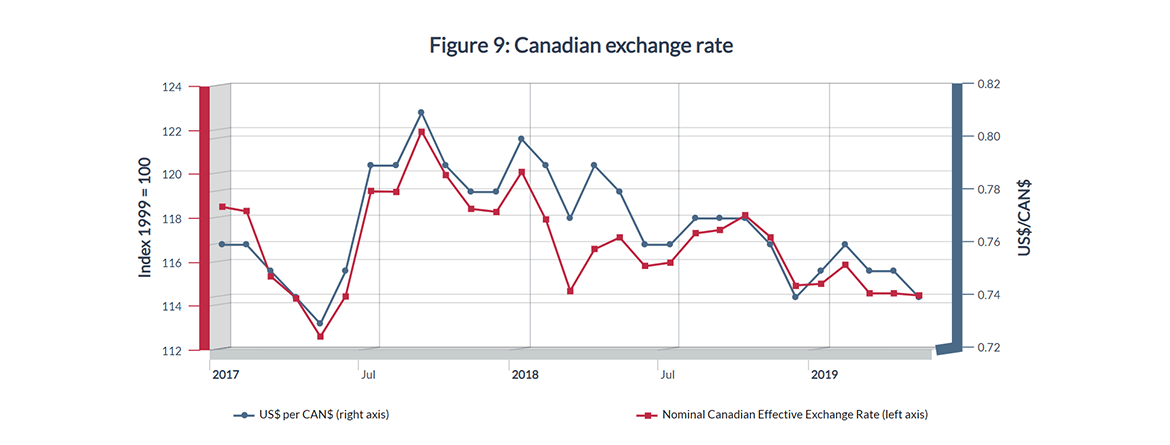

On an annual average basis, the Canadian dollar remained relatively steady in 2018 when benchmarked against the US dollar, appreciating by 0.2% compared to 2017.

However, on a monthly average basis, the Canadian dollar has been on a depreciating trend since September 2017.

Source: Bank of Canada; retrieved on 21-06-2019

Long description

Figure 9: Canadian exchange rate

| US$ per CAN$ | Nominal Canadian Effective Exchange Rate | |

|---|---|---|

| January 2017 | 0.76 | 118.52 |

| February 2017 | 0.76 | 118.32 |

| March 2017 | 0.75 | 115.36 |

| April 2017 | 0.74 | 114.37 |

| May 2017 | 0.73 | 112.62 |

| June 2017 | 0.75 | 114.47 |

| July 2017 | 0.79 | 119.23 |

| August 2017 | 0.79 | 119.21 |

| September 2017 | 0.81 | 121.96 |

| October 2017 | 0.79 | 119.97 |

| November 2017 | 0.78 | 118.43 |

| December 2017 | 0.78 | 118.3 |

| January 2018 | 0.80 | 120.11 |

| February 2018 | 0.79 | 117.93 |

| March 2018 | 0.77 | 114.71 |

| April 2018 | 0.79 | 116.59 |

| May 2018 | 0.78 | 117.13 |

| June 2018 | 0.76 | 115.82 |

| July 2018 | 0.76 | 115.99 |

| August 2018 | 0.77 | 117.32 |

| September 2018 | 0.77 | 117.47 |

| October 2018 | 0.77 | 118.13 |

| November 2018 | 0.76 | 117.15 |

| December 2017 | 0.74 | 114.95 |

| January 2019 | 0.75 | 115.02 |

| February 2019 | 0.76 | 115.88 |

| March 2019 | 0.75 | 114.59 |

| April 2019 | 0.75 | 114.59 |

| May 2019 | 0.74 | 114.49 |

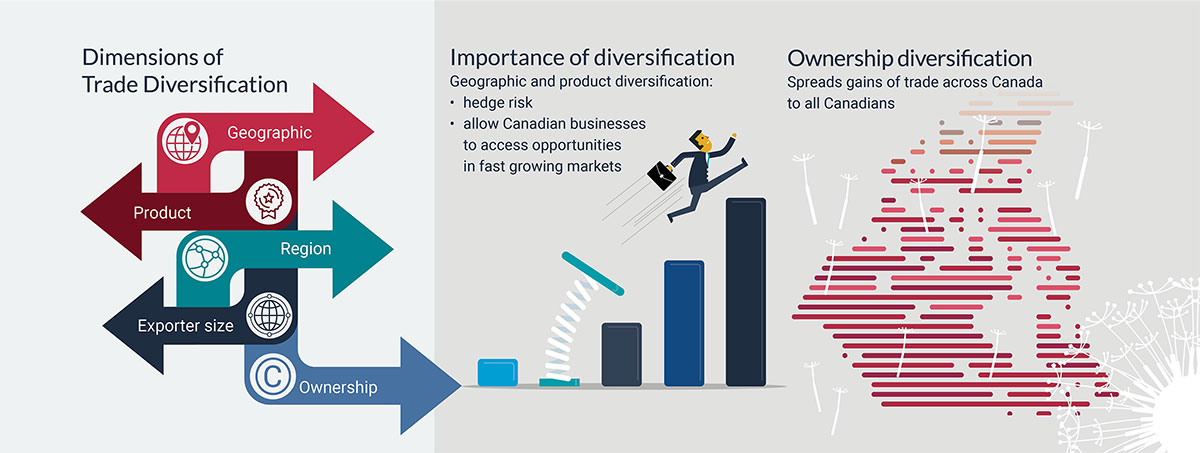

The price of crude oil is of interest for the Canadian economy, particularly the price differential between West Texas Intermediate (WTI), which is representative of American crude oil pricing, and Western Canadian Select (WCS), which is representative of Canadian oil sands crude oil pricing. WCS oil is heavier than WTI and requires more refining. Because of this, WCS trades at a discount relative to WTI. Typically, the price differential is between US$10 and US$20.

However, in November 2018, the price differential between WCS and WTI widened to US$45.93 per barrel, well beyond the historical average, due mainly to excess supply and the lack of export capacity resulting from transportation bottlenecks. To address these issues and to provide price relief to WCS, the Alberta government put in place mandated crude oil production cuts, and made public its intention to acquire locomotives and rail cars for crude oil transportation.

Source: Government of Alberta, Economics Dashboard; retrieved on 21-06-2019

Long description

Figure 10: Oil prices, US$ per barrel

| Date | WCS | WTI | Price differential |

|---|---|---|---|

| August 2014 | 73.89 | 96.08 | -22.19 |

| September 2014 | 74.35 | 93.03 | -18.68 |

| October 2014 | 70.6 | 84.34 | -13.74 |

| November 2014 | 62.87 | 75.81 | -12.94 |

| December 2014 | 43.24 | 59.29 | -16.05 |

| January 2015 | 30.43 | 47.22 | -16.79 |

| February 2015 | 36.52 | 50.58 | -14.06 |

| March 2015 | 34.76 | 47.82 | -13.06 |

| April 2015 | 40.26 | 54.45 | -14.19 |

| May 2015 | 47.5 | 59.27 | -11.77 |

| June 2015 | 51.29 | 59.82 | -8.53 |

| July 2015 | 43.49 | 50.9 | -7.41 |

| August 2015 | 29.48 | 42.87 | -13.39 |

| September 2015 | 26.5 | 45.48 | -18.98 |

| October 2015 | 32.78 | 46.22 | -13.44 |

| November 2015 | 27.78 | 42.44 | -14.66 |

| December 2015 | 22.51 | 37.19 | -14.68 |

| January 2016 | 17.88 | 31.68 | -13.8 |

| February 2016 | 16.3 | 30.32 | -14.02 |

| March 2016 | 23.46 | 37.55 | -14.09 |

| April 2016 | 27.88 | 40.75 | -12.87 |

| May 2016 | 32.52 | 46.71 | -14.19 |

| June 2016 | 36.47 | 48.76 | -12.29 |

| July 2016 | 32.8 | 44.65 | -11.85 |

| August 2016 | 30.9 | 44.72 | -13.82 |

| September 2016 | 30.62 | 45.18 | -14.56 |

| October 2016 | 35.83 | 49.78 | -13.95 |

| November 2016 | 31.89 | 45.66 | -13.77 |

| December 2016 | 37.18 | 51.97 | -14.79 |

| January 2017 | 37.19 | 52.5 | -15.31 |

| February 2017 | 39.14 | 53.47 | -14.33 |

| March 2017 | 35.68 | 49.33 | -13.65 |

| April 2017 | 36.84 | 51.06 | -14.22 |

| May 2017 | 38.84 | 48.48 | -9.64 |

| June 2017 | 35.8 | 45.18 | -9.38 |

| July 2017 | 36.37 | 46.63 | -10.26 |

| August 2017 | 38.5 | 48.04 | -9.54 |

| September 2017 | 39.93 | 49.82 | -9.89 |

| October 2017 | 39.87 | 51.58 | -11.71 |

| November 2017 | 45.52 | 56.64 | -11.12 |

| December 2017 | 44.02 | 57.95 | -13.93 |

| January 2018 | 42.53 | 63.55 | -21.02 |

| February 2018 | 37.72 | 62.16 | -24.44 |

| March 2018 | 35.53 | 62.87 | -27.34 |

| April 2018 | 40.47 | 66.33 | -25.86 |

| May 2018 | 53.25 | 69.89 | -16.64 |

| June 2018 | 52.1 | 67.32 | -15.22 |

| July 2018 | 52.83 | 70.74 | -17.91 |

| August 2018 | 48.55 | 67.85 | -19.3 |

| September 2018 | 40.37 | 70.07 | -29.7 |

| October 2018 | 41.15 | 70.76 | -29.61 |

| November 2018 | 11.03 | 56.96 | -45.93 |

| December 2018 | 5.97 | 49.52 | -43.55 |

| January 2019 | 34.3 | 51.38 | -17.08 |

| February 2019 | 45.33 | 54.95 | -9.62 |

| March 2019 | 48.21 | 58.15 | -9.94 |

| April 2019 | 53.25 | 63.86 | -10.61 |

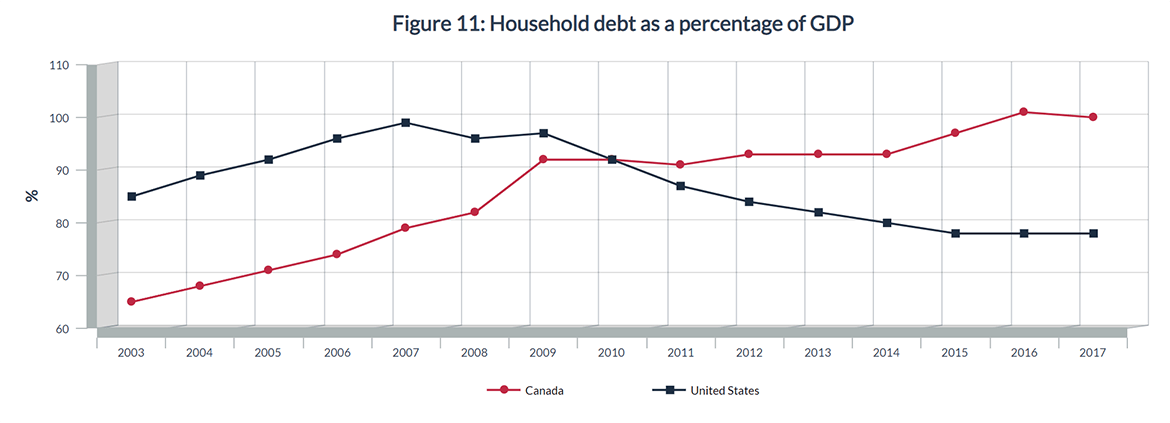

Another issue of interest is the high level of household debt in Canada. While households in the United States have been deleveraging since the 2009 financial crisis, dropping the household debt to GDP ratio to 78% in 2017, Canadian households have not followed suit, and as a result household debt has exceeded 100% of GDP since the second quarter of 2016.

A persistently high and increasing level of household debt can cause constraints to household consumption, an important driver of economic growth. On the other hand, continued strength in the labour market should mitigate some of the negative impact of household debt.

Source: IMF, DataMapper; retrieved on 24-06-2019

Long description

Figure 11: Household debt as a percentage of GDP

| Date | Canada | United States |

|---|---|---|

| 2003 | 65 | 85 |

| 2004 | 68 | 89 |

| 2005 | 71 | 92 |

| 2006 | 74 | 96 |

| 2007 | 79 | 99 |

| 2008 | 82 | 96 |

| 2009 | 92 | 97 |

| 2010 | 92 | 92 |

| 2011 | 91 | 87 |

| 2012 | 93 | 84 |

| 2013 | 93 | 82 |

| 2014 | 93 | 80 |

| 2015 | 97 | 78 |

| 2016 | 101 | 78 |

| 2017 | 100 | 78 |

Goods-producing industries grew at 2.2% in 2018, slightly faster than services-producing industries (2.0%). On the goods side, oil and gas extraction was up 7.1% in 2018, causing its share of GDP to increase to 5.5% from 5.3%. Construction grew by a meagre 0.7%, corresponding to slowdowns in housing activity. Within manufacturing, durables grew by 2.5% in 2018, despite a 1.4% decline in motor vehicle and parts manufacturing.

Growth in non-durables was more robust at 2.9%, but negative growth in petroleum and coal product manufacturing mitigated some of the gain. In 2018, growth on the services side was led by professional, scientific and technical services (3.3%), transportation and warehousing services (3.0%), and educational services (3.0%). Growth in real estate services moderated to 1.6% in 2018, after growing by 2.5% the year before. The information and communication technology sector continued to be a bright spot in 2018, growing at 3.5%, though slightly lower than the 4.0% growth in 2017.

Table 9: GDP growth and share by industry

| GDP Growth (%) 2016 | GDP Growth (%) 2017 | GDP Growth (%) 2018 | Share of GDP (%) 2016 | Share of GDP (%) 2017 | Share of GDP (%) 2018 | |

|---|---|---|---|---|---|---|

| Goods-producing industries | -1.2 | 4.5 | 2.2 | 29.4 | 29.8 | 29.8 |

| Agriculture, forestry, fishing and hunting | 4.3 | -0.2 | 2.3 | 2.1 | 2.1 | 2.1 |

| Mining, quarrying, and oil and gas extraction | -3.4 | 8.8 | 4.7 | 7.2 | 7.6 | 7.8 |

| Oil and gas extraction | 1.5 | 6.7 | 7.1 | 5.1 | 5.3 | 5.5 |

| Utilities | 1.2 | 3.4 | 0.6 | 2.2 | 2.2 | 2.2 |

| Construction | -4.4 | 4.4 | 0.7 | 7.3 | 7.4 | 7.3 |

| Residential construction | 2.9 | 4.2 | 0.9 | 2.6 | 2.7 | 2.6 |

| Manufacturing | 0.7 | 3.8 | 2.7 | 10.3 | 10.4 | 10.5 |

| Durable manufacturing | -0.8 | 4.0 | 2.5 | 5.5 | 5.6 | 5.6 |

| Transportation equipment | -0.2 | -2.6 | 1.0 | 1.5 | 1.4 | 1.4 |

| Motor vehicles and parts | 2.4 | -2.8 | -1.4 | 0.9 | 0.9 | 0.8 |

| Non-durable manufacturing | 2.5 | 3.5 | 2.9 | 4.8 | 4.8 | 4.9 |

| Petroleum and coal | -1.0 | 6.0 | -3.0 | 0.6 | 0.6 | 0.6 |

| Petroleum refineries | -0.9 | 5.1 | -3.2 | 0.5 | 0.6 | 0.5 |

| Chemicals | 5.1 | 0.2 | 3.6 | 1.1 | 1.1 | 1.1 |

| Services-producing industries | 2.0 | 2.8 | 2.0 | 70.5 | 70.2 | 70.1 |

| Wholesale trade | 0.9 | 5.9 | 1.7 | 5.2 | 5.3 | 5.3 |

| Retail trade | 3.0 | 5.9 | 0.9 | 5.1 | 5.2 | 5.2 |

| Transportation and warehousing | 2.9 | 4.6 | 3.0 | 4.4 | 4.5 | 4.5 |

| Information and cultural industries | 0.9 | 1.3 | -0.2 | 3.1 | 3.1 | 3.0 |

| Finance and insurance | 4.1 | 3.1 | 1.7 | 6.6 | 6.6 | 6.6 |

| Real estate | 3.0 | 2.5 | 1.6 | 12.8 | 12.7 | 12.7 |

| Professional, scientific and technical | 0.2 | 2.6 | 3.3 | 5.7 | 5.6 | 5.7 |

| Educational | 1.6 | 1.3 | 3.0 | 5.4 | 5.3 | 5.3 |

| Health care and social assistance | 2.3 | 1.9 | 2.9 | 7.0 | 6.9 | 7.0 |

| Accommodation and food | 3.1 | 3.8 | 2.2 | 2.2 | 2.3 | 2.3 |

| Public administration | 1.3 | 1.9 | 2.4 | 6.7 | 6.6 | 6.7 |

| Special industry tabulations | ||||||

| Information and communication technology | 2.0 | 4.0 | 3.5 | 4.4 | 4.4 | 4.5 |

| Energy | -1.1 | 7.3 | 2.8 | 8.9 | 9.2 | 9.3 |

| Cannabis | 0.7 | -0.9 | 20.0 | 0.3 | 0.3 | 0.3 |

Source: Statistics Canada, Table 36-10-0434-06; retrieved on 24-06-2019

Overall employment grew by 1.3% in 2018, with goods-producing industries advancing by 1.4% and services-producing industries by 1.3%. On the goods side, utilities employment grew the fastest—at 9.2%—but still only accounts for 0.8% of employment. However, utilities had the highest average hourly wage, at $41, and a low sectoral unemployment rate of 1.7%. Employment in the forestry, fishing, mining, quarrying, and oil and gas sector grew by 3.3% in 2018, but overall employment is still below the 2014 peak (373,600), and the sector had the highest unemployment rate and a slower wage growth than average, despite being the second-highest paying sector in terms of average hourly wage.

Employment growth in manufacturing was tepid at 0.2% in 2018, but the unemployment rate (3.6%) and wage growth (3.3%) were solid. On the services side, transportation and warehousing led employment growth at 5.0%, supporting a low unemployment rate of 3.3%; however, wage growth was slightly below average at 2.7%.

Table 10: 2018 Employment and wage information, by industry

| Industry | Employment (‘000s) | Employment Growth (%) | Employment Share (%) | Unemployment Rate (%) | Hourly Wage Average ($) | Hourly Wage Growth (%) |

|---|---|---|---|---|---|---|

| Goods-producing industries | 3,929 | 1.4 | 21.1 | 4.9 | 28.74 | 2.6 |

| Agriculture | 277 | -0.8 | 1.5 | 4.0 | 19.59 | 8.3 |

| Forestry, fishing, mining, quarrying, oil and gas | 341 | 3.3 | 1.8 | 6.8 | 38.46 | 1.3 |

| Mining, quarrying, and oil and gas extraction | 272 | 3.1 | 1.5 | 4.7 | ||

| Utilities | 145 | 9.2 | 0.8 | 1.7 | 41.03 | 2.5 |

| Construction | 1,438 | 2.0 | 7.7 | 6.6 | 29.05 | 1.1 |

| Manufacturing | 1,728 | 0.2 | 9.3 | 3.6 | 26.34 | 3.3 |

| Durables | 1,043 | 0.0 | 5.6 | 3.3 | ||

| Non-durables | 686 | 0.6 | 3.7 | 4.1 | ||

| Services-producing industries | 14,729 | 1.3 | 78.9 | 3.2 | 26.44 | 3.0 |

| Wholesale and retail trade | 2,795 | -0.5 | 15.0 | 3.7 | 20.79 | 2.9 |

| Wholesale trade | 656 | -2.5 | 3.5 | 2.6 | ||

| Retail trade | 2,138 | 0.1 | 11.5 | 4.1 | ||

| Transportation and warehousing | 991 | 5.0 | 5.3 | 3.3 | 26.59 | 2.7 |

| Finance, insurance, and real estate | 1,174 | 0.2 | 6.3 | 1.8 | 31.08 | 3.6 |

| Finance and insurance | 829 | -0.3 | 4.4 | 1.8 | ||

| Real estate | 345 | 1.5 | 1.8 | 2.1 | ||

| Professional, scientific and technical | 1,467 | 1.2 | 7.9 | 2.5 | 33.56 | 1.9 |

| Business, building and other support services | 777 | 2.7 | 4.2 | 5.6 | 20.91 | 7.4 |

| Educational | 1,325 | 3.1 | 7.1 | 3.4 | 33.4 | 2.0 |

| Health care and social assistance | 2,407 | 1.0 | 12.9 | 1.6 | 27.51 | 1.3 |

| Information, culture and recreation | 787 | -0.3 | 4.2 | 4.8 | 24.9 | 2.6 |

| Accommodation and food | 1,235 | 2.0 | 6.6 | 5.4 | 15.9 | 5.7 |

| Other services | 803 | 2.8 | 4.3 | 2.9 | 23.42 | 4.6 |

| Public administration | 969 | 0.8 | 5.2 | 2.1 | 36.4 | 3.3 |

| All Industries | 18,658 | 1.3 | 100.0 | 5.8 | 26.92 | 2.9 |

Source: Statistics Canada, Table 14-10-0064-01 and Table 14-10-0023-01; retrieved on 24-06-2019

Although Canada has the lowest level of national unemployment since 1976 (5.8% in 2018), disparities in regional employment performance continued to exist in 2018. Notwithstanding strong employment growth in Prince Edward Island (3.1%) and Nova Scotia (1.5%), the Atlantic provinces experienced persistent high rates of unemployment in 2018: Newfoundland and Labrador (14%), Prince Edward Island (9.4%), Nova Scotia (7.5%), and New Brunswick (8.0%). Quebec’s unemployment rate reached a historical low of 5.5%, despite slower employment growth (0.9%). Furthermore, its wage growth was the highest among provinces, at 3.2%. Continued solid employment growth (1.6%) helped lower Ontario’s unemployment rate to 5.6%, the lowest since 1989, and supported wage growth of 2.9%.

As a result of weak employment growth (0.6%), the unemployment rate in Manitoba rose to 6.0% in 2018, from 5.4% in 2017. However, wage growth in the province was solid, at 2.8%. Employment growth in Saskatchewan was the second-weakest among provinces and territories, and the unemployment rate was above the national average. Similarly, Alberta’s unemployment rate was above the national average, however, the province posted the second-fastest employment growth among provinces and territories and had the highest average weekly earnings among the provinces. At 4.7%, British Columbia’s unemployment rate was the lowest among provinces (and at its lowest level since 2008), but the province has the highest inflation rate among all provinces and territories.

Table 11: 2018 Provincial and territorial employment and inflation

| Provinces/Territories | Employment (‘000s) | Employment Growth (%) | Unemployment Rate (%) | Weekly Earnings Average ($) | Weekly Earnings Growth (%) | Inflation (%) |

|---|---|---|---|---|---|---|

| Canada | 18,658 | 1.3 | 5.8 | 1,001 | 2.6 | 2.3 |

| Newfoundland and Labrador | 225 | 0.5 | 13.8 | 1,038 | 0.3 | 1.6 |

| Prince Edward Island | 76 | 3.1 | 9.4 | 841 | 2.3 | 2.3 |

| Nova Scotia | 456 | 1.5 | 7.5 | 871 | 1.2 | 2.2 |

| New Brunswick | 354 | 0.3 | 8.0 | 911 | 2.8 | 2.1 |

| Quebec | 4,262 | 0.9 | 5.5 | 932 | 3.2 | 1.7 |

| Ontario | 7,242 | 1.6 | 5.6 | 1,021 | 2.9 | 2.4 |

| Manitoba | 648 | 0.6 | 6.0 | 937 | 2.8 | 2.5 |

| Saskatchewan | 570 | 0.4 | 6.1 | 1,014 | 0.5 | 2.3 |

| Alberta | 2,331 | 1.9 | 6.6 | 1,148 | 1.7 | 2.4 |

| British Columbia | 2,494 | 1.1 | 4.7 | 969 | 2.7 | 2.7 |

| Yukon | 21 | 0.5 | 2.7 | 1,118 | 2.1 | 2.4 |

| Northwest Territories | 21 | 0.5 | 7.3 | 1,420 | 1.5 | 2.3 |

| Nunavut | 14 | 0.7 | 14.1 | 1,376 | 3.2 | 3.0 |

Source: Statistics Canada, Table 14-10-0090-01, Table 14-10-0204-01 and Table 18-10-0005-01; retrieved on 24-06-2019

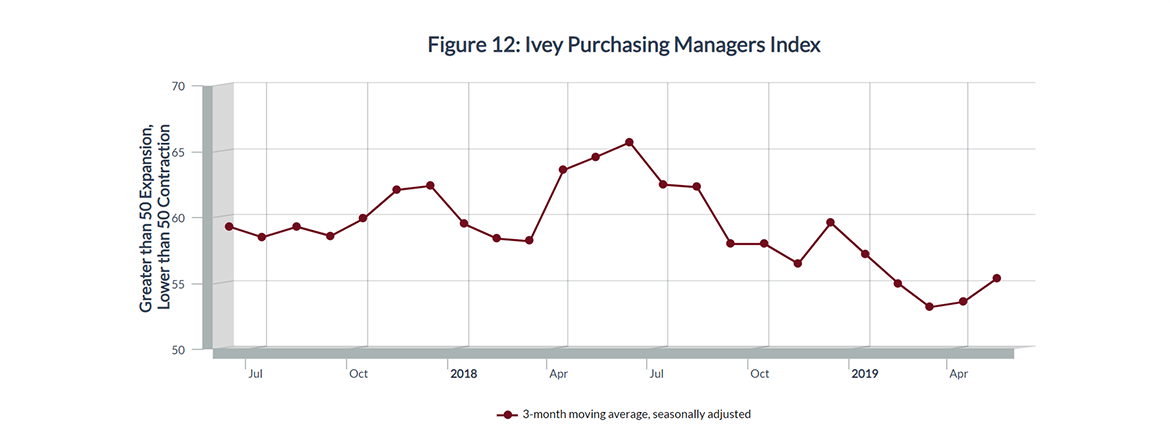

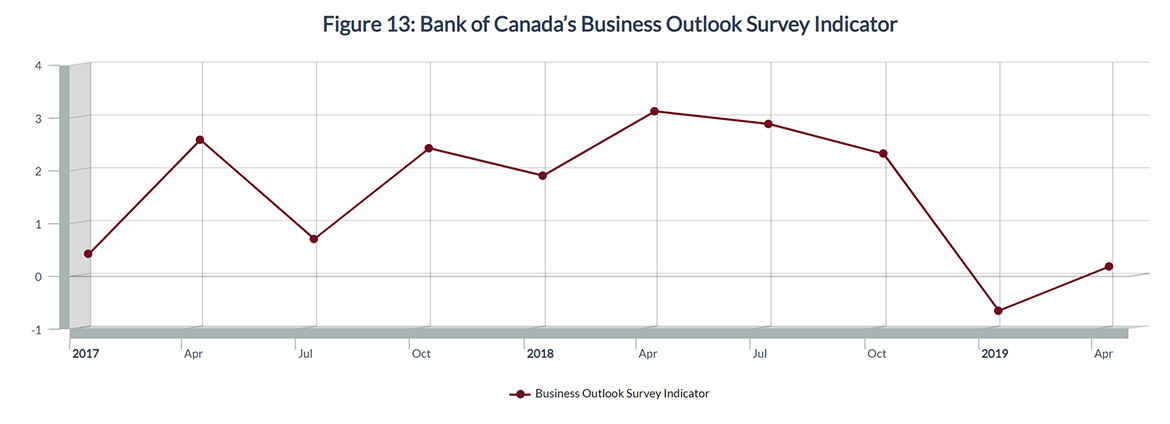

In conjunction with slowing growth toward the end of 2018, forward-looking economic indicators, such as the Ivey Purchasing Managers Index (PMI) and the Bank of Canada’s Business Outlook Survey (BOS) Indicator, point to a decline in economic sentiment among Canadian businesses. The Ivey PMI, which measures the month-to-month variation in economic sentiment as indicated by a panel of purchasing managers from across Canada, has been trending downward to sit at 50.6 in February 2019, indicating that firms with positive outlooks continue to outnumber firms with negative outlooks, but the gap has been declining.Footnote 9 In recent months, the Ivey PMI has improved slightly to 55.9 in May 2019, but sentiments in the first five months of 2019 are still lower than for the same period last year.

Another indication of softening business sentiment can be seen in the Bank of Canada’s BOS indicator, which has declined since the second half of 2018 from positive levels to a negative one. Results for several BOS survey questions in the spring 2019 edition were below historical averages. The latest edition of theBOS(summer 2019) points to a slight improvement in business sentiment, but weakness tied to Western Canada’s oil industry and global trade tensions continue to dampen outlook.

Source: Ivey Business School; retrieved on 24-06-2019

Long description

Figure 12: Ivey Purchasing Managers Index

| 3-month moving average, seasonally adjusted | |

|---|---|

| 2017-06-01 | 59.3 |

| 2017-07-01 | 58.5 |

| 2017-08-01 | 59.3 |

| 2017-09-01 | 58.6 |

| 2017-10-01 | 59.9 |

| 2017-11-01 | 62.1 |

| 2017-12-01 | 62.4 |

| 2018-01-01 | 59.5 |

| 2018-02-01 | 58.4 |

| 2018-03-01 | 58.2 |

| 2018-04-01 | 63.6 |

| 2018-05-01 | 64.6 |

| 2018-06-01 | 65.7 |

| 2018-07-01 | 62.5 |

| 2018-08-01 | 62.3 |

| 2018-09-01 | 58.0 |

| 2018-10-01 | 58.0 |

| 2018-11-01 | 56.5 |

| 2018-12-01 | 59.6 |

| 2019-01-01 | 57.2 |

| 2019-02-01 | 55.0 |

| 2019-03-01 | 53.2 |

| 2019-04-01 | 53.6 |

| 2019-05-01 | 55.4 |

Soft economic conditions persisted into early 2019, but the Bank of Canada expects activity to pick up later in 2019, resulting in an economy forecasted to grow by 1.2% for the year (April 2019 Monetary Policy Report). The negative effects of low oil prices, housing policy changes, and 2017-18 increases in borrowing rates should fade out later in 2019. The pickup in economic activity is expected to spill over into 2020, supporting Canadian economic growth of 2.1%.

Global trade tensions, for example between the United States and its trading partners, along with tensions between the parties to Brexit are sources of great uncertainty in the economic forecast, as persistent or escalating tensions can reduce foreign demand, disrupt global value chains, lower business confidence and depress commodity prices. On the other hand, if trade tensions are resolved, economic activity could be stronger than expected.

Source: Bank of Canada, Business Outlook Survey, spring 2019; retrieved 28-06-2019

Long description

Figure 13: Bank of Canada’s Business Outlook Survey Indicator

| Business Outlook Survey Indicator | |

|---|---|

| January 2017 | 0.42 |

| April 2017 | 2.59 |

| July 2017 | 0.71 |

| October 2017 | 2.43 |

| January 2018 | 1.91 |

| April 2018 | 3.13 |

| July 2018 | 2.89 |

| October 2018 | 2.32 |

| January 2019 | -0.65 |

| April 2019 | 0.19 |

Canada’s trade performance

At a

glance

Long description

Trade by sector

| 2018 Canadian Exports by sectors Value ($B) | 2018 Canadian Exports by sectors Change (%) | 2018 Canadian Imports by sectors Value ($B) | 2018 Canadian Imports by sectors Change (%) | |

|---|---|---|---|---|

| Goods | ||||

| Agri-food and fish | 39.7 | 1.9 | 20.3 | 4.4 |

| Energy | 111.1 | 14.8 | 38.1 | 14.2 |

| Metal ores and minerals | 19.3 | 19.7 | 14.4 | 16.1 |

| Metal and mineral products | 64.6 | 4.8 | 41.5 | 1.4 |

| Chemicals, plastics and rubber | 35.0 | 6.8 | 47.3 | 9.8 |

| Forestry, building and packaging | 47.2 | 7.8 | 26.9 | 5.6 |

| Industrial machinery and equipment | 39.4 | 6.2 | 68.2 | 8.8 |

| Electronic and electrical equipment | 29.4 | 3.5 | 71.3 | 5.4 |

| Motor vehicles and parts | 90.5 | -3.0 | 113.8 | 0.2 |

| Aircraft and other transport equipment | 25.8 | 12.7 | 23.8 | 13.8 |

| Consumer goods | 66.6 | 5.7 | 121.4 | 4.9 |

| Services | ||||

| Travel | 28.5 | 8.1 | 43.4 | 5.1 |

| Transportation | 17.9 | 4.9 | 31.6 | 10.0 |

| Commercial | 72.8 | 5.2 | 69.5 | 1.1 |

| Government | 1.6 | 0.8 | 1.3 | 5.0 |

Long description

Trade by region

| 2018 Canadian Exports by regions Value ($B) | 2018 Canadian Exports by regions Change (%) | 2018 Canadian Imports by regions Value ($B) | 2018 Canadian Imports by regions Change (%) | |

|---|---|---|---|---|

| Goods | ||||

| United States | 432.7 | 5.4 | 390.8 | 5.4 |

| European Union | 46.2 | 5.9 | 63.5 | 11.8 |

| China | 29.0 | 16.4 | 46.4 | 8.5 |

| Japan | 13.3 | 9.1 | 12.7 | -6.3 |

| Mexico | 9.5 | 3.5 | 20.9 | -1.9 |

| South Korea | 6.1 | 9.7 | 8.3 | 12.0 |

| India | 4.4 | -0.7 | 3.9 | 29.6 |

| Rest of World | 43.9 | 13.0 | 60.7 | 4.0 |

| Services | ||||

| All countries | 120.8 | 5.8 | 145.8 | 4.2 |

| United States | 66.5 | 4.4 | 78.8 | 4.0 |

| European Union | 20.6 | 8.0 | 26.1 | 0.5 |

| Japan | 1.5 | -3.8 | 2.6 | 9.8 |

| Rest of World | 32.2 | 7.8 | 38.2 | 6.7 |

Canada trade overview

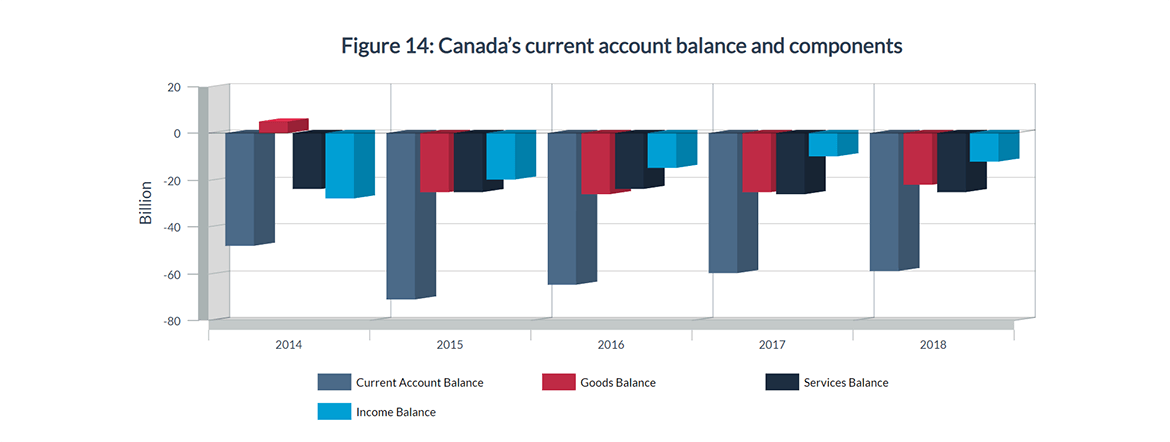

Canada’s current account balanceFootnote 10 recorded a deficit of $59 billion in 2018. This was $1.6 billion smaller than in 2017. The lower trade deficit was mainly due to a narrowing of the goods trade deficit by $2.7 billion.

However, these gains were partially offset by the combination of a widening income deficit and the services trade balance moving sideways.

Source: Statistics Canada, Table 36-10-0014-01; retrieved on 24-06-2019

Long description

Figure 14: Canada’s current account balance and components

| Dates | Current Account Balance ($ Billion) | Goods Balance ($ Billion) | Services Balance ($ Billion) | Income Balance ($ Billion) |

| 2014 | -48 | 5 | -24 | -28 |

| 2015 | -71 | -25 | -25 | -20 |

| 2016 | -65 | -26 | -24 | -15 |

| 2017 | -60 | -25 | -26 | -10 |

| 2018 | -59 | -22 | -25 | -12 |

In 2018, Canada’s exports of goods and services to the world increased 6.2%, or $41 billion, to reach $706 billion, while imports rose 5.4%, or $39 billion, to $753 billion. As both exports and imports expanded, the total value of trade in goods and services reached a record high of $1.5 trillion, or 66% of GDP.

Overall, export prices increased 2.9% while import prices grew 2.4%, and Canada’s terms of tradeFootnote 11 improved for the second consecutive year to 94.5, an improvement of 0.4 percentage point over the previous year.

Source: Statistics Canada, Table 36-10-0104-01; retrieved on 24-06-2019

Long description

Figure 15: Canadian Trade of Goods and Services

| 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|

| Exports of Goods and Services (in $ Billion) | 628.9 | 629.1 | 632.4 | 664.8 | 706.0 |

| Imports of Goods and Services (in $ Billion) | 647.6 | 678.3 | 681.2 | 714.4 | 753.0 |

Canada’s goodsFootnote 12 exports continued to grow in 2018, up 6.5% to $585 billion, with export prices increasing by 2.2% and export volumes expanding by 4.1%.Footnote 13 Concurrently, Canada’s goods imports advanced 5.8% to $607 billion, as both import prices and import volumes increased, up 2.4% and 3.3%, respectively. As a result, total goods trade reached a record high of $1.2 trillion. Moreover, since exports outpaced imports in 2018, Canada’s goods trade deficit narrowed by $2.7 billion to $22 billion.

Exports

Canadian goods exports grew for the second consecutive year in 2018, with export up in all sectors, except motor vehicles and parts. Energy exports growth led the way, advancing $14 billion, or 15%, to reach $111 billion in value, followed by consumer goods (+ $3.6 billion) and forestry, building and packaging products (+ $3.4 billion). Unlike the previous year, the growth of Canadian exports was driven more by an expansion in volumes than in export prices, as volumes were up 4.1% compared to a 2.2% growth in prices. Notable increases in export volumes were registered for metal ores and minerals (+17%), aircraft and other transportation equipment (+12%), and energy products (+8.2%). On the price side, prices of forestry, building and packaging products were up 9.7%.

However, the growth of energy prices slowed from 22% in 2017 to 6.2% in 2018. Crude oil, the main component of this category, experienced large price fluctuations, as its average price rose steadily in the first five months of 2018 and then trended downward slightly until October, before falling sharply in November.Footnote 14 Other sectors that posted strong price increases were metal and mineral products (+5.9%) and chemical, plastic and rubber products (+5.4%). Exports of motor vehicles and parts fell by $2.8 billion, or 3.0%, in 2018, due mainly to a 3.1% decline in export prices.

By destination, goods exports to the United States increased 5.4%, or $22 billion, to $433 billion in 2018. However, exports to non-U.S. destinations grew even faster, up 9.8% (or $14 billion) to $153 billion. As a result, Canada’s goods exports continued to diversify away from the United States. Among Canada’s major non-U.S. trading partners, exports to China recorded the fastest growth (+16%), followed by South Korea (+9.7%) and Japan (+9.1%). Goods exports to the European Union rose modestly (+5.9%), but exports to the Netherlands and Italy posted strong growth, up 51% and 33%, respectively. However, due to falling gold exports, these strong gains were partially offset by declining exports to the United Kingdom (-9.7%).

Table 12: Goods exports, 2018

| Value of Exports, 2018 ($B) | Change in Value (%) | Change in Volume (%) | Change in Price (%) | |

|---|---|---|---|---|

| Total | 585.3 | 6.5 | 4.1 | 2.2 |

| By product | ||||